Bitcoin is hovering around 96.5K as it continues consolidating below the key 100K milestone. With altcoin season hotting up, questions remain over whether Bitcoin can make the final push above 100 K.

Bitcoin rose to a record high in November, boosted by the halving event earlier in the year and, more recently, by optimism surrounding a Trump presidency, a favorable economic backdrop with central banks cutting interest rates, rising active addresses, and falling supply on exchanges. Strong institutional demand through ETFs and corporate capital flows have added to the upbeat picture.

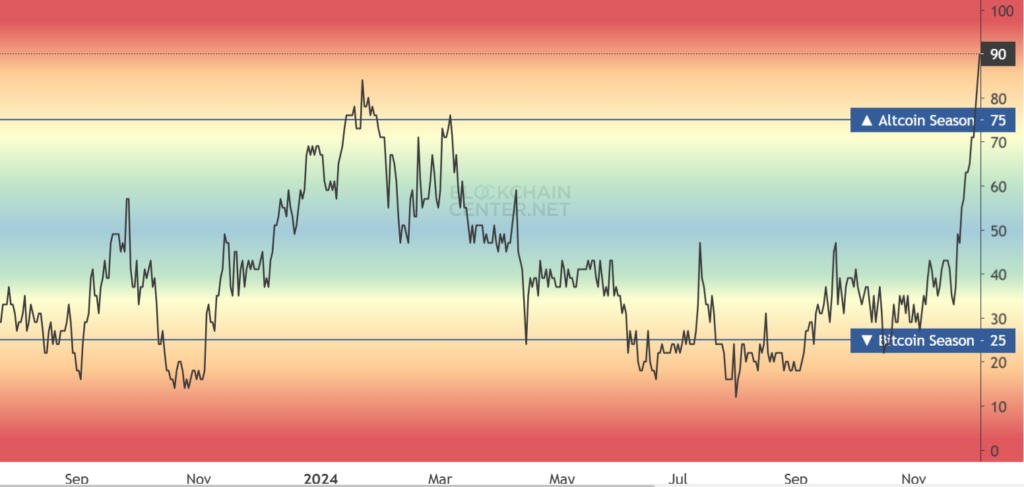

After rallying almost 130% this year, Bitcoin has plateaued and is struggling to make a significant final move towards the key 100k milestone. As a result, interest in other digital assets has been on the rise. Bitcoin dominance has fallen sharply, and altcoin season has arrived.

What is altcoin season?

Altcoin season is when at least 75% of the Top 50 coins perform better than Bitcoin across the past 90 days. Today, this level is 90%, meaning altcoin season has started.

ETH shows a bullish form

As the altcoin season kicks off, Ether has shown bullish form after underperforming Bitcoin in recent months. The world’s second-largest cryptocurrency rallied 11% last week, outpacing Bitcoin. Spot ETH ETFs saw record inflows of $333 million on Friday when it outpaced spot Bitcoin inflows of $320 million. Across November, spot ETH ETFs saw $1.1 billion in net inflows, marking a record month.

XRP sees as an explosive rally

XRP is easing slightly today on profit taking, but the coin has seen an explosive rally in recent weeks, surging 370%. The rally to a peak of $2.8 for the first time in seven years resulted in the market cap jumping, overtaking popular tokens such as Solana USDT and Binance.

The surge in XRP comes amid signs that legal pressures weighing on the price for years are about to let up. Notably, Securities and Exchange Commission (SEC) chair Gary Gensler announced his resignation on January 20th, when Trump will take office. As a result, the long-running case against Ripple is currently making its way through the appeals court and may become less of a priority or even be settled.

These are just some examples of altcoin prices surging while Bitcoin remains stuck below 100k.

Can Bitcoin rise above 100k?

However, this shift of attention away from Bitcoin and towards altcoins doesn’t necessarily mean that Bitcoin won’t rise above 100k. While retail investors have been the driving force in previous cycles, rotating out of Bitcoin into altcoins, this cycle is different due to institutional participation.

Strong institutional demand through ETFs has increased the industry’s credibility, meaning that this altcoin season could be different. The rise in altcoins could come from an organic increase in volume into the crypto market and real market growth rather than a rotation out of BITC, leaving the world’s largest crypto in with a chance of rising above 100k