In this technical update we are going to take a look at MKR (Maker), one of the few altcoins currently showing relative strength against the broader crypto market. While most altcoins continue to follow similar bearish structures, MKR is beginning to diverge, offering potential early signals of a new trend.

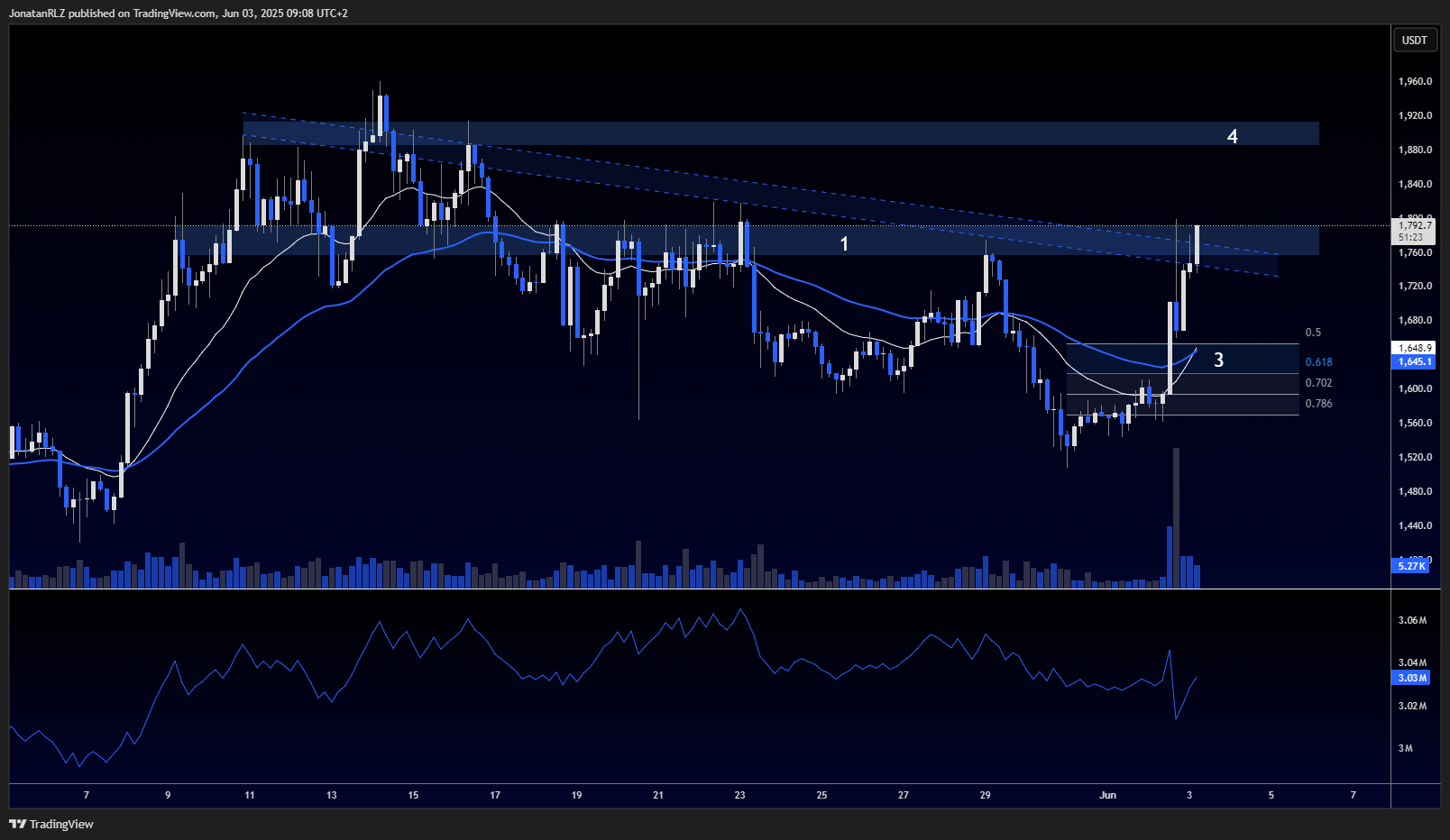

Looking at the daily chart, MKR has broken above a key descending trendline, marked as number 3. This breakout also coincides with a move above the previous lower high, signalling a possible shift in structure.

However, despite the positive development, price is now testing an important resistance zone around $1,770, marked as number 1. This level has acted as resistance before and may do so again. Just above, we also have another resistance zone at $1,900, marked as number 2. These zones represent the next major trouble areas for bulls.

If MKR can reclaim and hold above the $1,770 area, a move toward $1,900 becomes increasingly possible. But a rejection here could open the door for a pullback into the local reload zone.

On the 4-hour chart, the descending trendline break is even more obvious. The current resistance zone is clearly visible, with price now pushing into that area. If we do see a rejection here, eyes will turn to the 50 percent to 61.8 percent Fibonacci retracement zone, which sits around $1,635, marked as number 3. This region aligns with the breakout origin and could serve as a support zone if tested.

Volume is a key factor in assessing this move. The breakout candle was backed by strong volume, but since then, volume has slowed. For this trend shift to gain momentum, I want to see rising volume on continuation candles. Without it, the breakout risks turning into a fakeout.

In the fast-moving altcoin markets, understanding relative strength can be an important factor to success. MKR is one to watch closely, especially if the broader crypto market finds a base. A clean break above the $1,770 – $1,800 area with strong volume could open up upside potential toward $1,900 and beyond. Until then, we remain inside a key decision zone.

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.