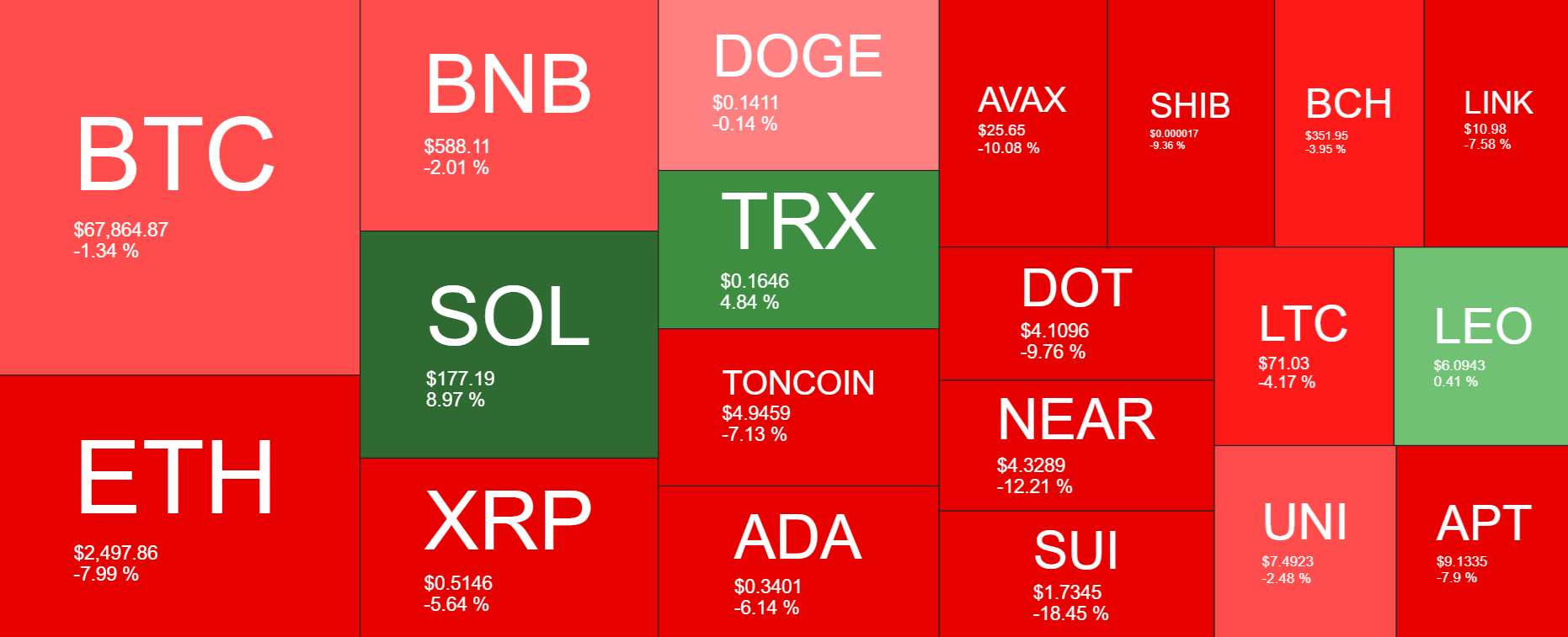

Bitcoin fell modestly across the previous week, consolidating after solid gains in the previous week. The price failed to rise above the key 70k level but also closed above 66.5k, a key technical level. The price of Bitcoin rises at the start of the new week, keeping the 70k level in focus.

The picture was more mixed across altcoins. Ethereum and XRP underperformed, falling 7% and 5%, respectively, and NEAR dropped 12%. Meanwhile, Solana outperformed, rising 9% across the week, with the token heading into its fourth straight weekly gain.

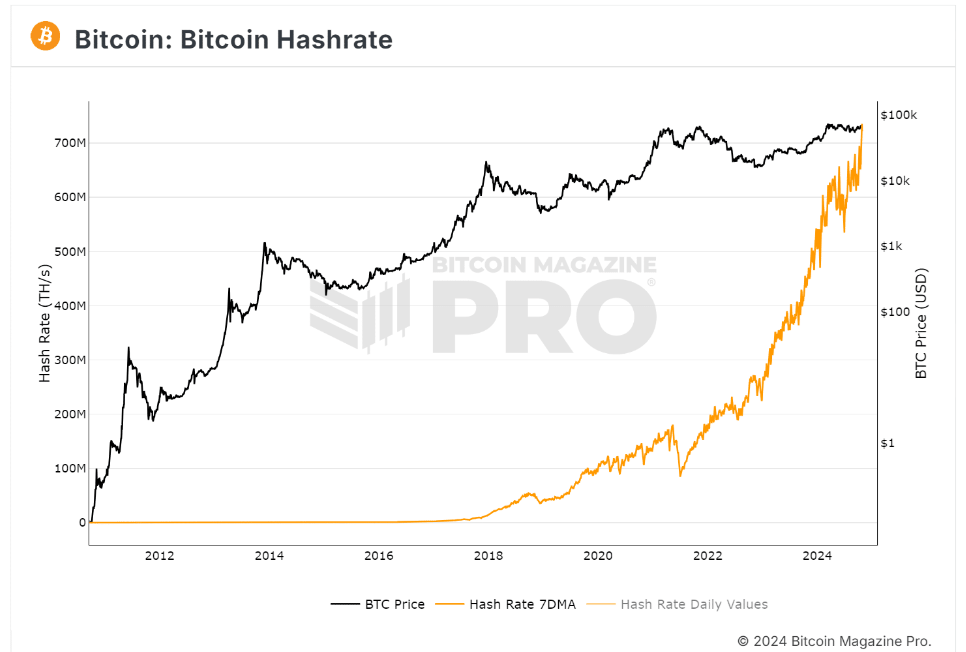

Bitcoin Hashrate reaches a record high

As the Bitcoin price is on the verge of entering the final stage of its four-year cycle, the effects of Bitcoin’s halving are evident—Bitcoin mining difficulty has reached an all-time high. Processing transactions requires more computational power, forcing out less efficient miners.

Publicly traded mining companies leverage financial resources and economies of scale to deploy advanced mining equipment. They are steadily increasing their dominance in the Bitcoin ecosystem and forcing out less efficient miners. Twelve of the largest public Bitcoin miners now control nearly 29% of the network’s total hash rate.

As a result, Bitcoin’s hash rate, a critical measure of its processing power and security, has also increased. Last week, the hash rate surged to a record 769.8 per second. This record high reflects a robust and increasingly secure blockchain, meaning the network is more resistant to attacks.

This trend highlights the consolidation of mining operations, where only the best technology and lowest costs can survive. A capitulation could be on the horizon, potentially leading to price increases as available supply dwindles against persistent demand.

Institutional interest rises

Bitcoin ETFs

US Bitcoin ETFs saw another strong week of inflows, recording nearly $1 billion in total inflows. Following an impressive third week of October, which saw Bitcoin ETF inflows of $2.18 billion, institutional investors maintained interest again last week with $997 million in inflows. According to data from SoSoValue, BTC ETFs saw positive inflows on every day except Tuesday, when $79.09 in outflow was recorded.

BlackRock’s IBIT was once again the dominant fund, attracting $291.96 million across the week, taking cumulative net inflows to £23.99 billion.

BTC ETF inflows have reached $3 billion in the past 11 days; such significant inflows point to strong institutional investment, which could see the price head toward $100k.

Bitcoin whales

According to sentiment data, the number of Bitcoin whale wallets holding 100 or more BTC has increased by 1.9% over the past two weeks, or 297 well-swell wallets under 100 PC have decreased by 0.1%. This indicates that stakeholders are accumulating more coins from retail traders, a trend historically suggesting bullish.

US Bitcoin ownership rebounds

According to crypto quants, the amount of Bitcoin owned by US entities has increased for the first time since the March record highs. The percentage of Bitcoin held by US entities, including exchanges, banks, and funds, has started to grow again in a similar way that it did in the bull run at the beginning of 2023.

Macroeconomic backdrop

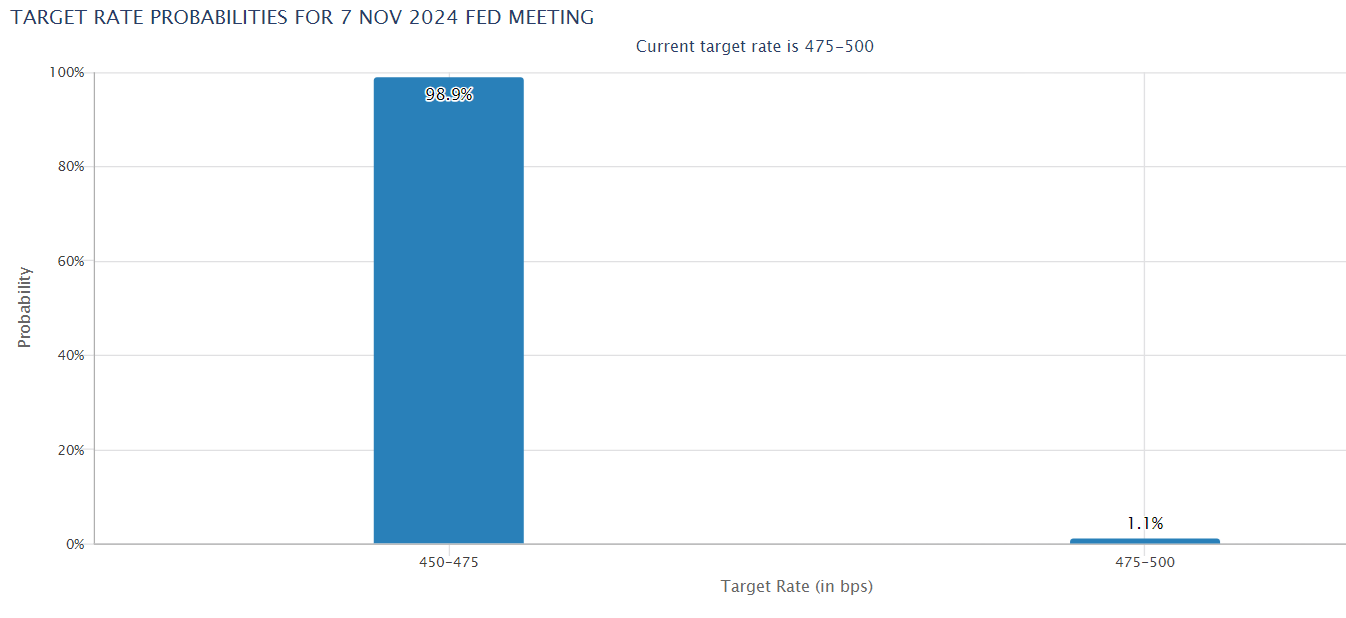

Last week was a quiet week for macroeconomic developments, with no major US economic updates. This means there haven’t been any major deviations in the Federal Reserve’s expected monetary policy easing path. The Fed is widely expected to cut rates by 25 basis points at the next FOMC meeting on November 6 to 7, shortly following the US election on November 5th.

As a result, the market was more focused on the US elections over macroeconomic signals.

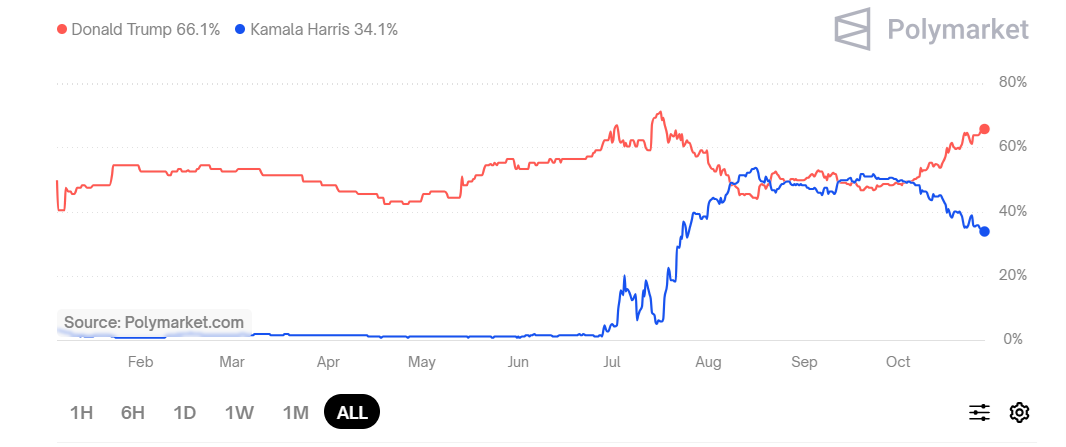

US elections

Prediction polls have only moved marginally towards Donald Trump over the week, but traders are increasingly confident that the Republican candidate will win. The Polymarket is pricing and has a 66% chance of Trump winning on November 5th. Barring any late surprises, the former president appears to be heading into the election countdown with a slight advantage.

As previously mentioned, crypto markets would prefer a Trump victory, given that he has been so pro-crypto throughout the campaign. However, both candidates are expected to increase US national debt levels, so some also see the elections as a win-win event.

Stablecoin & Stripe

Stripe, a leading payment company, purchased a stablecoin platform bridge for $1.1 billion, the largest crypto acquisition to date. This move reflects the increasing importance that traditional institutions are attributing to stablecoins and crypto more broadly, especially for cross-border payments.

Stablecoin usage has increased rapidly since its inception. However, it also has a large potential for further growth in a market still dominated by traditional banking in domestic and international payments.

The deal comes less than two weeks after Stripe introduced stablecoin payments on its main payment user interface by integrating Circle stablecoin.

According to Bernstein brokers, the acquisition validates the usage of stablecoins for public blockchains. U.S. dollar-denominated stablecoins and crypto rails are now the cheapest method for cross-border payments, costing only one to two basis points. This deal highlights the growing recognition of stablecoin-based payments and their benefits, which are increasingly used by non-crypto firms.

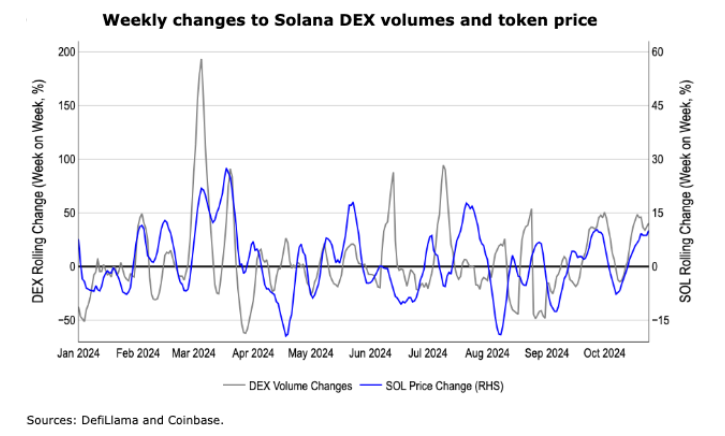

Solana outperforms

Solana has far outperformed the broader crypto market due to improving network fundamentals, which are partly driven by the ongoing attention to meme coins, particularly AI-related meme coins.

DEX volumes on Solana have increased 37% week on week, while DEX volumes on Ethereum have fallen 14%. In the past week, cumulative volumes on Solana have nearly doubled that of Ethereum, which may only partly be driven by AI-related hype.

Pump.fun, the largest meme coin launcher on Solana, has also made two core announcements: the ability to tokenize videos and the launch of an advanced trading interface with non-custodial wallets.

Given the centrality of Dex volumes to Solana activity, meme coin attention, and overall bullish crypto positioning, Solana’s ecosystem benefits from considerable tailwinds.

Week Ahead

US data

After two relatively quiet weeks, US macroeconomic data ramps up again, which could impact risk sentiment and asset volatility.

Q3 GDP figures, major tech earnings, US nonfarm payrolls, and the Federal Reserve’s preferred gauge for inflation, the PCE index, are all due this week.

Furthermore, the timing of this data could hardly be more important, as it comes ahead of next week’s U.S. presidential election and the Federal Reserve’s next interest rate decision, in which it is expected to cut interest rates.

Both of these events will be key to deciding the trajectory of risk assets, including Bitcoin and US equities.

However, right now, it’s expected to take a lot for the market to change its mind about expectations surrounding the Fed’s next move on December 7th. The odds of a 25-basis-point rate cut are sitting at a comfortable 95%, with little expectation of surprise.

Trade big events with PrimeXBT

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.