Wash trading is a deceptive practice where individuals or entities simultaneously act as buyers and sellers of a financial instrument, creating an illusion of genuine trading activity. It artificially inflates trading volumes and manipulates financial data, misleading other participants. In both financial and cryptocurrency markets, wash trading undermines market integrity, distorts price discovery, and can harm investors’ trust. Regulatory efforts and technological solutions are crucial in detecting and preventing manipulation, ensuring fair and transparent trading environments. Unfortunately, this is still a market risk as the round trip trading can cause traders to lose in an unethical manner.

What is Wash Trading?

Wash trading is a dishonest practice in the financial markets where a person or entity simultaneously acts as the buyer and seller of a financial asset to provide the appearance of real trading activity. Executing trades without a change in beneficial ownership or economic substance is what is meant by this. Instead, manipulating conditions or misleading others by increasing trading volumes or prices is the primary goal of these traders.

This practice has a long history that dates back to the inception of financial markets. Trading was done to manipulate prices and give the appearance of market activity in the 19th century, when exchanges were less regulated than they are now.

Wash trade is prohibited and punishable under rules and regulations that have been created over time by regulatory agencies in various nations. For instance, the Securities Exchange Act of 1934 in the United States gives the Securities and Exchange Commission (SEC) the authority to enforce rules prohibiting wash trading. Similar actions have been taken by other jurisdictions to stop this dishonest behavior.

Wash Trading in the Financial and Cryptocurrency Markets

This practice has been noted in both the traditional financial markets and the cryptocurrency market, albeit its prevalence may vary owing to a number of circumstances.

Regulators have long been concerned about wash trading in traditional financial markets like stock exchanges. Wash trade has been somewhat reduced as a result of restrictions and surveillance systems, although it still happens occasionally. Wash trading is a tactic used by participants to inflate liquidity, manipulate stock prices, or mislead investors about the demand or interest in a given security.

The problem of wash trading has become prominent in the bitcoin market. Many bitcoin exchanges have less regulation and are decentralized, which has made wash trading more common. Furthermore, the absence of centralized monitoring and transparency foster a climate where people or organizations can carry out wash trades more anonymously.

Volume Manipulation: This manipulation has the potential to artificially boost trading volumes. A more active and liquid market may appear to be created by higher trading volumes, which may draw more traders and investors. This may skew perceptions of market demand and affect financial decisions.

Price Manipulation: Wash traders are able to manipulate prices by regularly carrying out wash deals at predetermined prices. Others may be duped into thinking there is real price movement as a result and may be persuaded to purchase or sell based on false signals.

Market Depth Deception: Wash trading can give investors a false impression of the volume of buy and sell orders at various levels, or “market depth.” To give the impression that there is a lot of interest in a specific asset, manipulators can perform wash trades and place sizable buy or sell orders, giving the impression that there is a lot of demand or supply. These wash trades will often inflate prices.

Technical analysis distortion: Wash trading can affect indicators that use trading volume and price data in their calculations. For instance, because this practice inflates trade volumes and price movements artificially, indicators like moving averages, oscillators, and trend lines may produce erroneous signals.

A Notable Case of Wash Trading

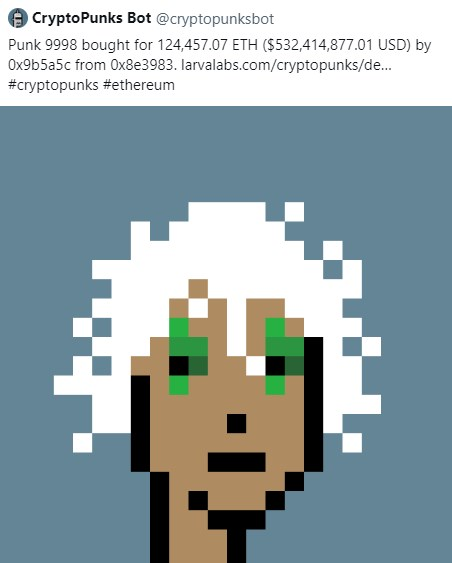

There have been prominent instances of inflated NFT trades that were utilized to manipulate prices, even though wash trades are frequently difficult to spot. CryptoPunk 9998 was exchanged between two wallets on October 28, 2021, for 124,457 ether (ETH), which was then valued about $532 million. The pixelated avatar with white hair and green eyes was purchased thanks to the CryptoPunks Bot, which automatically monitors and tweets about CryptoPunks transactions.

Etherscan claims that the buyer utilized a flash loan from a number of sources to pay 124,457 ETH to the CryptoPunk’s smart contract, which was then transferred to the seller’s wallet. After the loans were repaid, the seller delivered the 124,457 ETH back to the buyer, raising suspicions about the transaction.

The NFT was relisted on the market for 250,000 ETH, or around $1 billion, after the conclusion of the wash trade. To put things in context, before this wash trade, this same CryptoPunk was selling for between $300,000 and $400,000.

Additionally, several NFT platforms have been charged with promoting a culture of manipulation. For instance, data gathered by NFT tracker CryptoSlam indicates that $18 billion, or roughly 95% of the total trading volume on LooksRare, has been associated with wash trading.

The Legal and Regulatory Landscape Surrounding Wash Trading

All financial markets, both traditional markets and the cryptocurrency industry, view wash trading as an illegal and manipulative behavior. It is classified as a form of manipulation due to its deceptive nature and the intent to create false or misleading activity.

Although wash trading’s legal standing differs from jurisdiction to jurisdiction, most regulatory organizations expressly forbid it and punish those who are caught doing it. For example, in the United States, wash trading is forbidden under the Securities Exchange Act of 1934. The Securities and Exchange Commission (SEC) is given the authority by the legislation to enforce rules against wash trading in the securities markets. Similarly, in the context of commodities markets, the commodities Exchange Act outlaws wash trading and allows authorities to the Commodity Futures Trading Commission (CFTC) to take action against violators. The Commodity Exchange Act is one of the most frequent threats regulators use to prevent wash trading.

Detecting and Avoiding Wash Trading: Tips for Traders

To detect a potential wash trade activities:

- Analyze market volume patterns for unusual spikes or consistent high volumes.

- Examine order book data for repeated placement and cancellation of orders at similar price levels.

- Compare activity across reputable exchanges and multiple accounts for inconsistencies.

- Utilize data analysis tools and indicators provided by available platforms.

- Stay informed about investor developments and regulatory changes.

- Choose reputable platforms with robust security measures.

- Trust your instincts, conduct research, and seek professional advice if needed.

- Understand examples of a wash sale.

Alternative Market Manipulation Techniques

Market manipulation encompasses various techniques aimed at distorting conditions and misleading participants. Here’s a brief description of some common market manipulation techniques:

- Spoofing: Spoofing involves placing large orders with the intention of canceling them before execution, creating a false impression of supply or demand. Traders use spoofing to manipulate prices by artificially influencing trader’s intentions and sentiment.

- Pump-and-Dump Schemes: In pump-and-dump schemes, manipulators artificially inflate the price of an asset by spreading positive information or false rumors to attract buyers. Once the price rises, they sell their holdings, causing the price to plummet and leaving other investors with losses.

- Front-Running: Front-running occurs when a broker or trader executes orders on a security based on advance knowledge of pending trades by their clients. By placing their own trades before executing client orders, they can profit from price movements caused by the client’s order.

- Churning: Churning refers to excessive trading in a client’s account by a broker solely to generate commissions, disregarding the client’s best interests. It aims to generate fees for the broker while eroding the client’s portfolio value due to increased transaction costs.

- Painting the Tape: In painting the tape, manipulators collude to trade among themselves to produce artificial activity and influence the perception of market demand. They aim to attract other traders or investors to join the perceived trend based on the false exchange activity.

- Wash Sales: Similar to wash trading, wash sales involve simultaneous buying and selling of securities, but with different beneficial owners. The purpose is to create an appearance of activity while avoiding regulatory restrictions or tax consequences.

- Bear Raid: A bear raid occurs when traders collude to drive down the price of a security by overwhelming the market with sell orders. This creates panic selling among other individuals, allowing the manipulators to profit from the price decline.

Technological Solutions for Combating Wash Trading

Several technological tools and methods can be employed to detect and prevent manipulation in financial markets. Here are some notable examples:

Artificial Intelligence (AI) Algorithms: AI algorithms can analyze vast amounts of trading data, identify patterns, and flag suspicious trading activities. Machine learning techniques can be utilized to train algorithms to recognize manipulation patterns based on historical data, allowing for more efficient detection and monitoring.

Data Analytics Platforms: Specialized data analytics platforms leverage advanced statistical techniques and algorithms to analyze trading data in real-time. These platforms can detect irregular trading patterns, abnormal volume spikes, or repetitive trading behavior that may indicate potential wash trading.

Call to Action: Encourage readers to further educate themselves on manipulation practices, emphasizing the importance of due diligence and informed decision-making in trading activities

Blockchain Technologies: Blockchain technology can promote transparency and auditability in financial markets. The ability to manipulate or fabricate trading data is made more difficult by recording trades and transactions on a distributed ledger. Analyzing blockchain data can help identify inconsistencies and anomalies associated with manipulation.

Trade Surveillance Systems: Trade surveillance systems are used by exchanges and regulatory bodies to monitor trading activities. These systems use rule-based engines and algorithms to find possible market manipulation, such as wash trading. They analyze trading data, order book information, and other relevant market data to identify suspicious trading patterns.

Network Analysis: Network analysis methods can be used to investigate trader connections and relationships. By analyzing the network structure, transaction flows, and interdependencies, potential wash trading schemes involving colluding parties can be identified.

Transaction Monitoring Tools: Real-time tracking and analysis of individual deals is performed through transaction monitoring tools. They look for indicators such as rapid order placement and cancellation, consistent round-trip trades, or repetitive trade sizes that may suggest nefarious actions. These technologies can provide compliance teams notifications or reports for more in-depth analysis.

It’s important to note that while these technological tools and methods can aid in the detection and prevention of manipulation, no single solution is foolproof.

Conclusion: The Need for Market Transparency and Vigilance Against Wash Trading

In conclusion, wash trading is a deceptive practice that creates an illusion of genuine trading activity by simultaneously acting as the buyer and seller of a financial asset. It is regarded as illegal and manipulative in financial markets.

Wash trading has a long history and has been addressed through regulations and penalties imposed by regulatory authorities. It is prevalent in both traditional financial markets and the cryptocurrency market, although the extent may vary due to factors such as regulation and transparency.

Detecting and preventing wash trading requires vigilance from traders and the use of technological tools. Artificial intelligence algorithms, data analytics platforms, blockchain technologies, trade surveillance systems, network analysis, and transaction monitoring tools can aid in the detection and prevention of manipulation activities.

Additionally, it is important for traders to choose reputable platforms, stay informed about market developments, and be aware of various market manipulation practices beyond wash trading. By being vigilant and conducting due diligence, traders can protect themselves and contribute to maintaining fair and transparent markets.

Combating all forms of manipulation requires a combination of regulatory efforts, technological advancements, and market participants’ cooperation. Continued education, awareness, and adherence to ethical trading practices are essential in promoting market integrity and protecting investors’ interests.

Is wash trading legal in crypto?

Yes, it is illegal in all markets, including the crypto space. Unfortunately, NFT wash trading has been a major issue in the NFT markets and cryptocurrency exchanges.

How do you identify wash trading crypto?

Most of the time is involves large trading volume that is followed by a return of the original transaction to the original holder of the crypto assets.

How much crypto is wash trading?

While the exact amount is unknown, Forbes recently suggested that as much as 50% of all bitcoin transactions are wash trades.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.