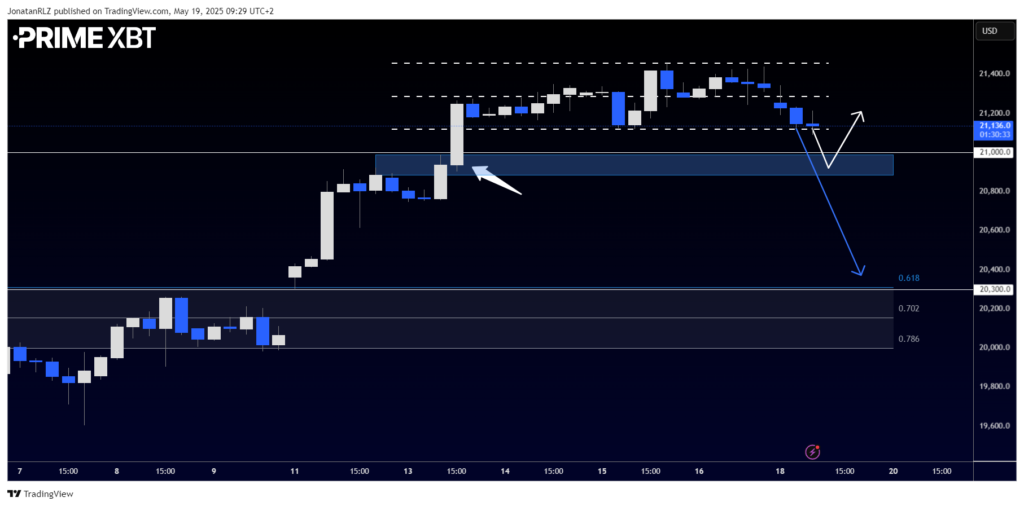

Nasdaq has climbed an impressive 30% from the lows that followed the Trump administration’s proposed tariffs in early April. On the weekly timeframe, we now see price testing a high timeframe resistance zone between 21,000 and 21,400. While Friday’s Moody’s downgrade of US assets didn’t spark an immediate sharp reaction, the weekend gap down suggests the impact may have been delayed.

The key question is whether this marks the beginning of a broader shift in sentiment or simply a technical reaction to resistance, resulting in a healthy retrace within a bullish trend.

Zooming into the daily chart, two levels stand out. The first is immediate support just below current price at 21,000. Holding this level would be a sign of strength and could establish a solid foundation for another leg higher. However, if this support fails, we may see price drift toward the 20,400 to 20,200 region, where the 0.618 and 0.786 Fibonacci retracement levels align with an untested breakout zone and a previously unfilled gap.

On the 4-hour chart, the Nasdaq is currently trading inside a defined range. The range lows sit right above the 21,000 support, which also matches the location of the previous breakout area. A break below the range lows could bring the 21,000 area into focus for another potential bounce, but failure to hold that level would shift our attention to the lower support zone mentioned on the daily chart around 20,300.

Intraday traders will be watching this range closely. The clearly defined levels make for a favourable environment to manage risk, and as always, technical analysis is about identifying and preparing for probable outcomes based on structure and historical patterns.

Trade Nasdaq

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.