Following a sharp jump above 100k on May 8, Bitcoin traded in a tight range last week, within a holding pattern between 100.7k and 105.7k. At the start of the new week, BTC jumped 4% to 107k before quickly giving these gains back. The price has rebounded 39% over the past month, climbing from the April low of 74.6k to 105.7k, its highest level since late January.

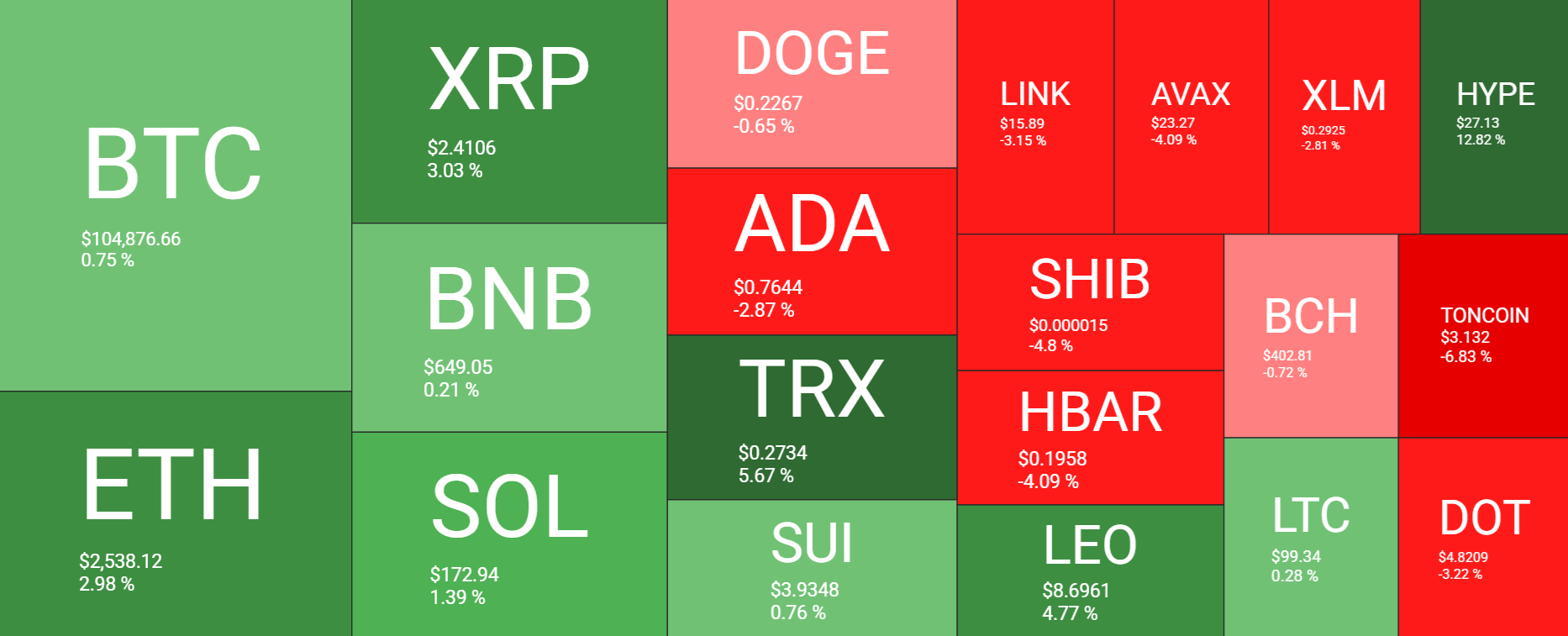

The picture across the altcoin market was more mixed. Ripple and Ethereum outperformed Bitcoin, rising 3% and 2.2%, respectively. Meanwhile, smaller altcoins saw some losses, with ADA, DOGE, HBAR, and TON falling between 2.8 and 6.8% each.

The cryptocurrency market capitalisation is down slightly from the peak of $3.35 trillion reached on May 14 to $3.34 trillion at the time of writing.

The cryptocurrency fear and greed index is at 66 in Greed territory, down slightly from 77, Greed, last week, and up from 32 Fear last month.

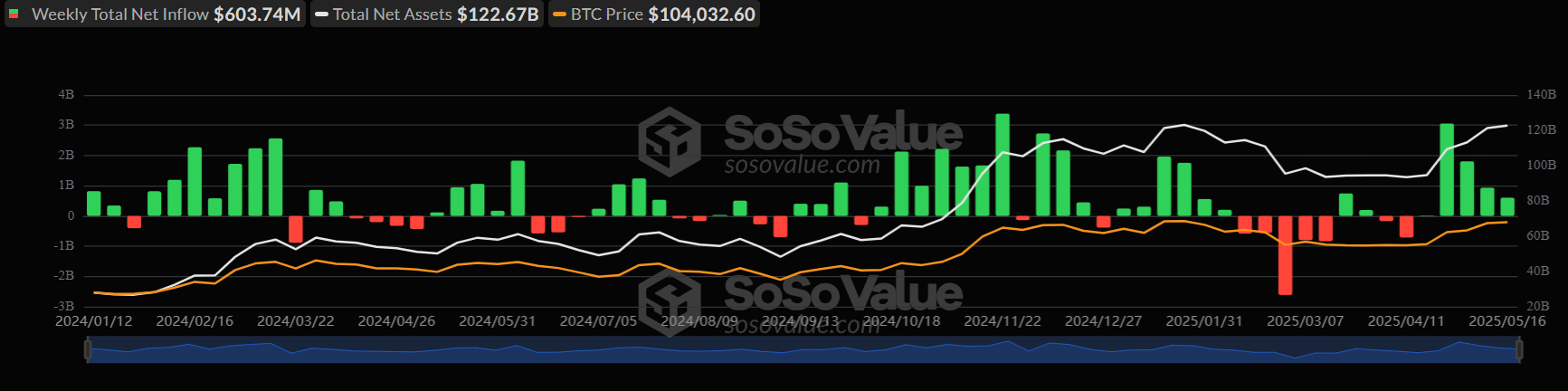

BTC ETFs book net inflows

Institutional demand for Bitcoin has remained solid, with Bitcoin ETFs seeing the fifth straight week of net inflows. According to SoSo Value BTC ETF data, net inflows reached $603.74 million last week, putting total monthly ETFs’ inflows at $2.64 billion following $2.97 billion in net inflows in April. Persistent BTC ETF inflows could lift Bitcoin’s price higher.

Q2 is already stacking up to be a stronger month for ETF inflows than Q1. According to US filings, several high-profile asset managers cut their stakes in spot Bitcoin ETFs as the price dropped 12% in the first quarter of 2025. The 13F findings showed that hedge funds trimmed their holdings amid the collapse of the premium people were paying for Bitcoin futures, which had set up a lucrative basis trade.

Meanwhile, the Wisconsin Investment Board sold off its entire $350 Bitcoin ETF stash in the first quarter.

Separately, the Abu Dhabi sovereign wealth fund snapped up a further 491,439 shares of IBIT in Q1.

Macro backdrop

A de-escalation in the US-China trade war helped lift investor sentiment last week. This was reinforced by the US administration agreeing to $600 billion in commercial deals with Saudi Arabia, suggesting that there could still be momentum within trade diplomacy. Meanwhile, Japan, the fourth-largest economy, suggested a trade agreement with the US could be reached by June, which would help resolve concerns surrounding advanced semiconductors. These developments are helping calm investor concerns about a potential US recession this year.

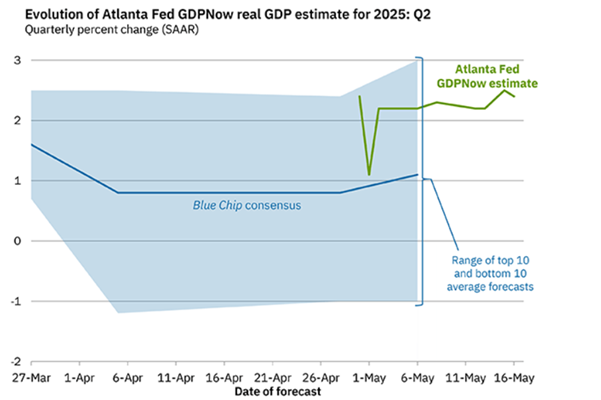

After Q1 US GDP contraction of -0.3%, a technical recession was looking increasingly likely; however, the Atlanta FedGDP Now estimate is pointing to real growth of 2.5%, up from 2.3% a week ago, again easing recession expectations.

Meanwhile, US inflation was also cooler than expected, easing to 2.3% year on year, while PPI inflation fell by the most in five years. Inflation data shows few signs of the inflationary impact from tariffs. However, it is still early days, which could take longer to show through to hard data.

Moody’s downgrades the US credit rating

Moody’s, a major US credit rating agency, downgraded U.S. government credit from AAA to Aa1, owing to increased deficits and mounting national debt. The agency forecasts higher U.S. government debt, fueled by increasing interest expense on the debt and a lack of cost-cutting measures.

Expectations for a deteriorating US fiscal performance, highlighting fiscal concerns, could boost bitcoin’s appeal as a hedge.

The latest developments come as the cryptocurrency is on track to confirm a golden cross in the coming days. This is when the 50 SMA crosses above the 200 SMA, typically a bullish signal. Following a death cross bear trap, a similar pattern unfolded from August through September 2020, setting the stage for a rally before prices eventually hit a record high of 109K in January this year.

Regulatory developments are supportive

There have been some recent developments around friendly regulation. Stablecoin legislation could be just around the corner with a bipartisan bill on US stablecoins hitting the Senate floor this week. The Genius Act will be debated, which, if passed, establishes the first of a pro-growth regulatory framework for payment stablecoins.

Retail investors re-entering & whales accumulating

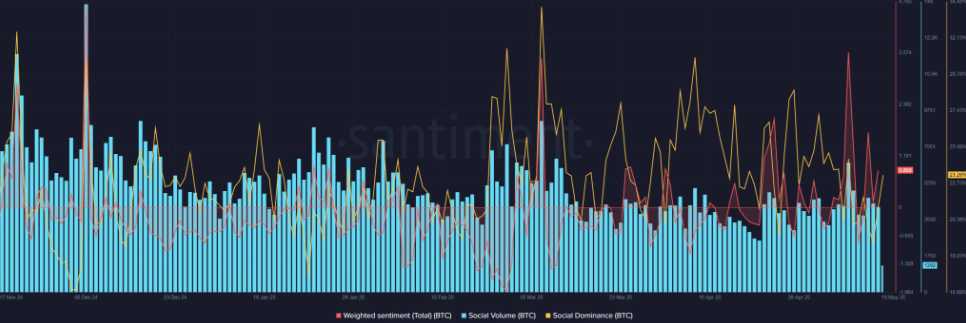

Retail engagement has picked up strongly, with BTC-related social volume surging to 1292 while social dominance rebounded to 23.26%. These figures imply that Bitcoin is a central topic in market discussions. Furthermore, weighted sentiment has turned positive to 0.859, pointing to growing optimism from the broader community.

Strength in these measures points to retail participants gaining confidence.

Whales accumulate as net flows stay negative

Demand across market participants from both retail traders and whales can be seen.

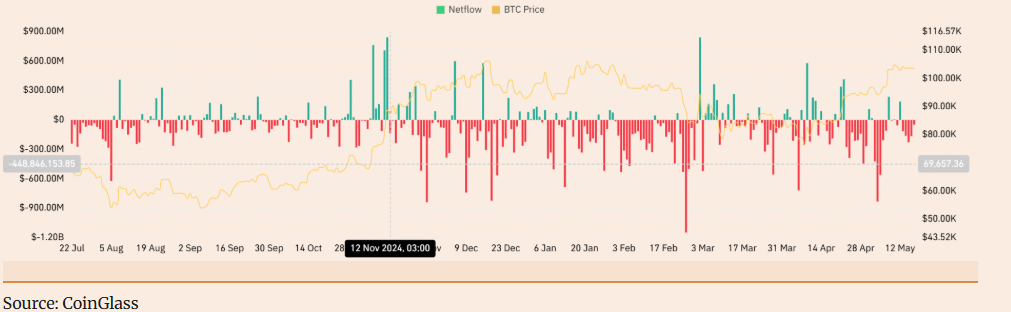

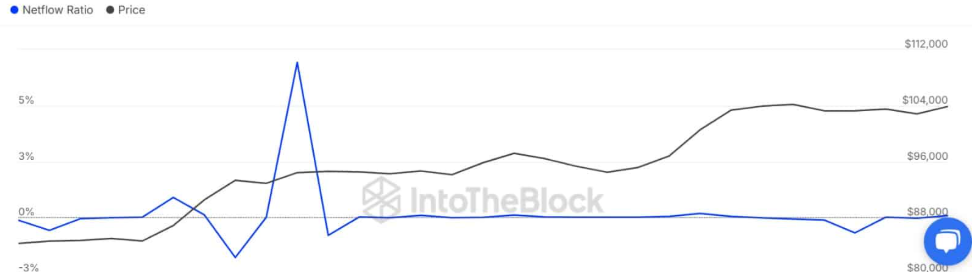

Bitcoins’ netflow has remained negative over the past five days, at—$48.9 million, reflecting a strong accumulation trend.

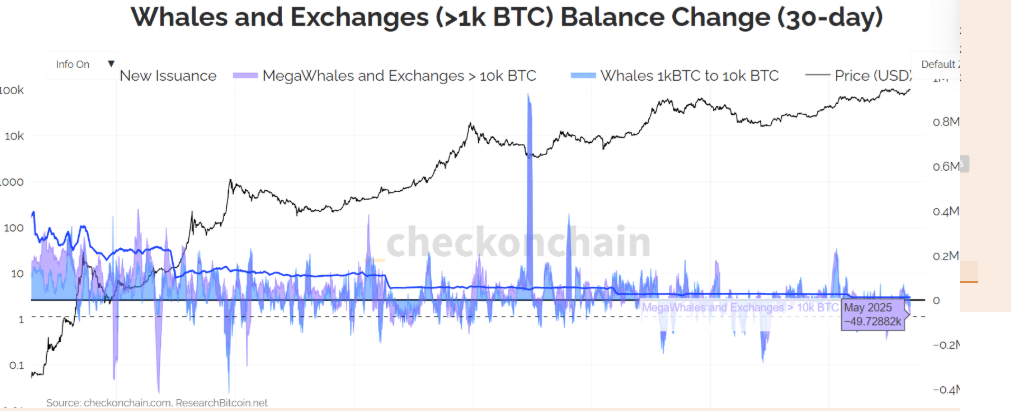

Demand for Bitcoin is even more aggressive among large holders, with whales accumulating over the past 30 days. Whale exchange flows have declined significantly over the past month. On Binance, whale inflows declined to a six-month low.

The Whale Exchange Balance change hit 49.7k BTC over the last 30 days, while large whales (1k-10k BTC) showed a -22k balance. In other words, the data suggests that whales are not sending coins to exchanges.

Additionally, Bitcoin large holders’ net flows to exchange net flow ratio has dropped from 6.93% to 0.08% over the last 30 days. This suggests reduced exchange inflows from whales; if they sell less, they must be accumulating more.

Open Interest Delta repeats bull run pattern

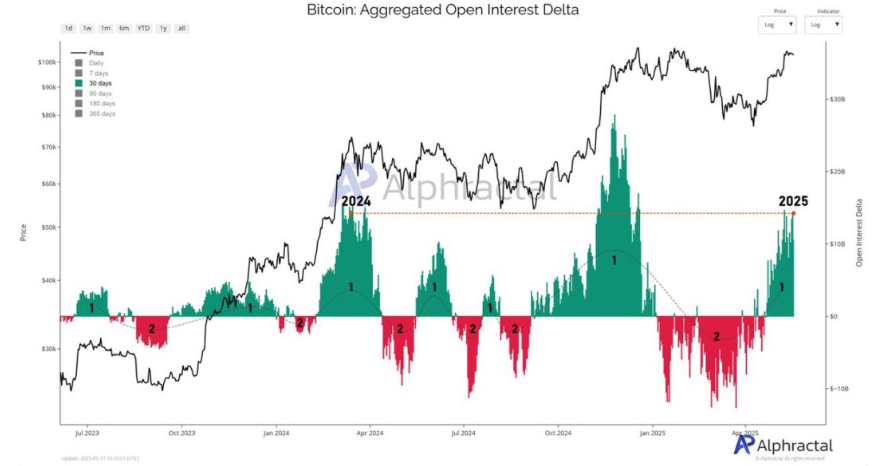

According to Alphractal, Bitcoin Open Interest is showing patterns that have coincided with significant price moves.

Open interest measures the total amount of money flowing into BTC derivatives at any given period. The open interest delta indicator estimates changes in open interest over a specific time period. This has typically seen two phases. Phase 1 is marked by rapid accumulation, which shows as a positive delta.

Phase 2, where positions start to unravel, reverses the Delta into negative.

Alphractal noted that the open interest delta recently reached the same level as during the Bitcoin bull runs. This pattern could show that BTC is beginning a cyclical behavioural change.

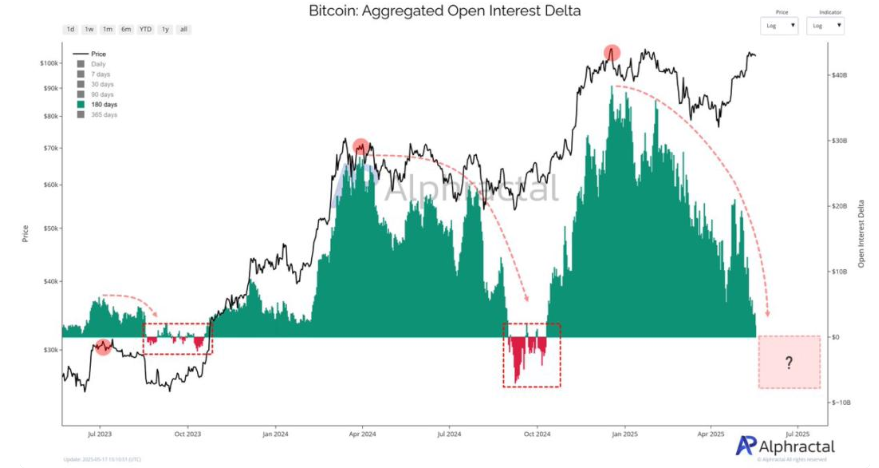

Looking beyond the short term, the OI 180-day delta offers further insight into the Bitcoin price trajectory in the coming weeks. A negative 180-day OI delta metric is associated with the market bottom or an accumulation trend. A cross beneath a zero threshold could also signal the start of a new consolidation phase. This transition is often where large investors start loading up quietly.

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.