Bitcoin started the precious week around 96k before shooting above 100k on December 4 to an all-time high of 103.6k, marking a 45% gain since the US elections. The peak was short-lived, with Bitcoin quickly dropping to 92k amid profit-taking, incurring $1 billion in liquidations in 24 hours. The price of the world’s largest cryptocurrency has since edged higher, starting the new week at 99k.

While Bitcoin rose 2.8% across the week, Ether rose 7%, and some other tokens performed even more impressively. XRP was a standout performer, rising 34%, BNB jumped 12%, and TRX jumped 51%. A few coins fell across the week, including SOL, TON, and XLM, down 0.5%, 2%, and 4%, respectively.

Macro backdrop

The move across the key 100k milestone had been hotly anticipated. It came as the Bitcoin price has appreciated by 45% since the US elections, based on expectations of more crypto-friendly regulation in Washington. According to Coinmetrics data, average daily BTC spot volumes on centralized exchanges jumped by 81% in November compared to the previous three months.

Last week, President-elect Donald Trump nominated Paul Atkins to replace Gary Gensler as the chair of the Securities and Exchange Commission (SEC) from January 20th. Atkins has been vocal in his support for cryptocurrency. The news spurred Bitcoin above 100k to an ATH and XRP to its highest level since 2018.

Bitcoin’s rise above 100k was short-lived. The price faced limit orders around the key level and plunged to 92k in a healthy round of profit-taking.

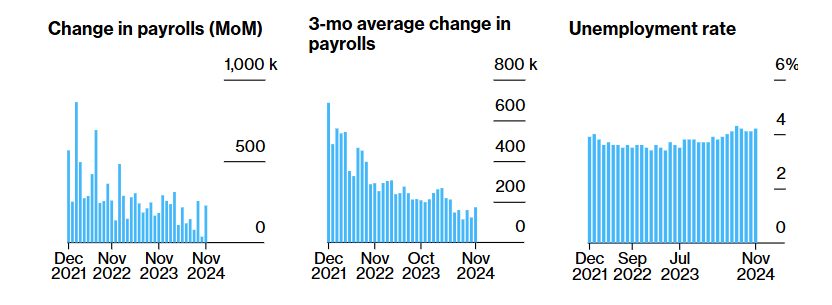

Bitcoin recovered on Friday following a US non-farm payroll report, which showed that 227k jobs were added in November, up from 36k in October. This was above the 220k forecast. Meanwhile, the unemployment rate rose to 4.2%, up from 4.1%, pointing to a Goldilocks report.

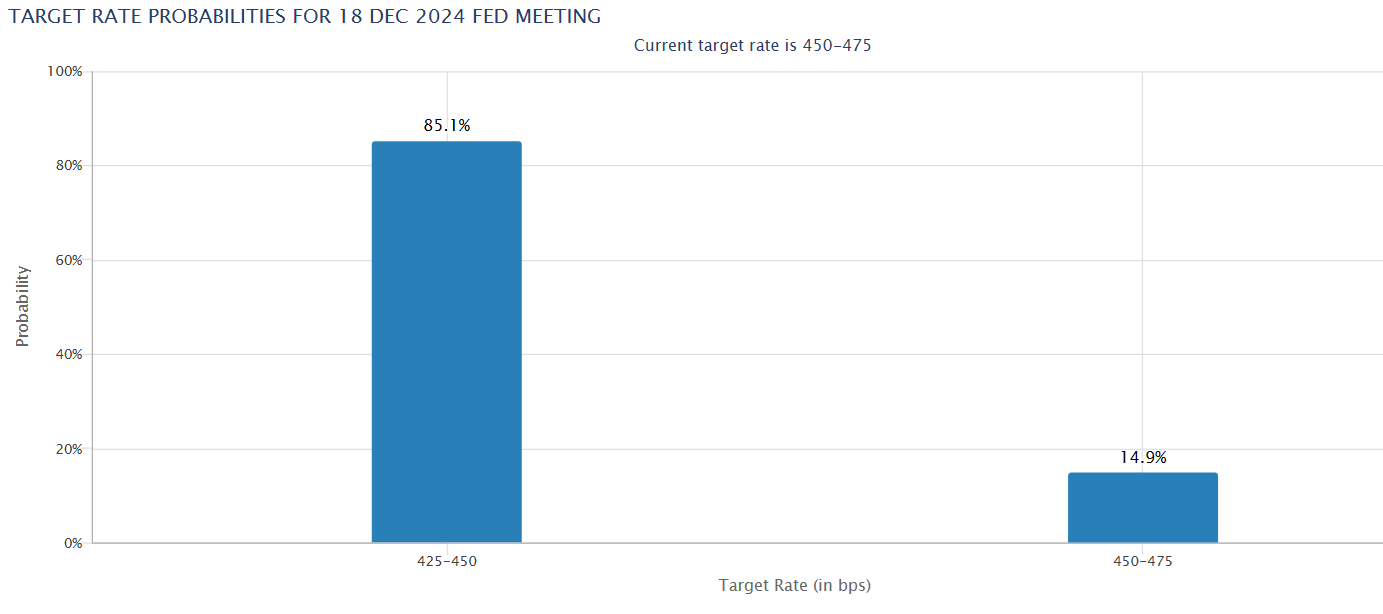

This means there is a small amount of weaknesses seeping into the labor market- enough to continue supporting the view the Fed will cut rates in December, but not with anywhere near enough weakness for the market to worry. Following the report and according to the CME group’s Fed watch tool, the market is pricing here in a 90% probability of a 25-basis point rate cut in the December 18 announcement. This was up from around 72% in the days before the release. Bitcoin, along with other risk assets, tends to perform better in a lower interest rate environment, given the increased liquidity.

Separately, Federal Reserve chair Jerome Powell remarked that he considers Bitcoin to compete with gold rather than the U.S. dollar, which has drawn more attention to the digital asset and given it legitimacy.

BTC ETF holdings surpass Satoshi

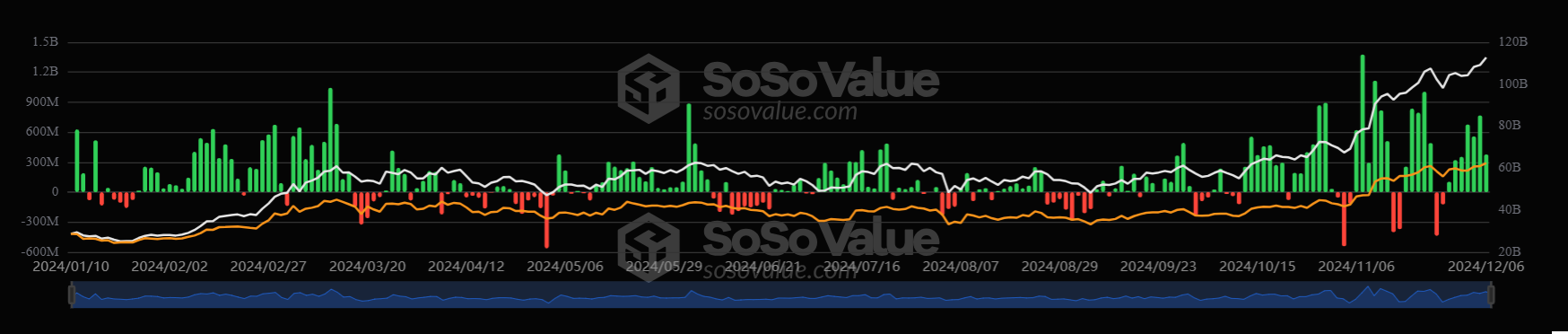

Bitcoin ETFs set a significant milestone last week, with the level of accumulation reaching 1.104 million coins as of December 6, which was above the 1.1 million coins in Satoshi Nakamoto-associated addresses. This means that institutions in the US control the biggest share of BTC in circulation and highlight the impressive institutional demand across the market.

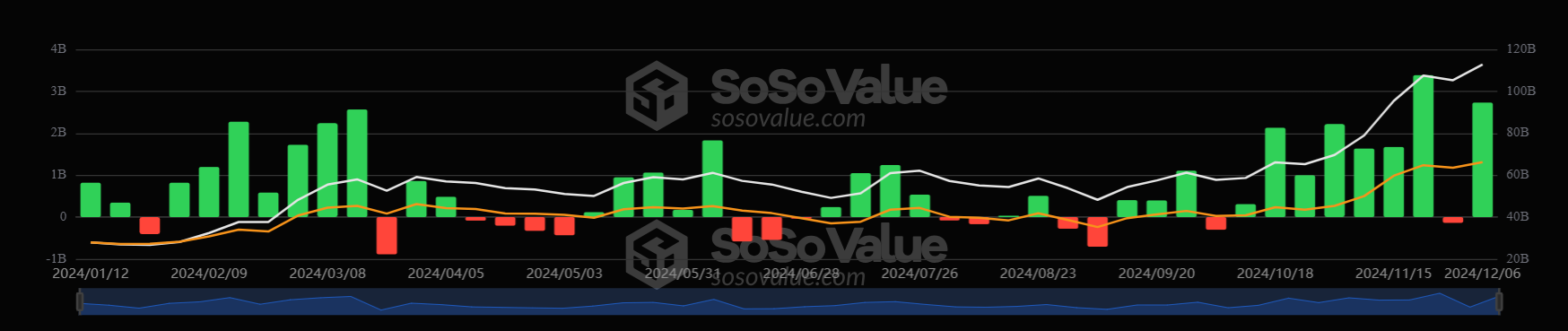

Bitcoin ETF funds saw a positive shift last week, attracting $2.73 billion in net inflows. This marked the second-best week for these investment vehicles, trailing the November 18-22, which saw $3.38 billion in net inflows.

Last week, the highest net inflows totaled $766 million, recorded on December 5th. A 50% surge in daily ETF trading volumes helped Bitcoin soar past the 100K milestone.

Institutional interest in Bitcoin through ETFs is expected to keep growing, driving the digital asset toward global adoption. This could also ignite competition among nation-states to acquire Bitcoin. According to Standard Chartered’s Geoff Kendrick, a new institutional era could help drive Bitcoin to 200k in 2025.

Whale accumulation

In addition to an encouraging fundamental backdrop, technical factors were also behind the move higher, including unprecedented buying from publicly traded firms such as MicroStrategy. Between November 25 and December 1, MicroStrategy sold 3.7 million shares of its stock, using the funds to make its fourth major weekly Bitcoin purchase. The firm has recently acquired 15.4K BTC, equating to $1.5 billion, taking the corporation’s total holdings to 402K, around $40 billion.

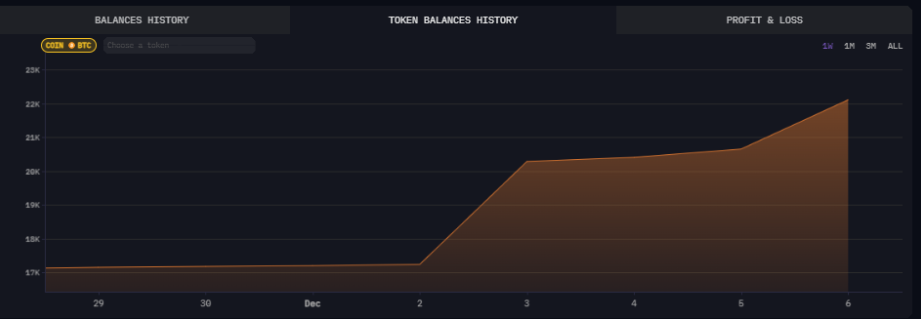

Meanwhile, according to the SEC filing, MARA bought 6.5K BTC between October 1st and November 30th and plans to purchase more. MARA holds close to 35K BTC, as the chart below highlights the rise.

On-chain activity

Strengthen Bitcoin and other cryptocurrencies supported on-chain activity. Aggregate decentralized exchange (DEX) volumes rose 78% over the past week from $10.4 billion on November 28 to $18.5 billion on December 4th. Stablecoin borrowing and lending rates also increased, reaching 10% to 20% annualized on Aave and Compounded across nearly all of the deployed networks.

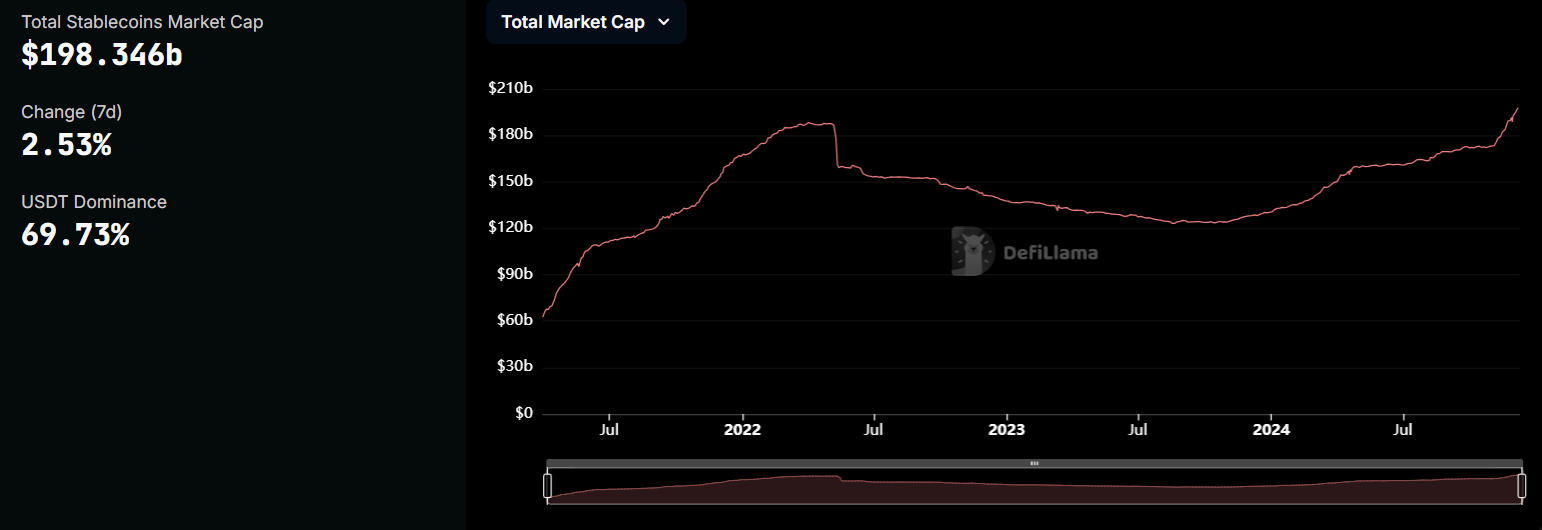

The total stablecoin market cap continued to reach new record highs at $198 billion, up from $189 billion at the end of November. This likely represents an influx of capital into the space looking to capitalise on elevated lending rates.

Profit-taking is a short-term risk

After reaching 100k, the price dropped sharply lower as limit orders kicked in. This level could continue to prove a challenge in the short term.

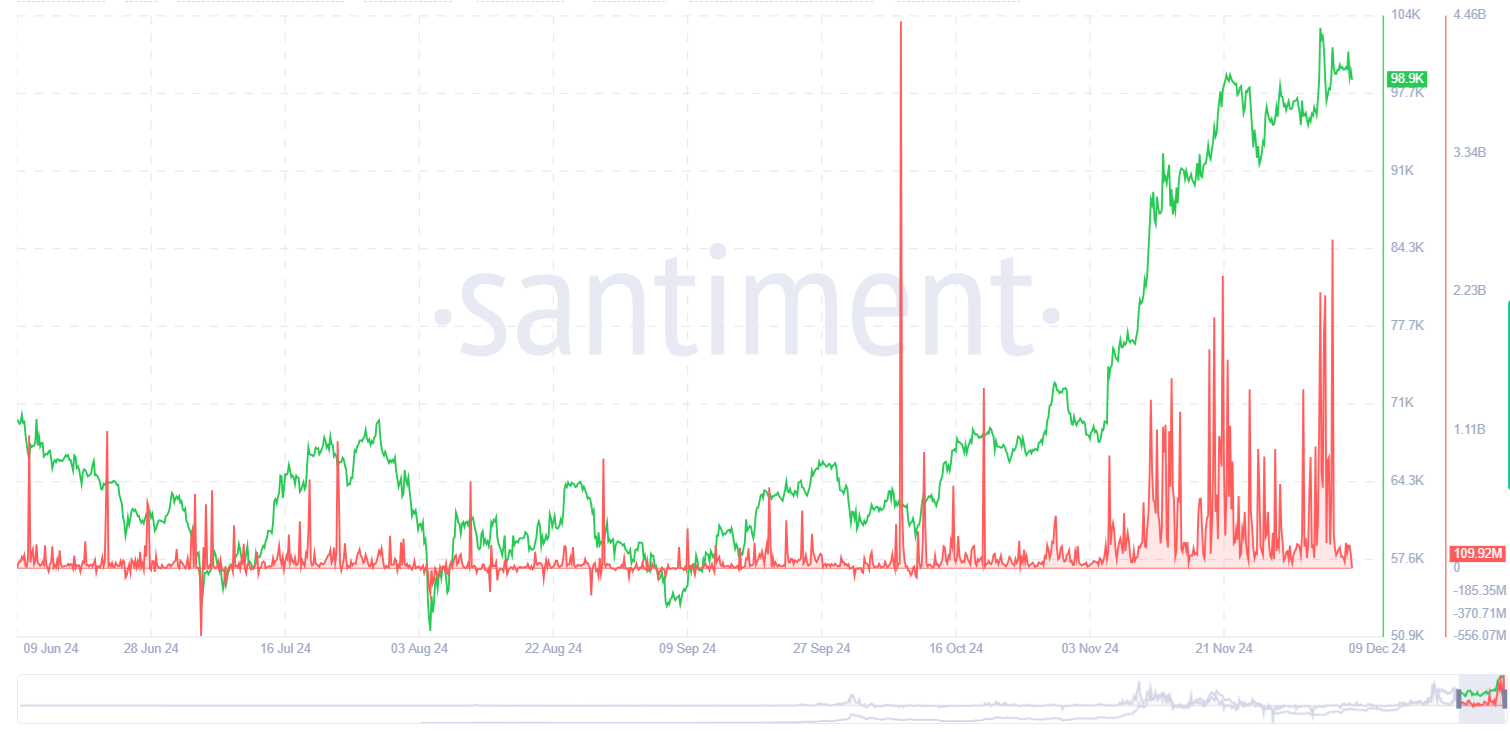

Saniment’s Network Realized P/L indicator data showed that holders booked profits at the top. The NPL metric spiked on Thursday, indicating that holders are selling at significant profits on average.

However, worries about increased supply could also limit gains. According to data from Arkham, a wallet related to the US government, 10k BTC worth $962.88 million last week from Silk Road seized addresses to Coinbase Prime.

Mt Gox also transferred 24,052 BTC worth $2.43 billion to a new wallet, according to Lockonchain data. Mt Gox also transferred 3620 BTC to two new wallets on Friday.

Should any of the above wallets sell or distribute these coins, it could create bearish sentiment amid expectations of increased supply.

Bitcoin dominance falls & altcoin season begins

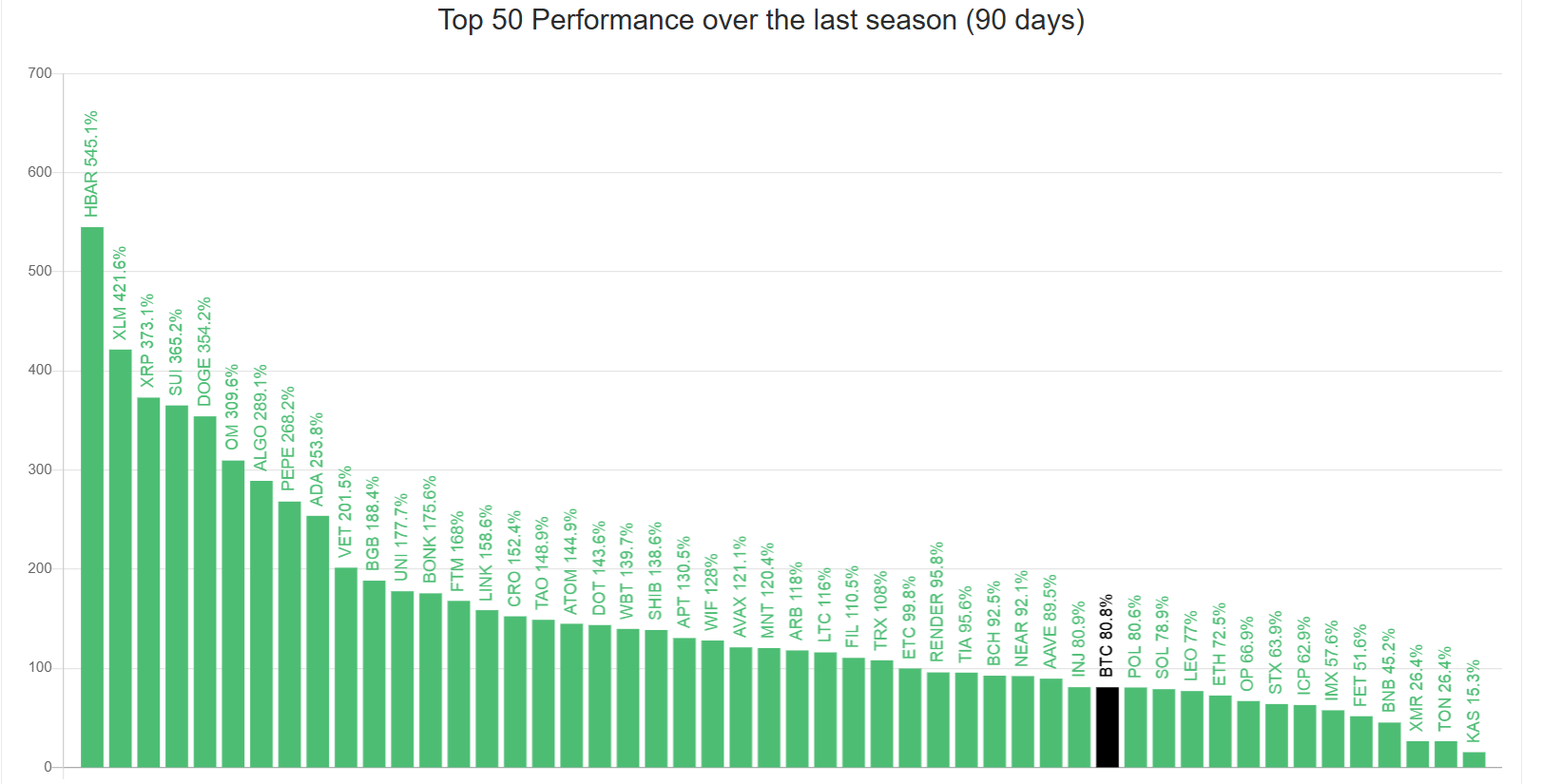

Bitcoin dominance has plunged from 61.5% at the start of November, a 3.5-year high, to a low of 54% last week. The shift in trend comes as Bitcoin’s momentum has stalled while altcoins are delivering impressive returns.

The altcoin market cap has surged to a record high as Bitcoin’s dominance falls. The total altcoin market cap is now $1.369 billion, up from $784.7 million just 30 days ago – marking a gain of 74.5%.

Last week alone, XRP broke $2.50, HBAR gained over 100%, and Ethereum hit a six-month high. Meanwhile, numerous smaller-cap tokens have smashed through key levels.

The altcoin index rose above 75%. This means that of the top 50 coins, 75% have performed better than Bitcoin over the past 90 days, marking the start of the altcoin season. While this index reached a high of 88% last week, it eased to 73% at the start of the new week.

The last significant altcoin season occurred in H1 2021. During that time, altcoin gained 174%, while Bitcoin gained 2%. During this period, Bitcoin’s dominance dropped from 61% in February to 40% in May 2021. Many altcoins, such as BNB, Dogecoin, Chainlink, and XRP, reached their cycle highs.

If the market plays out similarly, we could expect Bitcoin’s market dominance to fall to 40% and altcoin’s market share to continue rising. However, it’s worth noting that this year is different, given institutional demand. While previous cycles have been driven by retail traders rotating out of Bitcoin and into altcoin, Bitcoin could show more resilience this time around owing to institutional demand.

Week Ahead: CPI

The market will continue to watch Bitcoin move around the 100k level. There is a good chance the bears and the bulls will battle at this level, resulting in a period of consolidation. Meanwhile, the altcoin season may continue.

On the economic calendar, US inflation is the primary focus. CPI is expected to rise to 2.7% from 2.6%. Hotter-than-expected inflation could raise concerns over the Fed’s ability to cut rates across 2025 and drag on risk assets.

Microsoft shareholders are scheduled to vote on a proposal to add Bitcoin to its balance sheet on December 10th. If this proposal is passed, it will be bullish for Bitcoin.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.