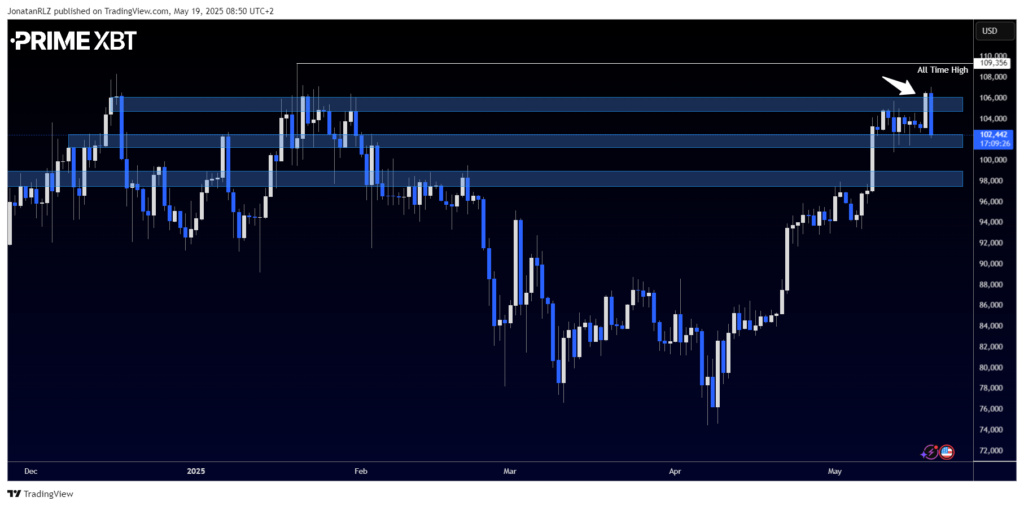

Bitcoin (BTC/USD) delivered an impressive move over the weekend, pushing above the $106,000 area and marking the highest daily close in Bitcoin’s history. However, that strength was short-lived. At the time of writing, Bitcoin is trading back below the $106,000 level, suggesting we may be seeing the formation of a daily fakeout. This refers to a situation where price briefly closes above a major resistance level, only to fall back below it soon after.

Let’s go into the lower time frames to see if we can find anything that supports this potential reversal.

Zooming into the 4-hour timeframe, we can observe that the previous breakout above $106,000 aligns neatly with the current range highs that have developed in recent days. Price is now testing the range low area, and if this level fails, attention may shift toward the $98,000 to $99,000 zone as the next area of support. On the flip side, a reclaim of the range EQ would signal that strength is returning to the bulls and may open the door for another upside move.

This week’s risk sentiment will be key, especially following Moody’s downgrade of the U.S. economic outlook on Friday. Bitcoin continues to behave as a high-beta risk asset, showing no signs of decoupling from traditional markets. With existing home sales data set for release on May 22th, we may see a catalyst that triggers a decisive move in either direction.

For now, all eyes remain on the range and how price behaves around these key technical zones.

Trade Bitcoin

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.