Bitcoin has recovered from yesterday’s 105.5k low, rebounding to 110k, boosted by trade deal optimism ahead of the US non-farm payroll report. The move higher is being seen across the crypto sector with Ethereum, Solana, and Ripple trading between 4-6% higher.

Bitcoin posted a sharp recovery on Wednesday and has continued the recovery today, following President Trump’s announcement of a trade deal with Vietnam. Vietnamese goods imported into the US are subject to a 20% tariff, while third-party goods trans-shipped through Vietnam are subject to a 40% levy. The deal has helped to boost optimism that more trade agreements will be agreed before Trump’s July 9 deadline.

Weak NFP could boost Fed rate cut bets.

Attention is now turning to the US non-payroll report, which is expected to show that 110k jobs were created in June, down from 139k in May. The lead indicators suggest a reading below the forecast. There are clear signs that the US labour market is deteriorating.

ADP payrolls fell for the first time in two years, while initial jobless claims have just shown a sustained uptick, and continuing claims have been persistently higher, suggesting that it’s increasingly hard for unemployed workers to find a new job.

Meanwhile, unemployment is expected to rise to 4.3%, up from 4.2%, and average hourly earnings are expected to increase by 0.3%MoM, down from last month’s reading.

Heading into the data release, the market is expecting two 25-basis-point rate cuts from the Federal Reserve this year. Weaker-than-expected NFP payroll numbers could confirm a slowing labour market, raising expectations for a Federal Reserve rate cut. A lower interest rate environment is beneficial for Bitcoin due to higher liquidity.

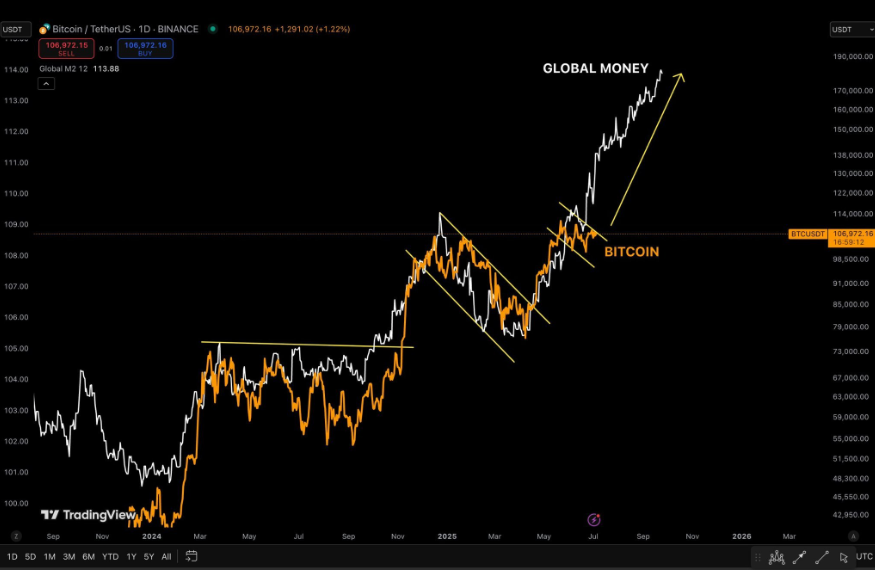

M2 supply reaches record highs. BTC to follow suit?

The nonfarm payroll report and a focus on Fed rate cut expectations come at a time when the M2 US money supply has reached a record high. The US M2 money supply is a comprehensive measure of money circulation within the United States, encompassing hard currency, bank deposits, and money market fund deposits that are relatively liquid. US M2 supply rose to a record $21.94 trillion at the end of May, surpassing the previous high of $21.72 trillion last seen in March 2022.

Meanwhile, the global M2 money supply hit a record high of 55.48 trillion.

Typically, a growing money supply is a signal of looser financial conditions and a growing economy, which often leads to increased investor exposure to riskier assets.

Why is this important? Historically, the BTC price has followed global and US M2 supply, lagging behind the move by approximately three months. While Bitcoin can rally during periods of low M2 growth, such moves are often unsustainable. In contrast, M2 rallies tend to produce longer, more stable BTC uptrends, supported by real liquidity rather than just speculation.

With the global money supply expanding, Bitcoin’s next target could be around the $ 170,000 mark, following the upward trend.

Standard Chartered predicts BTC to 135k in Q3

These latest developments come as Standard Chartered predicts the Bitcoin price will hit $ 135,000 by the end of Q3, possibly reaching $200,000 by the end of the year.

Standard Chartered cites massive inflows into Bitcoin ETFs and growing corporate demand as reasons for these price forecasts. In the second quarter alone, spot Bitcoin ETFs and corporate treasuries bought up 245,000 BTC, and since January 2024, ETFs have attracted more than $48 billion in net buying.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.