EUR/AUD is currently in a zone it has not traded in for five years. Following the powerful breakout at the end of March, price has since pulled back to retest the breakout area and the weekly 20 exponential moving average. This retrace has brought the pair back into the reload zone of the breakout move, a region that often attracts accumulation during bullish cycles.

This level represents a key decision point.

From a mean reversion perspective, many traders may view this rally as overextended and anticipate a move lower toward the average price. However, with the changes we are seeing in global trade, and with today’s ECB interest rate decision on the calendar, the market could be preparing for a deeper shift. The key question is whether this current pullback is simply a retest or the beginning of a new higher timeframe cycle for EUR/AUD.

If this indeed marks a new cycle, then the current area may become a high-probability zone for longer-term accumulation.

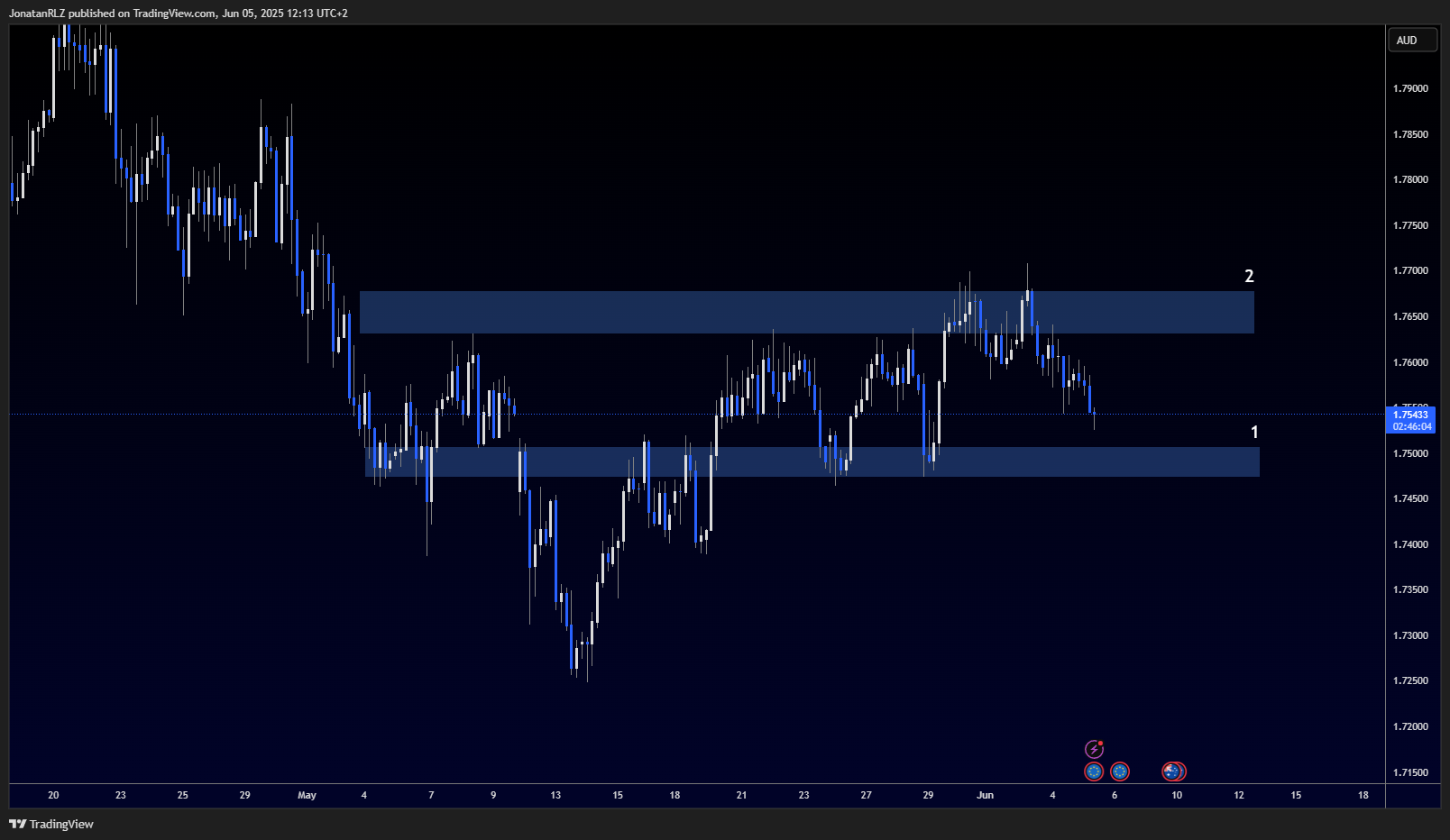

On the daily chart, EUR/AUD is currently sitting inside the reload zone. The 0.618 Fibonacci level is acting as local resistance, marked as number 2 around 1.7650. Below, we have key support marked as number 1 at 1.7000. Price remains in a consolidation phase between these two zones.

If EUR/AUD can reclaim the resistance around 1.7650, it could open up a path toward 1.8000, aligning with the 0.618 retracement of the previous downward leg. However, if resistance continues to hold and the pair rolls over, we could instead see the development of a range between support at 1.7000 and resistance at 1.7650.

With the ECB interest rate decision due later today, this zone becomes even more important. The outcome could act as a catalyst for a move either deeper into the range or toward a potential breakout above resistance.

On the 4-hour chart, we can clearly see two key levels. The first is support near 1.7500, marked as number 1, which is holding the current bullish intraday structure. Price is still forming higher highs and higher lows, but a break below this level would invalidate the current trend and could lead to a move back toward the daily support zone around 1.7300.

To the upside, the key level remains the resistance at 1.7650, mentioned previously as number 2. A clean break above this zone could act as a confirmation trigger for higher timeframe continuation, potentially targeting the next major resistance near 1.8000.

Until a breakout or breakdown occurs, EUR/AUD remains in a consolidation phase with bullish characteristics, and today’s ECB announcement may be the event that resolves the range.

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.