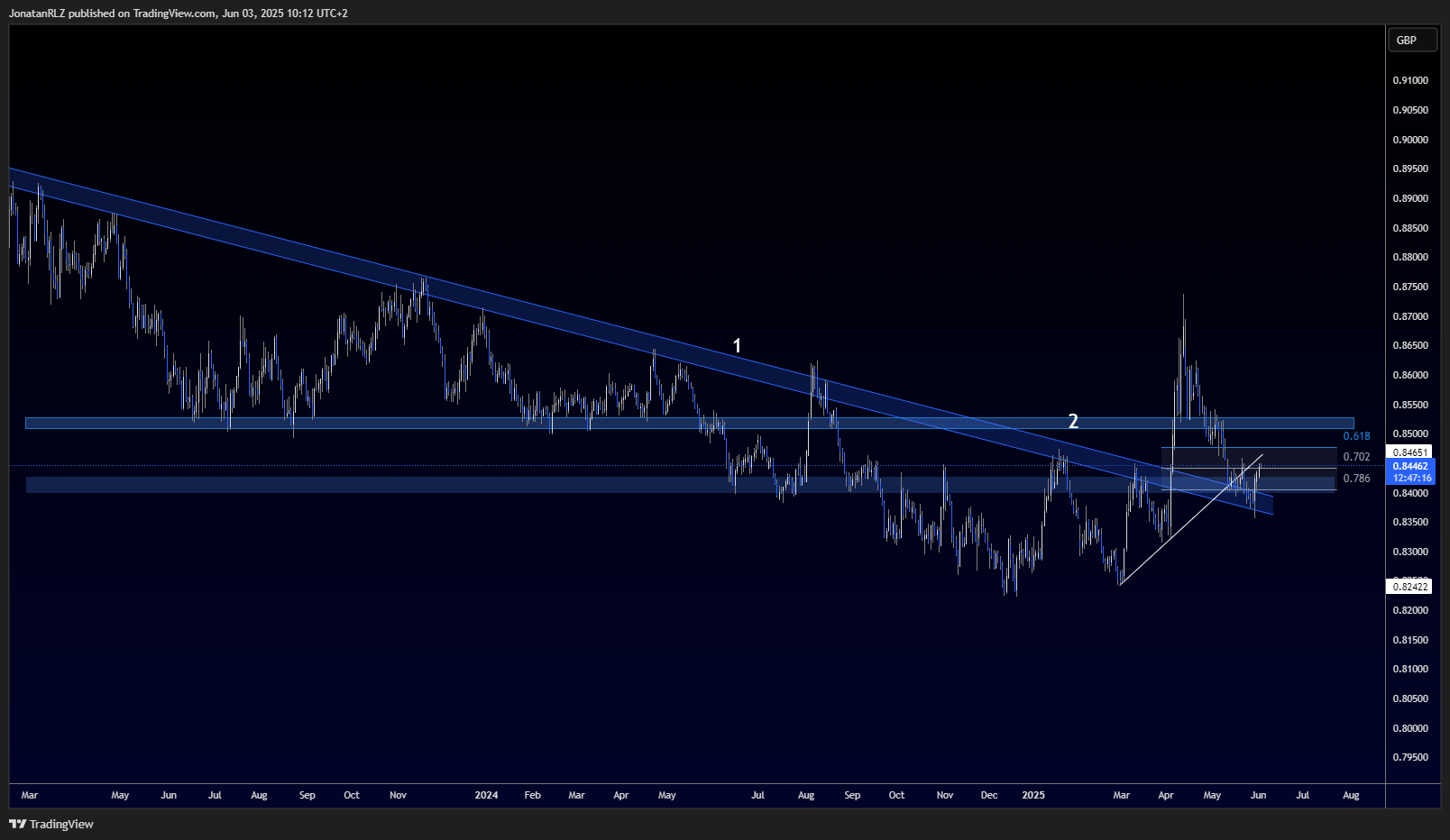

Back in early April, EUR/GBP delivered a sharp breakout move that caught the attention of many traders. Price not only broke above a key descending trendline, marked as number 1, but also surged through a major high time frame resistance zone around 0.8500, marked as number 2.

Following that explosive move, price has since retraced significantly. Rather than collapsing further, EUR/GBP found support at the descending trendline that was previously broken. This retest has now potentially confirmed that level as a valid structural base. Price action has since rebounded and is currently trading near the 0.702 Fibonacci level, the midpoint of the reload zone.

This area now becomes pivotal.

If we begin to see a series of higher highs and higher lows on the lower time frames, this could mark the beginning of a local uptrend. Should that structure build out, the next logical target would be the prior resistance area above 0.8500, marked again as number 2.

On the 4-hour chart, EUR/GBP is currently testing the 0.702 zone discussed on the daily timeframe. This level is marked with a horizontal resistance line as number 1. We can also see that price has recently broken above a descending trendline, marked as number 2, indicating a potential end to the recent local downtrend.

If this short-term breakout holds and we see continuation to the upside, the next key level to monitor is the high time frame resistance around 0.8500, marked as number 3. That remains the primary upside resistance if momentum builds.

However, if price fails to break out from the current range and instead moves lower, focus shifts to the region between the 50 percent and 61.8 percent Fibonacci retracement levels. This zone also aligns with the 20 and 50 exponential moving averages on the 4-hour chart. A confirmed bounce in this area would offer a favourable location for bulls to accumulate, particularly if the larger structure points toward a continuation move higher.

Regardless of the direction, the area marked as number 1 near 0.8450 remains the key intraday resistance level to watch closely.

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.