Bitcoin is consolidating around 94.5k after surging over 10% over the past week. The price broke out from its holding pattern last Monday, rising from a low of 83k above the key 200-day moving average resistance to a two-month high of 95.8k on Friday.

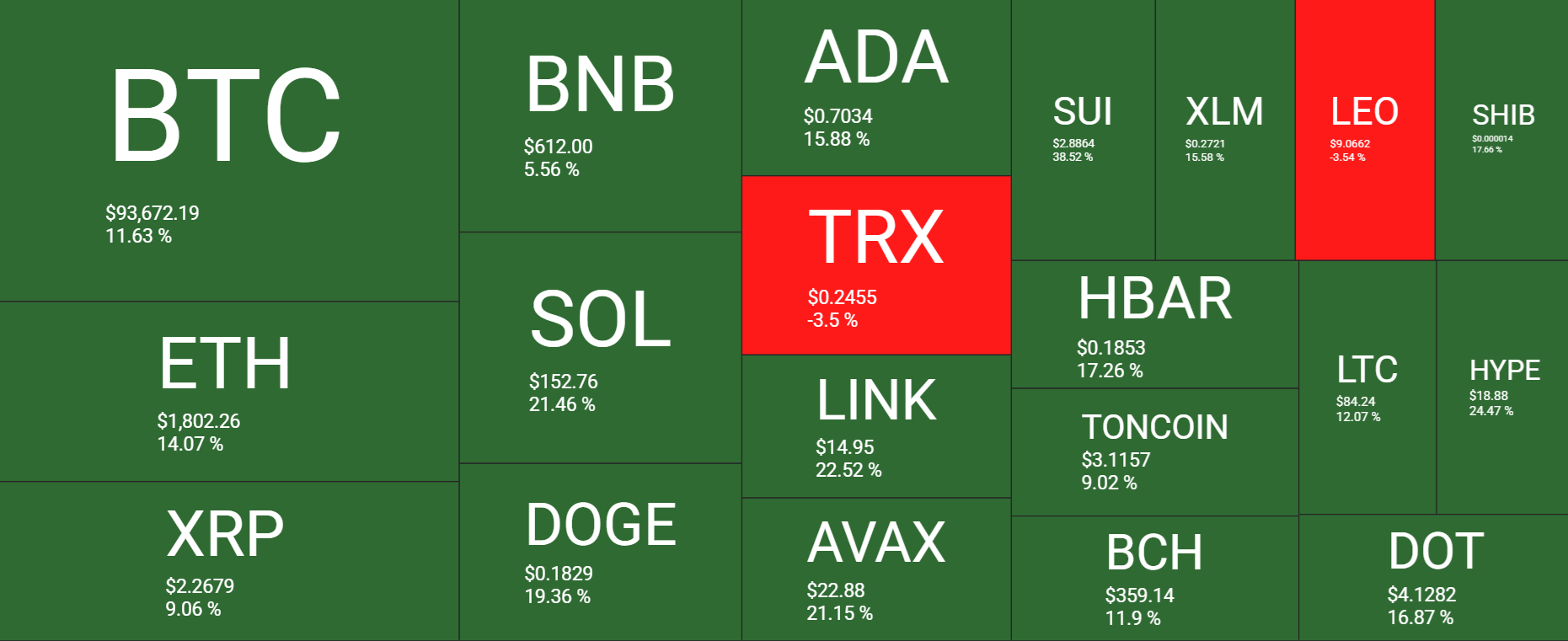

The move higher was replicated across the crypto market, with Ethereum rising 14% and Solana gaining almost 20%, while XRP lagged with gains of 9%. ADA booked gains of 15%, and DOGE rose almost 20%.

The total cryptocurrency market capitalisation recovered from $2.66 trillion to $2.99 trillion on Friday before easing to $2.95 trillion at the start of the new week.

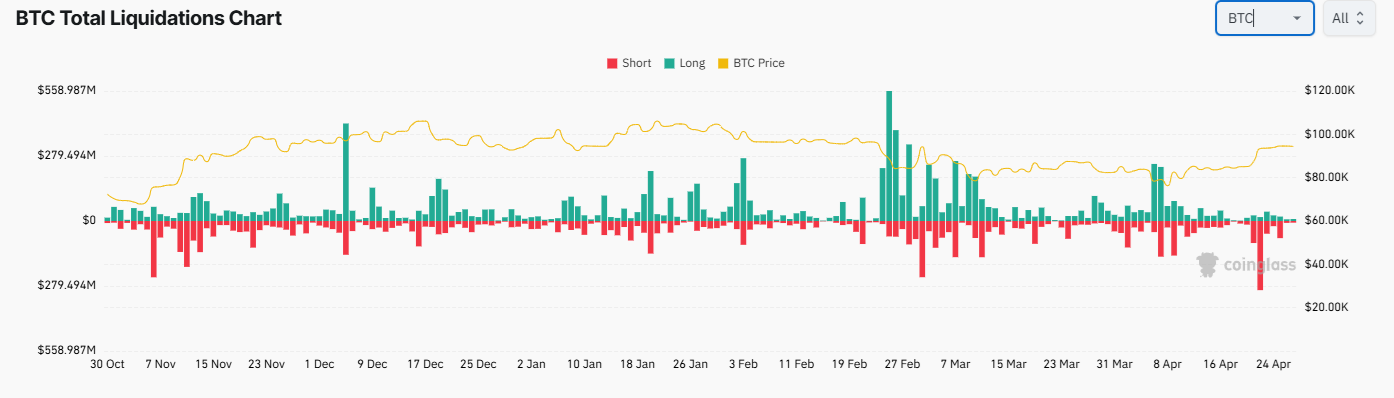

Liquidations

Bitcoin long liquidations were low across the week, remaining below $40 million each day. However, Bitcoin’s 6.7% jump on April 22 brought a wave of short liquidations totaling $297.3 million, compared to just $16.9 million long liquidations.

ETF demand surged

Bitcoin institutional demand supported the price rally last week. According to SoSoValue data, US spot Bitcoin ETFs took over $3 billion in new capital last week. This was the highest level in five months and the second highest net inflows of all time, second to the $3.38 billion record inflows of mid-November, the week of the US elections.

Breaking this down daily, BTC ETFs record six straight days of net inflows, bringing the total value of assets to $110 billion. Should these strong inflows persist, Bitcoin’s price could rise further.

Corporate interest heats up

Demand from corporations was also strong across the week, with MicroStrategy announcing that it acquired 6556 Bitcoin for $555.8 million. Japanese investment firm MetaPlanet also acquired 330 BTC for $28.2 million and then purchased an additional 145 BTC, bringing their total holdings to 5000 tokens.

Meanwhile, the latest example of this rising corporate interest was 21 Capital, a new firm backed by Tether, Bitfinex, Softbank, and Cantor Fitzgerald, led by Jack Maller, the founder and CEO of Strike. The company is set to hold 42,000 Bitcoin at the start, which equates to around 8% of the Bitcoin currently held by Strategy.

Corporate buying activity is considered bullish for Bitcoin’s price. It lifts demand and reduces circulation, similar to ETFs.

Macro backdrop

The market mood improved considerably this past week, with global markets rallying after President Trump stated that he is not planning to fire Federal Reserve Chair Jerome Powell. Meanwhile, the Trump administration and China both signaled a softening stance in the global US-China trade war. While Trump said that 145% tariffs on China were “very high” and “will come down substantially,” China granted some tariff exemptions for US imports.

Hopes of a de-escalation in the US-China trade war helped stocks gain across the week. The S&P 500 gained 4.5%, and the tech-heavy Nasdaq rose 6.7%. The selloff in the USD also eased, with the US dollar index rising after four straight weeks of declines, as the sell-America trade steadied.

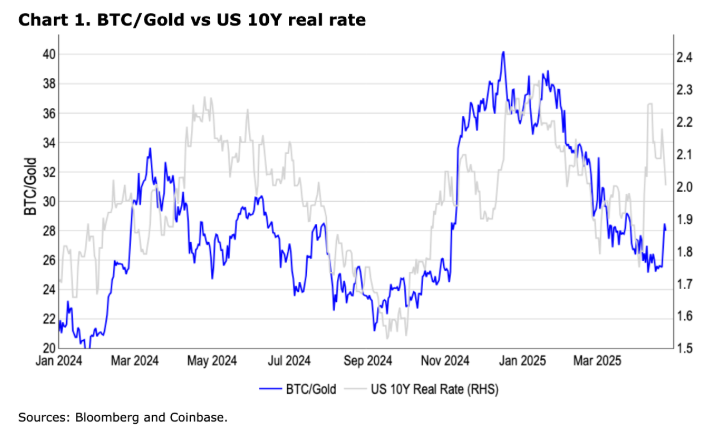

Bitcoin has been outperforming stocks on a risk-adjusted basis in recent weeks. Perhaps even more importantly, this week, we saw Bitcoin sharply appreciate against gold, which typically moves inversely to the US dollar and U.S. Treasury yields. This could suggest that Bitcoin is starting to chart its own course in global financial markets. However, it’s still too early to tell, as the markets are still very headline-driven.

Divergence could highlight Bitcoin’s maturing role as a store of value rather than a risk asset. The return of institutional demand and increasing corporate demand support this view.

Over the past month, Bitcoin has outperformed most assets, with the token up 14% compared to a 6% rise in Gold and a 0.5% increase in US equities. It is still premature to draw concrete conclusions, but this price action could highlight crypto’s emerging role and potentially challenge the notion that crypto is merely leveraged NASDAQ beta.

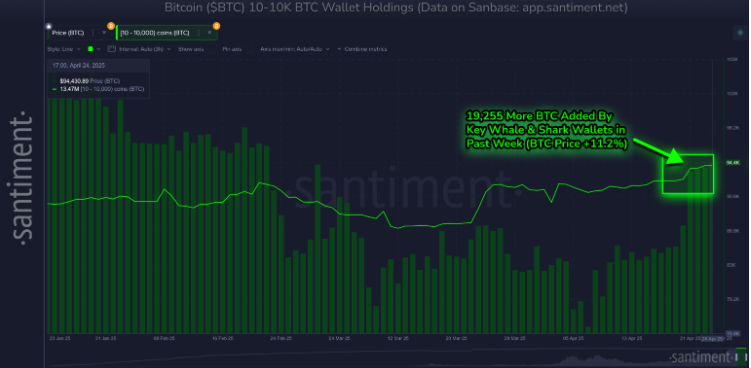

Bitcoin whales & sharks strike

Last week, the 11.2% rise in BTC price coincided with whales and sharks adding to their holdings. In this period, wallets holding 10- 10k Bitcoin have added 19,255 more coins. According to Santiment key bitcoin stakeholders keep accumulating and now hold 13.47 million BTC, the highest amount ever.

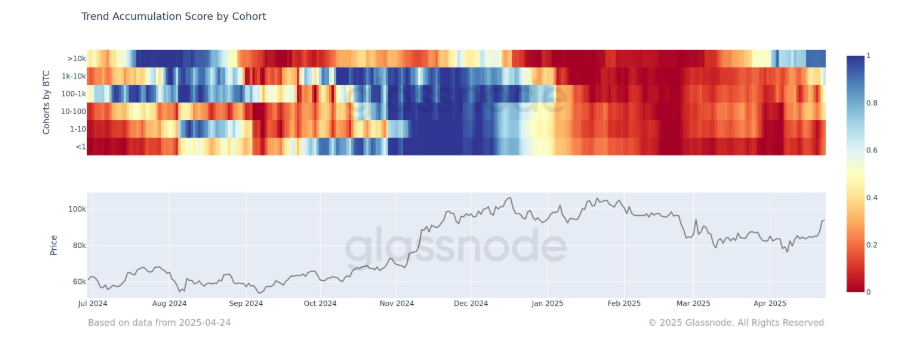

Meanwhile, data from Glassnode showed that renewed demand from whales is evident in the Accumulation Trend score. This score reflects the relative size of entities actively soaking up new coins on chain. A score of 1 indicates entities are accumulating, whilst a value close to 0 suggests otherwise. Data this week showed wallets holding over 10,000 BTC had an accumulation score of 0.9. Those with 10 to 10k BTC showed 0.7, and smaller wallets were also pivoting to accumulation, with the trend store of 0.5. This tells us that large players have been buying into this rally so far.

Bullish on-chain metrics

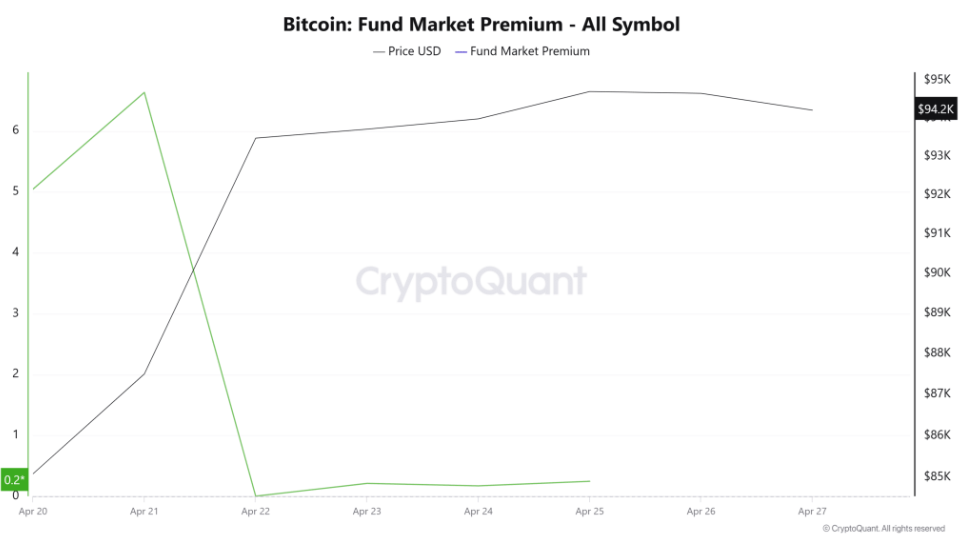

Bullish sentiment can also be seen in multiple ways, including bitcoin’s fund market premium, which turned positive to settle at 0.2. A positive fund premium suggests investors, particularly institutional investors, are experiencing enthusiasm and FOMO. This suggests significant demand for Bitcoin across the market, including traditional finance.

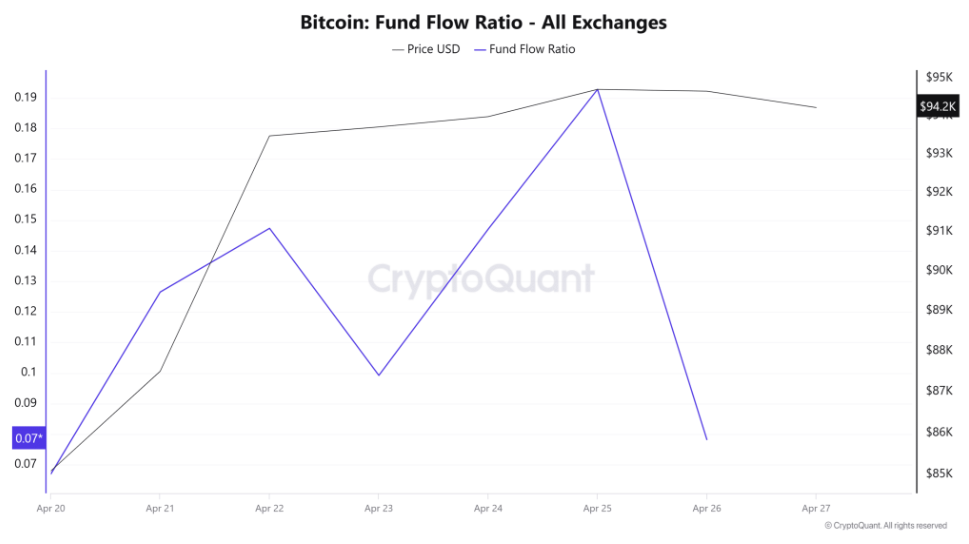

Meanwhile, Bitcoin’s fund flow ratio has fallen to a low of 0.078. The decline points to increased holding behaviour, as investors prefer moving BTC into cold storage and private wallets, which is a typical sign of long-term conviction.

Bitcoin network fees climb 42%

According to data from IntoTheBlock, Bitcoin network fees surged by 42% over the past week. Traders spent $4.03 million on transaction fees during this time, suggesting a high level of network engagement.

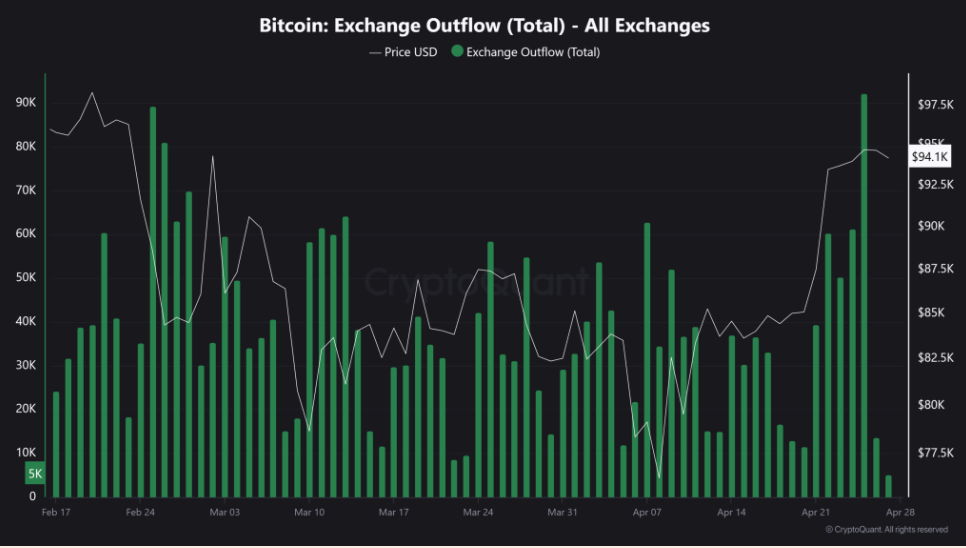

Meanwhile, investors are moving coins off exchanges with one of the largest outflow surges since mid-February, indicating that investors are still opting to keep their assets and tightening supply. A combination of an increase in network activity and sustained exchange outflows pointed to strong underlying demand and positive sentiment in the market.

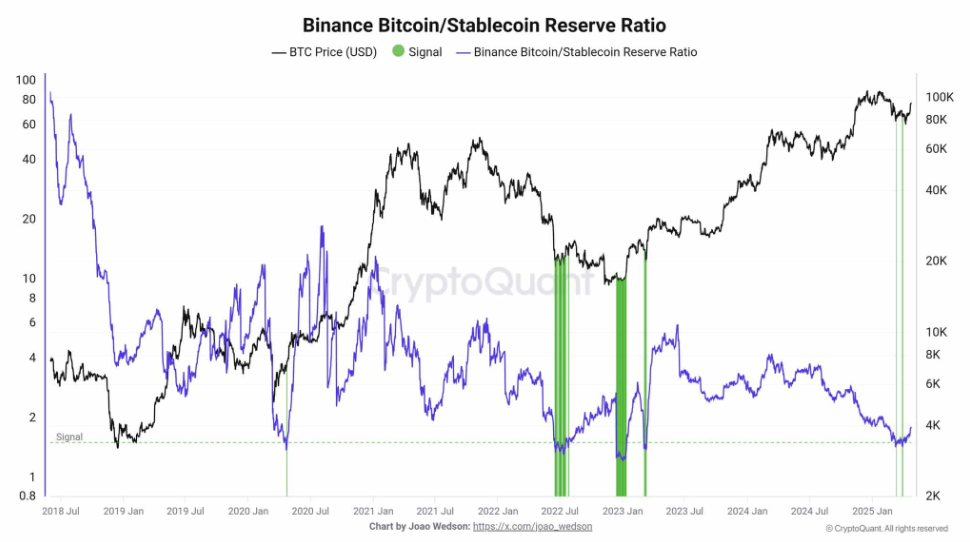

Binance Reserve Ratio flashes a bullish signal

The Bitcoin to stablecoin reserve ratio on Binance has turned bullish near the 76K mark, signalling a surge in stablecoin reserves. A similar pattern was seen in 2020 and late 2022, which preceded significant BTC rallies.

As Bitcoin rises above 94k, the Binance Bitcoin / Stablecoin reserve ratio, which is considered a key liquidity signal, turned bullish at the 76 to 77 K level. This indicates that stablecoin reserves on Binance are now growing faster than Bitcoin reserves. In other words, this means that the exchange has plenty of potential buying power waiting to be deployed. Historically, when stablecoins have risen relative to BTC, this has been a precursor to aggressive buying and strong price action. The green signal in the chart shows exactly that

Where next for Bitcoin?

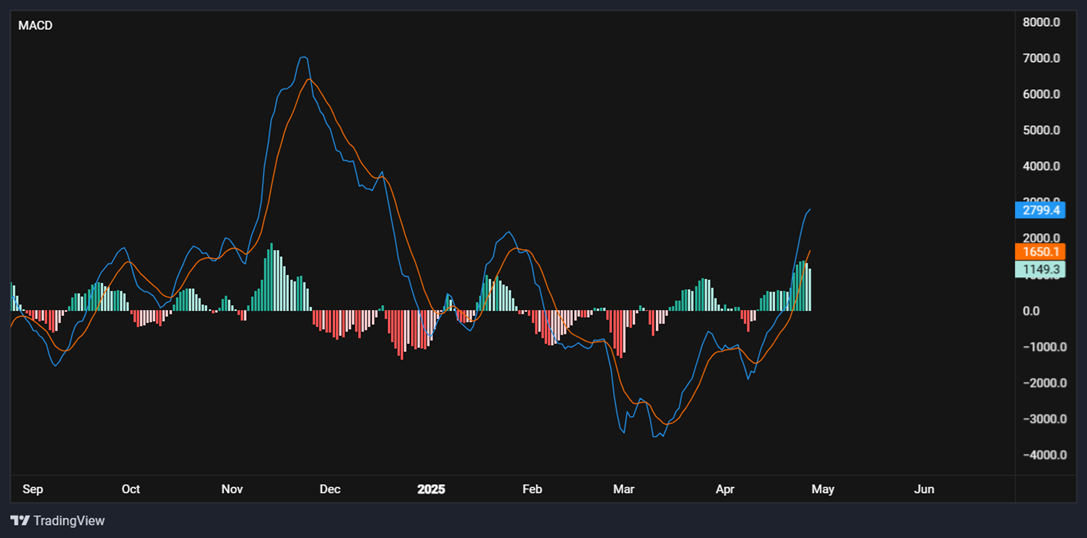

Bitcoin is continuing to attract strong demand as the price enters a key level. The price holds above the 200 and 50 SMAs, and the MACD is at its highest year to date, indicating strong bullish momentum.

The next crucial level is 96K, representing the entry price for short-term holders who have had Bitcoin for three to six months. A rise above this level could bring the psychological 100,000 level back into focus.

However, profit taking by holders of recent gains could cause the price to consolidate between 88K and 94 K.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.