Solana is an open-source project that implements a new, permissionless, and high-speed layer-1 blockchain. Created in 2017 by Anatoly Yakovenko, Solana scales to a massive thorough put beyond what is achieved by many other blockchains while keeping costs low.

What Is Solana? – Definition & Meaning

Solana is an open-source crypto project that implements permissionless and high-speed layer-1 blockchain functionality. It implements a unique consensus model that combines Proof-of-History with its lightning-fast synchronization engine, its own version of Proof-of-Stake. In theory, the networking process over 710,000 transactions per second without any scaling needed. In its current form, Solana has reached 50,000 transactions per second.

Its third-generation blockchain can facilitate smart contracts and decentralized application (dApp) creation. Solana hosts several decentralized finance (DeFi) platforms and nonfungible token (NFT) marketplaces.

A Short History of Solana

Solana was created in 2017 by Anatoly Yakovenko and Raj Gokal. Its goal was to create a new blockchain paradigm that enabled faster processing speeds. Yakovenko teamed up with a former colleague from Qualcomm named Greg Fitzgerald to build a single blockchain network in the programming language of Rust that used Proof-of-History as its “internal clock.” The first initial testnet and white paper were released in February 2018.

Solana Labs began raising funds for the new crypto network in 2018, raising over $20 million in private token sales. Solana then launched on Mainnet Beta in March 2020, shortly after raising $1.76 million in a public token auction hosted on CoinList. Solana Labs remains a core contributor to the Solana network, while the Solana Foundation helps ongoing fund development and community-building efforts.

How does Solana Work?

Solana is built with scalability in mind, and it uses a unique combination of algorithms, including Proof-of-History, and Proof-of-Stake. Proof-of-Stake is relatively common in the crypto world, as it is a way to validate most blockchain transactions. Validators are chosen based on the number of crypto tokens they have staked (Locked on the blockchain). The validators will receive rewards when they confirm new blocks of transactions and add them to the blockchain.

Proof-of-History verifies the order of the blockchain transactions and the passage of time between them. Timestamps on transactions are built into the blockchain itself, and as a result, validator nodes do not need to communicate with each other to confirm transaction times. You can think of Proof-of-History as optimizing the transaction process. Cutting down the amount of work that the validators need to do speeds up processing times.

What is Proof-of-History (PoH) in Solana?

Solana uses Proof-of-History to overcome the problem of time throughout the network. Stamping time into the blockchain allows validation nodes to skip processing earlier blocks, as they have already been confirmed. Proof-of-History is a cryptographically safe source of time throughout the network, providing a unique result that can be publicly verified. Proof-of-history is one of the unique aspects of the Solana ecosystem.

Because validators can trust the date and sequencing of the messages they receive, nodes can generate the next block without aligning themselves with the entire network beforehand. The consensus algorithm allows for much quicker transactions than most other blockchain projects.

What Kinds of Applications Run on Solana?

Solana is a computing platform that can interact with smart contracts. This means it can power a wide range of applications, from NFT markets and DeFi platforms to games and lotteries. The most popular Solana applications are decentralized exchanges and lending apps.

The ecosystem on Solana supports billions of dollars worth of assets. The user might choose to use one of these apps on Solana instead of the Ethereum network because the speeds are high and congestion is low. This results in extraordinarily low fees.

Solana also can support stablecoins and wrapped assets. UST Coin is one of the most popular versions found on Solana. As Solana expands in both scale and popularity, it is expected to attract more stablecoins and wrapped assets.

What is Solana (SOL) Token?

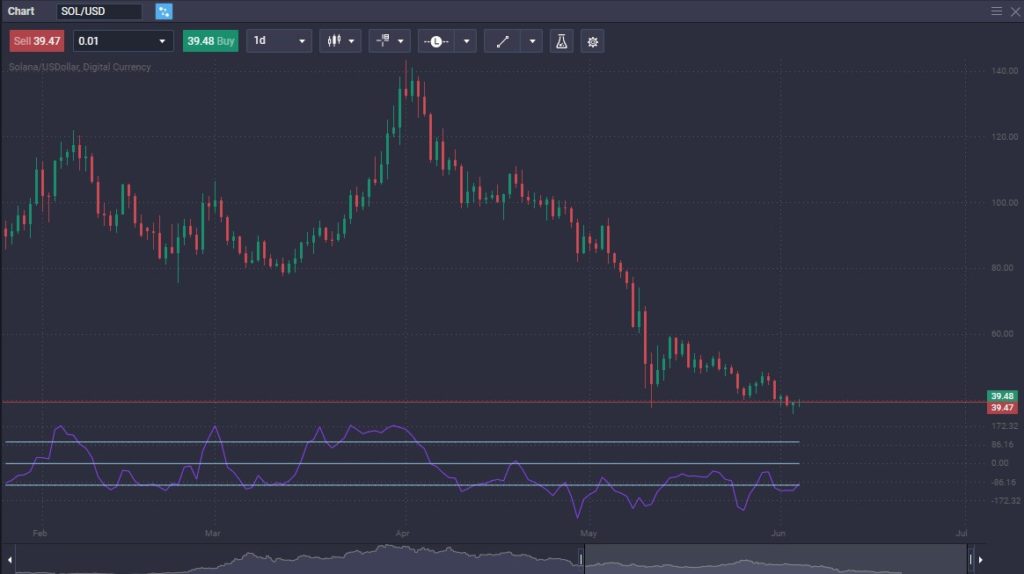

Solana’s cryptocurrency is known as SOL. The native and utility token provides the means of transferring value and the ability to provide security through staking. SOL was launched in March 2020 and has become one of the top 10 cryptocurrencies measured by market capitalization. Even through all of the volatility that the crypto markets have seen in 2022, Solana stays on this list.

The SOL token operates similarly to Either, the token used on the Ethereum blockchain. Solana token holders stake the token to validate transactions through the Proof-of-Stake consensus mechanism. It is also used to receive rewards and pay transaction fees.

Solana Token Distribution of SOL

Solana has distributed almost 50% of its initial token allocation to insiders, such as venture capital firms. Only a fractional amount went to the public at that point. Some of the biggest investors include prominent venture capital firms such as Alameda Research, Coinfund, Coinshares, and a16z.

Investment in Solana continues, as plenty of venture firms are willing to back it. The list of contributors is expected to increase over the next several years.

| Solana Token Distribution | |

| Allocation | Token Percentage |

| Seed Round Investors | 16.23% |

| Founding Sale Investors | 12.92% |

| Validator Sale Investors | 5.18% |

| Strategic Sale Investors | 1.88% |

| CoinList Auction Sale | 1.64% |

| Team Members | 12.79% |

| Solana Foundation | 10.46% |

| Community Reserve Fund | 38.89% |

Can Other Crypto Tokens be Issued in the Solana Ecosystem?

https://solana.com/developers/nfts

Yes, Solana can allow multiple types of tokens to be created on the network. Both fungible and nonfungible tokens of various kinds can be created using the Solana Program Library (SPL). Most developers credit the SPL as being a very user-friendly library.

Nonfungible tokens, sometimes referred to as NFTs, are unique, while the fungible variety of tokens is all the same in equal to all other tokens of that type. A fungible token can be thought of as something like a stablecoin, as one token has the same value as another.

One token that has been issued to the Solana ecosystem is FIDA, which is the token that governs an ecosystem called Bonfida. The product aims to build a user interface, API, and data analytics for the Serum decentralized exchange on Solana.

ORCA is a token that covers the Orca exchange on Solana, which aims to enable decentralized token exchange using an automated market maker, supplying tokens that liquidity pools and algorithms that will set market prices based on supply and demand.

There are many other examples of tokens issued on the Solana ecosystem, as the list continues to grow quite rapidly.

Solana vs. Ethereum

Solana is a direct competitor to Ethereum, with some people referring to it as “the Ethereum killer.” Both blockchain projects are extraordinarily popular, but you should note that Ethereum is much larger.

When Ethereum initially launched, it used a Proof-of-Work consensus mechanism to validate transactions. This was a standard consensus validation method at the time, but Ethereum has switched to Proof-of-Stake since then, which is much more efficient. In this sense, Ethereum was playing catch up to Solana, which had already implemented POS and Proof-of-History.

Solana is much quicker than Ethereum, as it regularly processes thousands of transactions per second, while Ethereum only handles about 30 transactions per second. Once the Ethereum network is wholly upgraded, it is expected that it may be able to handle as many as 100,000 transactions per second. This remains to be seen.

Ethereum is much more prominent as it has been around much longer. Ethereum has roughly $120 billion worth of total value locked across its DeFi protocols, while Solana has just a little more than $7 billion. There has been a wave of projects jumping from Ethereum over to Solana. The efficiency and lower costs of transactions are desirable to the projects and the end-users.

How does Staking Work with Solana?

Staking your SOL on the Solana network allows for the validation of transactions. Participants in the network will stake their own SOL to become a validator, with the chance of earning new SOL and a cut of fees incurred in the network.

Those who choose to be a validator get rewards for verifying transactions in blocks, much like other ecosystems. The rewards are more SOL, thereby allowing investors to earn more income as they secure the blockchain.

The SOL serves as a governance token, meaning that holders of the token can vote on future upgrades and governance protocols that the community proposes. Staking on Solana is very similar to most other Proof-of-Stake blockchain networks.

What Are the Advantages of Solana?

Solana has a bright future, as it has multiple advantages over most other networks. The Solana network was built with the most major concerns about blockchain in mind.

- Speed – Solana offers an incredible speed of 50,000 transactions per second, with the possibility of going as high as 710,000 transactions without significant scaling work on the network itself.

- Scalability – Solana has managed high levels of scalability by using the Proof-of-History algorithm. This innovation makes Solana somewhat unique and has dramatically improved the network’s efficiency.

- Proven transactions – Solana has processed billions of transactions, achieving economies of scale, and has kept the application fees extraordinarily low.

- Composability between projects – Solana users do not need to deal with multiple shards or layer-2 systems.

- Hype – Unfortunately, part of what drives whether or not a cryptocurrency will survive is the hype around it. Luckily, Solana has plenty of that.

What Are the Disadvantages of Solana?

While Solana seems to be a great project, nothing is perfect. In the crypto world, many disadvantages have nothing to do with the developers but rather are a product of working in this space.

- Slow development – There have been complaints that some implementations still await their launch on the Mainnet Beta version.

- Hardware costs – The hardware used with Solana is relatively costly, even though it boasts such low transaction fees.

- Not decentralized enough – Solana has been criticized for not being decentralized enough in its current form. That being said, the foundation envisions more decentralization in the future.

- Massive competition – This issue is one that most cryptocurrency ecosystems face, the fact that there are so many competitors at this point. The future is still somewhat uncertain.

- Outages – it is worth noting that there have been a couple of outages on the Solana network. However, most people have looked at this through the prism of “growing pains.” Nonetheless, this is something to be well aware of.

Is Solana a Good Investment?

As crypto goes, you need to be mindful of the massive amounts of volatility that you will see from time to time. Understand that there is a cycle in the season for everything. That being said, Solana has a lot of potential, offering extreme speed with low costs. Part of the question will be if you’re trading Solana, or investing long-term. If you are looking for simple price appreciation, trading CFDs at PrimeXBT eliminates many extra custody and wallet issues, allowing you to focus on market direction.

It’s currently building a large ecosystem of different projects and could become a popular choice for merchants with one of its projects, Solana Pay. Although Solana has grown significantly, it is still just a fraction of the size of Ethereum. Because of this, it’s difficult to imagine going “all in” when it comes to Solana. However, it certainly could earn a place in a well-diversified crypto portfolio. Solana certainly has captured enough attention that there are plenty of investors in it, making the SOL token relatively liquid, something that you cannot always say when it comes to crypto projects.

Always keep in mind that crypto is a high-risk investment. Plenty of great projects fall apart completely, so only invest in Solana if you’re comfortable with the risk. Never risk more than you can afford to lose, and look to the longer term for directionality.

Conclusion

Solana certainly can be one of the biggest winners in the crypto markets. It features lightning-fast transaction times and operates without the need for sharding. Solana has been quite a performer initially, but you should note that its main competitor, Ethereum, is starting to gain ground again as it upgrades its platform.

Solana has a bright future but is in a space where there is a lot of competition. More likely than not, the crypto space will see a lot of projects completely fold. Solana seems to have a relatively strong backing, so therefore it makes sense that we should see it thrive in the future. That being said, one of the biggest questions is, “In what sense?”

While there are certainly enough possibilities with the ecosystem, the question is whether or not there will be room for Solana and Ethereum going forward. It does appear that there will be, but the future is quite murky. As things stand currently, Solana is quite frankly a much better version of the blockchain than Ethereum. However, this could end up being like the “Betamax versus VHS argument” decades ago, where although VHS won the war, it was not necessarily the best version. The question is whether or not we will lose some outstanding projects over the next couple of years?

Solana deserves a spot in a well-rounded portfolio, but diversification will continue to be your friend in crypto investment. Keep in mind that there is no promise of return on investment, but Solana is favored by many of the world’s leading crypto experts as a holding. This is because of the many advantages over Ethereum and because the world of crypto is so new that anything can happen over the next few years. Spreading out risk in this area of finance is crucial.

What is Solana used for?

Solana is used to transfer value and data across its network. It also provides security through staking, much like most proof-of-stake chains. The Solana network is quite often identified through its DeFi and NFT applications.

Is Solana better than Ethereum?

It comes down to your use. The Solana network is not as widely used as Ethereum, but it is much faster. Solana can reach a speed of over 50,000 transactions per second. Ethereum is in the process of changing its algorithm and should catch up quite a bit. However, not all use cases are on Solana that are on Ethereum.

Is Solana better than Bitcoin?

Bitcoin is the most widely known crypto network and has a long history of safety behind it. Bitcoin is used for a monetary system, while Solana is used for many situations. That being said, the price of Bitcoin affects all crypto, regardless of use.

Who is the founder of Solana crypto?

Solana was invented by Anatoly Yakovenko, a systems engineer who has done significant work at Qualcomm. Solana was cofounded by Raj Gokal, who also had considerable experience at Qualcomm.

How high can Solana go?

Predicting the future price movements on Solana will be difficult because crypto itself is a volatile market. However, it is a widely followed coin and ecosystem. It certainly shows promise, so Solana earns a place in most portfolios.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.