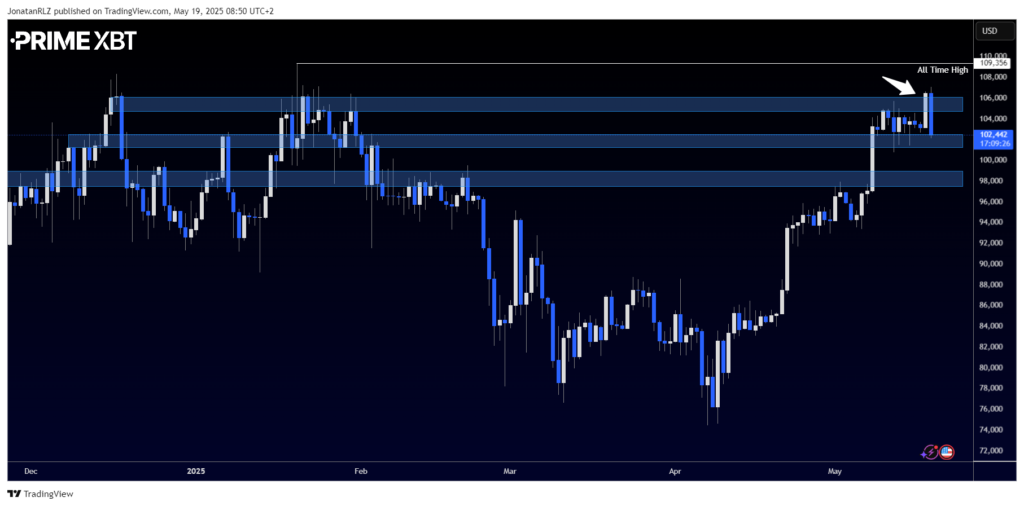

Gold continues to trade within a strong high time frame uptrend, maintaining a series of higher lows over time. However, it’s worth paying attention to the shift in local structure, where we are now seeing lower highs and lower lows forming on shorter time frames. This could indicate some short-term weakness within an otherwise strong macro trend.

The previous swing low printed right within the Fibonacci reload zone, with the midpoint, the 0.702 level, acting as support. Price has since bounced and is currently testing the 0.50 Fibonacci retracement level as resistance. A reclaim of this level could open the door for a potential intraday move toward the 3,005 region. So even though the broader trend remains bullish, it’s important to monitor this local structure and how price behaves around these levels.

Zooming into the 4-hour chart, we can spot an emerging pattern resembling a double bottom, with the second low forming higher than the first. This structure is notable because the previous swing low, the left leg, also occurred on a reclaim of the high time frame 0.618 Fibonacci level. Adding further confluence, the lower time frame reload zone (measured from the white up arrow to the white down arrow) aligns perfectly with this same support zone.

These overlapping Fibonacci levels between the high time frame and intraday charts create strong technical confluence, often acting as high-probability zones for directional shifts.

To the upside, the current resistance sits at the 0.50 Fibonacci level. A clean break above this level could trigger a move toward the next resistance at 3,005, which is also an untested breakout area. For traders focused on intraday setups, these levels offer a well-defined structure to base risk management decisions on.

Trade Gold

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.