In the world of cryptocurrency trading, the Wyckoff theory stands tall as a powerful tool, providing priceless insights to anyone looking to navigate the choppy waters of digital asset markets. Understanding this principle is now more important than ever for potential traders as the bitcoin market continues to develop and mature. Its value comes from its capacity to offer a greater comprehension of market dynamics, empowering traders to make wise choices and seize available opportunities.

The Wyckoff Accumulation theory, which examines the complex dance between purchasing and selling pressures inside a market, is fundamentally based on the concepts of supply and demand. This theory, which was created by the eminent trader and market theorist Richard D. Wyckoff in the early 20th century, aims to pinpoint the periods of accumulation and distribution, two separate stages that take place within market cycles.

Smart traders can watch as institutional investors or the smart money gradually build up a position in an asset during the accumulation period.

These massive investors join the market covertly and build up significant stakes at advantageous pricing. A price action that is moving sideways or consolidating and is characterized by declining volatility and modest trading volume is a common indicator of this period. Patient traders should take advantage of this critical opportunity to tactically position themselves and build their positions alongside the institutional players. This is one of the main points, to make informed trading decisions that follow “the big money.” Remember, it is not retail traders that move the markets, it is institutional investors. By following the institutional investors, retail traders give themselves a better chance at successful trades.

A breakout frequently happens after the accumulation phase reaches its peak, starting a new bullish trend. Wyckoff theory excels in this area. Understanding the accumulation process gives traders an edge in spotting potential breakouts and enables them to take appropriate action, placing themselves ahead of the market to benefit from the ensuing price spike.

It is impossible to exaggerate the importance of the Wyckoff Accumulation theory in the field of bitcoin trading. The volatility and unpredictability of cryptocurrency markets are well-known, with price changes driven by a wide range of fundamental and speculative variables. This theory enables traders to distinguish between actual price reversals and transient variations, as well as to better understand market patterns and prospective trends. This priceless information enables traders to make knowledgeable decisions, lowering risks and increasing their chances of success.

Who Was Richard Wyckoff and What Are His Principles?

Richard Wyckoff made significant contributions to technical analysis and had a lasting impact on the trading industry. He was born in 1873 and devoted his life to researching market behavior and formulating analytical theories that still influence how traders evaluate the financial markets today.

Wyckoff has made significant and wide-ranging contributions to technical analysis. Beyond mere speculation, he wanted to understand the fundamental factors behind price changes. His writings stressed the value of comprehending market psychology, the dynamics of supply and demand, and the behavior of significant market players. Wyckoff delved further into these ideas and came up with a set of essential ideas that form the basis of the Wyckoff Accumulation theory.

What is a Wyckoff Accumulation?

The first principle, “The Law of Supply and Demand,” emphasizes how crucially important supply and demand are in determining market pricing. Wyckoff understood that prices often decrease when supply exceeds demand, while prices rise when demand exceeds supply. This idea emphasizes how important it is to recognize supply and demand mismatches as a major factor in price changes.

The second concept, “Cause and Effect,” emphasizes the idea that market fluctuations are not accidental but rather the outcome of underlying factors. According to Wyckoff, large price changes are a result of either the accumulation or distribution stages. These stages are brought about by the actions of knowledgeable market participants who steadily increase their positions over time. Traders can foresee probable price reversals or breakouts by observing these cause-and-effect connections.

The third principle, “Effort versus Result,” looks at how volume and price are related. Wyckoff noted that major price changes that are accompanied by rising volume have a tendency to be more reliable and long-lasting. This idea underlines how crucial it is to examine volume patterns in order to verify the force of price fluctuations and determine the mood of the market as a whole.

A quick example:

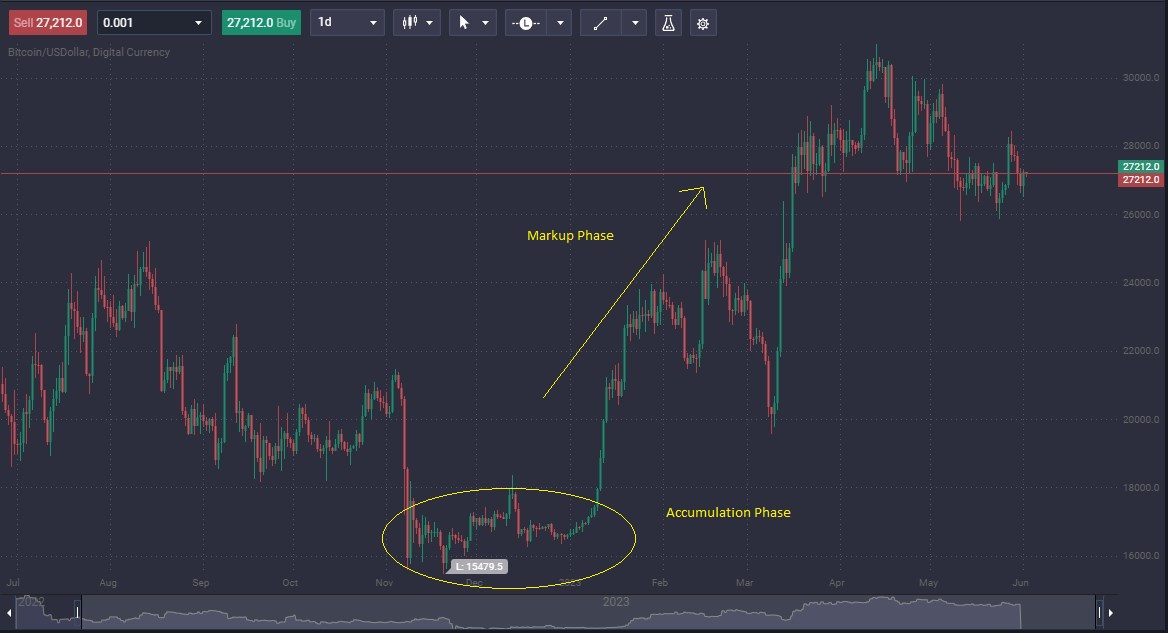

Notice the BTC chart below. There is a huge consolidation area, known as an Accumulation Phase, with heavy volume on the breakout. This is a good sign for buyers.

The fourth concept, referred to as “The Composite Operator,” discusses how big institutional actors and shrewd investors behave. Wyckoff understood that these powerful market players frequently have a considerable influence on price changes. Following their example and comprehending their motivations can help you gain important insights into current industry trends. For traders aiming to cooperate with the prevailing market forces, understanding the footprint of the composite operator is essential.

Trading participants can accept the core ideas of the Wyckoff theory by sticking to these essential rules. Wyckoff’s astute observations and perceptive insights are still used to this day to help traders position themselves profitably in the ever-evolving financial environment, analyze market dynamics, and comprehend supply and demand mismatches.

Comparing Wyckoff Accumulation to Other Trading Theories

Wyckoff Accumulation is a trading theory that differs from other well-liked trading methods in a number of important ways. We can better appreciate why certain traders choose the Wyckoff theory by contrasting it with other strategies.

Trend following is a well-liked trading method that is sometimes related to Wyckoff Accumulation. Utilizing momentum and consistent price movements, trend-following tactics aim to spot and capitalize on established market trends. In contrast to trend following, which aims to continue an existing trend, Wyckoff looks for the accumulation stage just before a new trend appears. Using the Wyckoff theory, traders can position themselves ahead of the trend and potentially make more money if the ensuing breakout takes place by spotting accumulation patterns.

The mean reversion trading method is another popular one. Mean reversion methods are based on the idea that after straying from the average or mean value, prices tend to revert to it. Traders who use mean reversion tactics search for overbought and overbought price fluctuations and predict a reversion to the mean. The Wyckoff theory, in contrast, focuses more on identifying the accumulation period and predicting a breakout than it does on mean reversion ideas. It focuses on identifying position development and institutional player activity, offering a unique viewpoint on market dynamics.

A quick example:

It isn’t only used to enter a trade. Look at the chart below. It is for Decentraland, and you can see that the market structure entered a Markup Phase into consolidation. Notice how the market is far from the 20-Day EMA. Once we enetered consolidation, traders would have been wise to think that a Distribution Phase might be at play, allowing them to keep as much of the profits as possible. Quite often, it is a pattern like this on the chart that signals a buying climax.

The Wyckoff theory sets itself apart from quantitative trading techniques as well. To provide trading signals based on statistical analysis and historical data, quantitative techniques use mathematical models and algorithms. These tactics frequently function automatically and systematically in an effort to take advantage of market patterns and inefficiencies. Although quantitative tactics have a chance to be successful, they could miss the subtleties of market psychology and the behavior of influential market players, which are crucial to the Wyckoff Accumulation hypothesis. In order to make informed trading decisions, you must take into account psychology of market participants.

The Wyckoff theory focuses on market dynamics, supply and demand imbalances, and the activities of knowledgeable market participants, which makes it unique and a favorite technique for some traders. It gives traders a foundation for comprehending the accumulation and distribution stages, enabling them to foresee potential breakouts and take advantage of favorable positions. The theory, which provides a distinctive viewpoint on market analysis, highlights the significance of examining volume, market mood, and the intents of the composite operator.

The Wyckoff theory stands out with its focus on market dynamics, accumulation patterns, and the activities of institutional players, even though other well-known trading strategies like trend following, mean reversion, and quantitative trading have their advantages. Its focus on comprehending and predicting supply and demand imbalances

Trading Crypto Using Wyckoff Accumulation Theory

The application of Wyckoff theory in cryptocurrency trading offers valuable insights and a strategic edge to traders in this dynamic and volatile market. By understanding the principles of accumulation and distribution, traders can navigate the unique characteristics of cryptocurrencies more effectively.

Cryptocurrency markets often exhibit high volatility and speculative behavior, making it challenging to identify genuine trends and reversals. The Wyckoff theory provides a framework to decipher these market dynamics. Traders can observe periods of accumulation characterized by sideways price action and diminishing volatility. This phase indicates the smart money or institutional players quietly building positions at favorable prices. Recognizing these accumulation patterns allows traders to strategically position themselves alongside the institutional players.

A quick example:

The following chart shows an area of extreme volatility in Polygon, with the red box. The market trends were all over the place, and the exhaustion set in. Notice where the yellow box sits. This is an area of showing stabilization. Once the market broke above the area, the buyers took over.

Furthermore, the theory helps traders anticipate breakouts and potential price surges. By studying volume patterns, market sentiment, and the intentions of the composite operator, traders can gauge the strength and sustainability of price movements. This insight enables traders to differentiate between temporary fluctuations and genuine trend reversals, reducing the risk of false signals.

In cryptocurrency trading, where market sentiment and speculation play significant roles, understanding the Wyckoff theory is particularly relevant. It empowers traders to make informed decisions based on supply and demand imbalances, the actions of influential market participants, and volume analysis. By embracing this theory, traders can gain a deeper understanding of cryptocurrency market dynamics and increase their chances of success in this rapidly evolving industry.

Case Study: Applying Wyckoff Accumulation Theory in a Real Trading Scenario

This recent example of Accumulation phase and the Markup Phase of the Wyckoff method can clearly be seen in the following BTC/USD chart. The fundamentals for BTC were getting stronger after a massive selling pressure engulfed the market. Pay close attention to the circle on the chart. Notice how the price just stopped falling. This lead to the Markup phase where the arrow is drawn. This happened time and time again. The breaking of the top of consolidation was a sign that the bull and bear markets were flipping over again.

Common Mistakes to Avoid When Using Wyckoff Accumulation for Trading

The Wyckoff theory can be an effective trading technique, but there are some common errors that can make it less so. For traders looking to use this theory successfully, being aware of these traps and understanding how to avoid them is essential.

Misidentifying accumulation patterns is a frequent blunder. Traders can hastily believe that any time of consolidation or sideways movement is the beginning of an accumulation phase. To confirm accumulation, it is necessary to carefully examine the price and volume dynamics, nevertheless. A distinct market phase may be indicated by a lack of lowering volatility and declining volume throughout the consolidation. To avoid making this error, traders should carefully examine the traits of real accumulation patterns and make sure the observed price movement adheres to the Wyckoff tenets.

Another error is to ignore the larger market context and depend just on accumulation trends. Inaccurate evaluations may result from traders failing to take into account important fundamental or macroeconomic issues that could affect the market. It is crucial to include a thorough study that takes into account both the macro-level market dynamics and the micro-level accumulation patterns. To avoid making choices entirely based on accumulation patterns, traders should stay current on pertinent news, events, and trends.

A common mistake is to disregard risk management concepts. Traders may lose sight of adequate risk management and position sizing as they get overly preoccupied on spotting accumulation stages and potential breakouts. To guard against unforeseen market fluctuations, it’s essential to implement risk management measures, set suitable stop-loss levels, and abide by them. Even if the predicted breakthrough does not materialize as anticipated, disciplined risk management ensures that losses are controlled.

Last but not least, traders may fall victim to confirmation bias, focusing primarily on data that confirms their intended results. This may skew judgment and result in poor decision-making through selective analysis and overly high expectations. Traders should retain neutrality, critically assess all information at their disposal, and be open to different scenarios in order to avoid confirmation bias.

Cryptocurrency traders seem to be especially vulnerable to this issue. Just because the coin that you are trading is active in a “community”, it doesn’t mean that it is going to suddenly become successful. Make sure to look at each market structure on a chart, and to look at whether or not there is a real use case for the coin.

Traders should exercise solid risk management techniques, be mindful of the larger market backdrop, avoid confirmation bias, and be cautious when detecting accumulation patterns. Traders can improve their capacity to successfully utilize the Wyckoff theory and make wise trading decisions by avoiding these common blunders and studying the theory with diligence and discipline.

The Impact of Market Conditions on Wyckoff Accumulation

It is possible to use the Wyckoff theory in a variety of market situations, including bull markets, bear markets, and high volatility settings. The principles of accumulation and distribution are still applicable under these market circumstances, despite the fact that its efficacy may differ to some extent.

The Wyckoff theory can assist traders in spotting possible accumulation phases before large breakouts take place in bull markets, where prices are often rising. Traders can get ahead of the market and profit from the ensuing price increases by recognizing the gradual influx of institutional and smart money players. By placing a strong emphasis on volume analysis and market mood, the theory can help determine the strength of bullish movements and help separate true breakouts from transient variations.

The Wyckoff theory can offer helpful insights into prospective trend reversals during weak markets, when prices are falling. Traders can spot the potential for a change in market sentiment and price recovery by looking for accumulation indicators amid selling pressure. Early signs of a bottoming process can be found in the accumulation phase’s decreasing volatility and rising volume. However, it is vital to proceed with caution in bad markets because downtrends can be difficult to traverse and protracted.

The Wyckoff theory can assist traders in navigating price fluctuations and seeing potential accumulation patterns amid the turmoil in high volatility conditions, such as during times of market upheaval or important news events. The fundamentals of supply and demand, as well as a detailed examination of volume dynamics, allow traders to distinguish between brief spikes in volatility and actual accumulation stages. Making thoughtful selections and staying away from impulsive trading activities brought on by short-term market changes can both benefit from this insight.

Even while the Wyckoff theory can be used in a variety of market situations, it’s crucial to understand that no trading method or theory can ensure success in every situation. The state of the market might be complicated and prone to unforeseen changes. In order to respond to changing market conditions, traders need augment the theory with thorough market analysis, risk management plans, and a flexible attitude.

The Wyckoff theory is still applicable and flexible in a variety of market environments. Traders can develop a deeper understanding of market dynamics, spot potential opportunities, and make better judgments in bull markets, bear markets, and high volatility conditions by incorporating its ideas into a holistic trading methodology.

Integrating Wyckoff Accumulation with Other Trading Strategies

Wyckoff Accumulation theory can be combined with other trading techniques to increase overall trading efficiency and offer a thorough method of market analysis. Here are a few instances of how it can be used in conjunction with other tactics:

Trend Following and Wyckoff method: Wyckoff Accumulation theory can be used by traders who use trend-following tactics to find probable entry points before a trend starts. For instance, a trader using a trend following technique would hold off on opening a long position until an uptrend is in place and confirmed. They can actively look for accumulation patterns during times of consolidation by adopting Wyckoff theory, positioning themselves before the breakout, and following the rising trend. This combination lowers the risk of entering at overextended levels while enabling traders to profit from a new trend’s initial impetus.

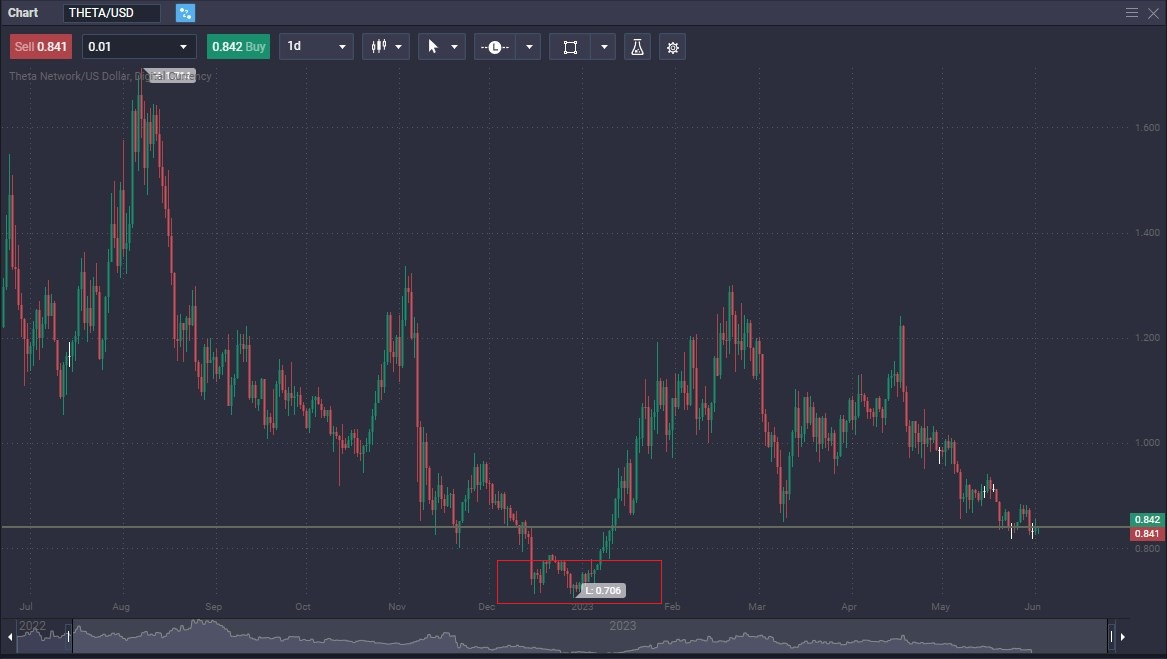

The following chart shows a classic Accumulation Phase followed by a breakout in Theta to catch a huge uptrend on recovery:

Breakout Trading and Wyckoff method: Key support and resistance levels are the main focus of breakout traders, who then trade the ensuing breakouts. Traders can use accumulation patterns as a confirmation of possible breakouts by incorporating Wyckoff Accumulation theory. For instance, the Wyckoff theory can verify the breakout and give traders more confidence to enter positions if a cryptocurrency has been consolidating inside a range and volume decreases, followed by a sharp spike in volume and a breakout over resistance. This integration improves the precision of traders’ breakout trading tactics and helps them prevent fake breakouts.

The following chart shows a Distribution Phase on the ETH/USD daily chart. Notice how the market structure bounced right back to the previous area of supply and demand patterns. This market structure then broke through the bottom of the rectangle, confirming the overall negativity of Ethereum at the time, leading to a lot of selling interest.

Fundamental Analysis and Wyckoff method: A comprehensive strategy to trading can be achieved by fusing Wyckoff accumulation theory with fundamental analysis. Fundamental analysis evaluates an asset’s underlying value based on data from the financials, market sentiment, and industry trends. Traders can employ accumulation patterns to timing their entrances in line with positive fundamentals by utilizing Wyckoff Accumulation theory. For instance, traders can wait patiently for the breakout to coincide with the good news or events if a cryptocurrency has solid fundamentals but is in an accumulation phase, optimizing their entry opportunities based on both fundamental analysis and Wyckoff principles.

A word on using Wyckoff method with other analysis:

Wyckoff Accumulation theory can be combined with other trading techniques to help traders get a more thorough understanding of market dynamics, verify entry signals, and raise the likelihood that their trades will be profitable. To enhance trading efficacy, it is crucial to make sure that the integration is carried out in a cohesive and complimentary way, aligning the strengths of each strategy and making adjustments to the unique market conditions.

Further Resources to Master Wyckoff Accumulation

Here is a list of resources that readers can explore to learn more about Wyckoff Accumulation:

Books:

- “The Richard D. Wyckoff Method of Trading and Investing in Stocks: A Course of Instruction in Stock Market Science and Technique” by Richard D. Wyckoff

- “Charting the Stock Market: The Wyckoff Method” by Jack K. Hutson

- “Wyckoff Strategies & Techniques” by David H. Weis

- “The Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State Management” by Hank Pruden

Websites:

- Wyckoff Analytics (https://wyckoffanalytics.com/): Provides educational resources, courses, and analysis based on Wyckoff principles.

- Wyckoff Stock Market Institute (https://www.wyckoffstockmarketinstitute.com/): Offers courses, webinars, and resources on Wyckoff analysis and trading techniques.

- StockCharts.com (https://stockcharts.com/education/doku.php?id=chart_school:market_analysis:wyckoff): Features articles and educational content on Wyckoff analysis and chart patterns.

- Investopedia (https://www.investopedia.com/terms/w/wyckoff-accumulation-distribution.asp): Provides an overview of Wyckoff Accumulation theory and its applications in trading.

Conclusion: Leveraging Wyckoff Accumulation for Profitable Crypto Trading

In conclusion, traders looking to learn the field of cryptocurrency trading can benefit greatly from the Wyckoff Accumulation theory. Traders can acquire insight into market dynamics, spot possible breakouts, and make well-informed decisions based on supply and demand imbalances by understanding the principles of accumulation and distribution.

The trading business continues to benefit from Richard Wyckoff’s contributions to technical analysis. The Wyckoff Accumulation theory is built on his emphasis on market psychology, supply and demand dynamics, and the actions of key market participants.

Unlike other well-liked trading tactics like trend following, mean reversion, and quantitative trading, this approach is unique. With a focus on accumulation patterns, volume analysis, and the actions of institutional participants, it offers a distinctive viewpoint on market analysis. The Wyckoff Accumulation theory can be combined with other trading techniques to help traders make better trading decisions overall.

Given the erratic and speculative nature of these markets, the use of Wyckoff Accumulation theory in cryptocurrency trading is particularly pertinent. It enables traders to negotiate market turbulence, distinguish between lasting trends and passing trends, and foresee possible price increases.

Although the Wyckoff Accumulation theory can offer insightful information, it’s crucial to keep in mind that no trading strategy can ensure success in all market circumstances. To adjust to shifting market conditions, traders should pair it with in-depth market analysis, risk management plans, and a flexible attitude.

Understanding and using the Wyckoff Accumulation theory can provide traders a competitive edge in the quickly developing realm of cryptocurrency trading. Traders can improve their chances of success and successfully traverse the dynamic environment of digital asset markets by researching market patterns, identifying accumulation stages, and making well-informed judgments.

What is a Wyckoff accumulation?

A trading theory known as Wyckoff Accumulation was created by Richard D. Wyckoff and focuses on finding and comprehending the accumulation phase in financial markets. In order to identify times when institutional investors or the smart money gradually build up positions in an asset, supply and demand dynamics must be analyzed. Prices often move sideways or consolidate during the accumulation phase, with falling volatility and low trading volume. By strategically positioning themselves alongside institutional players, traders who understand these accumulation patterns can profit from anticipated breakouts and subsequent price increases. Insights into market dynamics are provided by the Wyckoff Accumulation theory, allowing traders to make wise judgments and take advantage of profitable trading opportunities.

How accurate is Wyckoff?

The preciseness of Wyckoff Like any trading theory or practice, accumulation is influenced by a number of variables. It's crucial to remember that no trading strategy can absolutely guarantee precision or predictability in the financial markets. Wyckoff Analysis of supply and demand imbalances, market psychology, and institutional player activity all play a role in accumulation. Although it offers insightful research and a framework for comprehending market dynamics, the trader's ability to accurately recognize accumulation patterns, comprehend volume analysis, and make wise trading selections ultimately determines how effective it is. Depending on the trader's knowledge, experience, and capacity to effectively employ the concepts, Wyckoff Accumulation's accuracy can change. It calls for in-depth knowledge, practice, and continual market analysis. Furthermore, extraneous variables like unanticipated news occurrences, fluctuations in market sentiment, or macroeconomic variables can have an impact on the precision of any trading strategy, including Wyckoff.

What are the 5 phases of Wyckoff?

Accumulation Phase, Markup Phase, Distribution Phase, Markdown Phase, and the Accumulation Phase. (a repeat)

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.