Engaging in Bitcoin trading means buying and selling the digital currency through an exchange or predicting its price fluctuations using a CFD trading account. Like in other financial markets, the aim for crypto traders is to buy Bitcoin at a cheaper rate and sell it at a higher one, thereby benefiting from the price difference. Given its status as the most heavily traded and largest cryptocurrency by market cap, Bitcoin is the choice of millions of traders on a daily basis.

What is Bitcoin Trading?

Bitcoin trading refers to buying and selling Bitcoin in order to make a profit on the transaction. When a trader believes the price of Bitcoin will rise, he or she would buy (go long) Bitcoin and sell it later for a higher price.

The difference between the buying and selling price determines the profit of the trade. For example, if the trader bought Bitcoin at $50,000 and sold it at $54,000, the profit is $4,000.

Similarly, traders can also benefit from falling prices in the coin. If a trader believes that the price of Bitcoin will fall, he or she could short-sell the asset (go short) at a higher price, and cover the position at a lower price.

For example, if a trader goes short on Bitcoin at $54,000 and the price falls to $52,000, he or she would net a profit of $2,000.

Why Should You Trade Bitcoin?

Trading Bitcoin can be very lucrative if you get the foundations right and learn how to manage the risks. The Bitcoin market has the largest market capitalization of all coins (market price x coins in circulation) and is arguably the best-known digital currency out there.

Some benefits of trading Bitcoin include a large number of trading opportunities, the possibility to leverage your trades, and the potential of mass adoption of the coin around the world.

- Trading opportunities. Since Bitcoin can have extreme price fluctuations at times, this leads to the emergence of many trading opportunities, day by day. There is almost always a trading setup in Bitcoin. It’s not uncommon for the price of Bitcoin to rise or fall thousands of dollars in a couple of minutes, especially when important news hits the market.

- Margin trading. Just like other cryptocurrencies, Bitcoin can be traded on leverage with a margin account. Leverage allows you to open a much larger position size than your trading account while allocating only a small portion of your account as the collateral for the trade.

- Mass adoption and long-term potential. Digital currencies are pretty new in the world of finance. However, many large companies, such as Tesla or Microsoft, have already adopted Bitcoin, and other companies are also thinking about it.

What Moves the Price of Bitcoin?

The price of Bitcoin follows ever-changing supply and demand forces in the market. This means, there are many factors that can have a long-lasting influence on the price of Bitcoin, such as supply, the integration of the crypto market, or news, to name a few.

Important news

Many traders follow the news when trading in the financial markets. Those news traders can trigger a strong uptrend or sudden sell-off in the currency when important headlines hit the newswires.

Breaking news is always a risk factor for traders, especially for short-term trades. These include regulatory news, such as China banning crypto (again!), a few comments by Elon Musk over Twitter or indeed hacker attacks on the blockchain network, which can have a significant impact on the price of Bitcoin and other digital currencies.

In order to reduce the possible negative impact of breaking news on your trades, you should actively manage your trades and always use a stop-loss.

The supply of Bitcoin

By design, the supply of the Bitcoin digital currency is capped at 21 million. Every few years, the number of Bitcoin that come into existence through Bitcoin mining is halved in size, which means that the last Bitcoin could be mined as late as in 2140.

Nevertheless, the fact that there will be less and less new Bitcoin added to the global circulation of the coin means that, if demand suddenly increases over the next few years, the price could skyrocket.

Integration into the financial industry

As mentioned earlier, some large companies have already adopted Bitcoin as a means of payment. You can even buy a brand new Tesla car with Bitcoin! Other companies have also shown interest in adopting Bitcoin, which can lead to strong demand for the coin. The most important example of late is the Bitcoin ETF, which was finally accepted for issue on a global exchange. This was ten years in the making, having failed SEC approval many times. The impact of this event was very bullish for Bitcoin.

There are also many new projects that use the blockchain – the underlying technology of Bitcoin – to increase the speed and reduce the costs of international money transfers. Behind some of those projects stand the world’s largest banks, which can provide positive momentum to the coin.

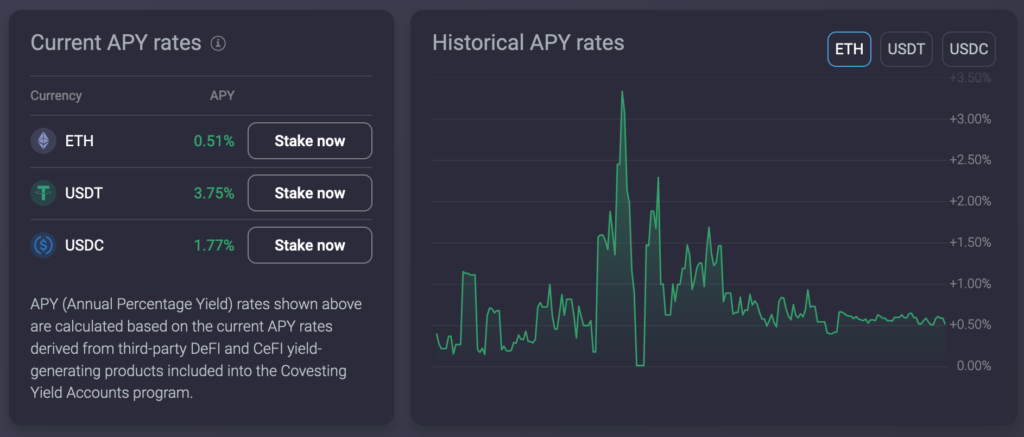

DeFi, which stands for Decentralized Finance is a massively popular area of the blockchain, common on the Ethereum network, which allows investors to access opportunities that can be unparalleled in the conventional investing arena. These include the ability to stake your tokens in return for passive income, to access yield farming and liquidity mining, which allow users to put idle tokens to work in return for APY (Annual Percentage Yield).

Key Events

Some events can send shockwaves through the crypto markets. These include ‘Hard Forks’, when a chain splits off into new forks e.g. Bitcoin Cash and Bitcoin Gold, and ‘Halving Events’, which occur approximately every four years. This is where miners’ rewards are halved, even though the amount of work they need to conduct to mine a coin stays the same.

Different Bitcoin Trading Strategies

There are many trading strategies to choose from for trading Bitcoin. While most Bitcoin traders are day traders, some of them prefer to buy and hold Bitcoin without much intervention in the trades. Here, we’ll take a deeper look at the most popular Bitcoin trading strategies.

How to Day Trade Bitcoin

Day trading is a trading style that involves opening and closing trades within the same day. Day trading is quite fast-paced as trades are held for minutes or hours, which requires active trade management or strict risk management rules.

There are quite a few day trading strategies, but one of the most popular is momentum trading. In momentum trading, traders aim to enter into a trade when momentum picks up, which is usually the cause around important technical levels.

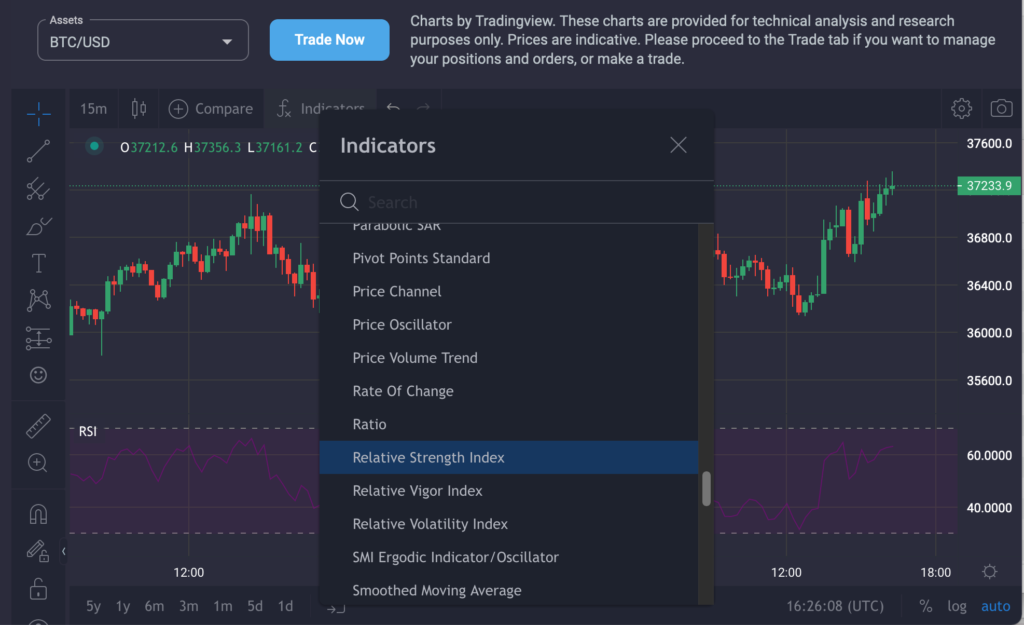

If you want to become a Bitcoin momentum trader, some of the tools you have at your disposal are support and resistance levels, chart patterns, and technical indicators such as RSI or Stochastics.

How to Trend Trade Bitcoin

Another popular day trading strategy is trend trading. In this strategy, traders aim to trade in the direction of the underlying short-term trend. This means they buy during uptrends and short-sell during downtrends.

Trend trading is a very powerful strategy that is also suited for beginner traders. In order to trade the trend, the first step is to determine the overall trend of Bitcoin. Use the 1-hour or 30-min charts to do so. Uptrends are characterized by higher highs and higher lows, while downtrends form with consecutive lower lows and lower highs.

A trend trader wants to buy weakness during uptrends, and strength during downtrends. Those phases of counter-trend moves are called price-corrections and can be measured with Fibonacci levels or determined using tools like channels and trendlines.

Bitcoin Hedging Strategy

An alternative strategy to trading Bitcoin is hedging. Instead of making a profit, the main purpose of hedging is to mitigate and reduce your downside risks and potential losses when trading Bitcoin.

For example, if you have a long position in Bitcoin but think that the price could collapse in the coming hours or days, instead of closing your long position, you could simply hedge the position by shorting Bitcoin in the same amount as your long trade.

This way, each drop in price in Bitcoin will be offset by the gains you make on your short position. Hedging is an advanced risk management strategy that requires some trading experience before you know how and when to apply it.

Bitcoin HODL Strategy

Last but not least, the “HODL” strategy is quite popular among some Bitcoin traders who have a positive long-term outlook for the coin. The name “HODL” is derived from a misspelling of “hold” on a popular cryptocurrency forum. Since then, it has also been interpreted as “hold on for dear life”.

While HODL is a viable strategy for traders who believe that digital currencies are the future of global trade and the economy, it doesn’t come without risks. There are no guarantees that digital currencies will completely replace traditional money in the years to come. You should only “HODL” with money you’re prepared to lose.

How to Trade Bitcoin

Once you choose a trading strategy, you’re almost ready to place your bet on Bitcoin! However, there are a few more steps that you need to take in order to increase your chances of success. Here we’ll list the most important steps in trading Bitcoin.

Step 1. Decide how you’d like to trade Bitcoin

Before placing your Bitcoin trade, it’s important to decide how you want to trade Bitcoin. There are many options to get exposure to Bitcoin, like trading CFDs, buying Bitcoin through an exchange, or using specialized crypto funds and ETFs. Here are some options you may consider.

Trading Bitcoin Derivatives

Derivatives are financial instruments that are designed to track the price of an underlying asset. Oil futures, stock options, and CFDs are all examples of financial derivatives, and they are also available to Bitcoin traders.

The most popular Bitcoin derivatives are CFDs, short for Contracts for Difference. CFDs track the price of the underlying asset, in this case, Bitcoin, and traders can profit from the differences in buying and selling prices, just like they would if they had bought a Bitcoin on an exchange.

A major advantage of CFDs is that leverage and margin trading is available to traders and easy to use. Unlike futures contracts, for example, CFDs offer much higher leverage and lower trading costs, which benefits the trader.

Buying Bitcoin Through an Exchange

An alternative way of trading Bitcoin is to buy and sell the coin through an exchange. Unlike with CFDs, in this case, the buyer is the owner of the coin and has to take care of storing it. Later in this article, we’ll explain how you can safely store Bitcoin.

- Trading Bitcoin through an exchange is usually more difficult and costlier than trading Bitcoin CFDs.

- Some exchanges lack proper regulation and have unreliable servers, which can lead to lower execution accuracy.

- Also, exchanges often impose fees on funding and withdrawing, which can eat up a good chunk of your profits.

Crypto 10 Index

Investing in a crypto index provides long-term exposure to the crypto ecosystem with relatively low maintenance costs. Some indices are set up as ETFs, which can be freely traded on a stock exchange, just like regular shares.

There are many crypto indices that provide different types of exposure to the market. Some are based on the 10 largest coins by market cap, like the Crypto 10 Index, while others invest in altcoins and exciting new projects that are based on blockchain.

Step 2. Develop a Trading Plan

The next step in trading Bitcoin is to have a well-defined, written trading plan. Trading without a trading plan is a recipe for disaster, as emotions are more likely to take over your logical brain when making trading decisions.

A well-defined trading plan includes all necessary points, that you consider important, for trading the markets. It’s like a roadmap for trades, defining under what conditions you open a trade, when to close a trade, how much to risk per each trade, where to take profits, what markets to trade, what strategy to use, and more.

It may take months to develop a good trading plan if you’re new in the markets. Fortunately, you can start with smaller position sizes and work your way up as you gain more experience in trading.

Step 3. Do Your Research

Once you know how and when you want to trade (you’ve defined your trading plan, haven’t you?), it’s time to do your research. Without proper analysis of the markets, trading would resemble gambling, which ultimately leads to large losses.

Let’s say you’ve defined a trend-following trading strategy in your trading plan. Your entries for an uptrend are based on pullbacks to previously broken resistance levels, and you want to risk only 2% of your trading account per any single trade.

In addition, you’ve defined that you want the RSI to return to normal conditions before placing a trade and that there should not be any important market news scheduled for the day that could ruin your trading idea. All of this can be part of your research step before placing a trade.

Step 4. Decide How to Store Bitcoin

If you’re trading Bitcoins through an exchange, you need to set up a secure storage method for your shiny new coins. There are two main types of storage for digital currencies: hot wallets and cold wallets.

- Hot wallets – Also known as web-based wallets, or mobile wallets, are easy-to-use storage methods for Bitcoin that are connected to the internet or an online exchange. Hot wallets are typically used to trade or pay for goods and services on the internet, as they are more convenient than cold wallets.

However, there are serious risks associated with hot wallets as they are vulnerable to hacker attacks. That’s why traders who own a large amount of Bitcoin usually store them on cold wallets and keep only a small portion of their coins on hot wallets for daily trading.

- Cold wallets – Also known as hardware wallets, cold wallets are small devices that look like a USB stick and that are used to store coins outside of the computer. Stealing from cold wallets is almost impossible, except the attacker has physical access to the wallet and knows the password for accessing the coins.

Step 5. Set Your Stops and Limits

The next step in trading Bitcoin is to set your stop and limit orders. Once you identify a trading opportunity, it’s important to identify where you want to place your stop-loss and take-profit orders before placing your trade. Stop-losses should always be used as they prevent large and unexpected losses.

If your strategy and trading plan are based on limit orders, then do your market analysis and determine the best possible level to place your orders. Limits are pending orders that turn into market orders once certain conditions are met, usually the price crossing above or below a pre-specified price level.

Step 6. Place a Trade

Finally, it’s time to place your trade! You have decided how to trade Bitcoin, developed a detailed trading plan, done your analysis, and identified high-probability technical levels on the chart for your orders. Now simply hit the “buy” or “sell” button, and your trade is live!

Tips for Trading Bitcoin

Beginner traders may feel overwhelmed with the amount of information that they need to process when they first get started trading Bitcoin. To overcome some of those issues, here are a few tips on how to trade Bitcoin the right way.

- Don’t overtrade. If you’re trading Bitcoin CFDs, you’ll often have access to high leverage ratios and margin accounts. While leverage can significantly improve your trading profits, they can also magnify your losses if you’re wrong. Don’t overtrade Bitcoin on high leverage, or you may quickly blow up your account.

- Always use stop-losses. Stop-losses are designed to prevent large and unexpected losses from occurring. Although you should always use stop-losses on your trades, don’t make the mistake of placing them too close to your entry price, or you may get stopped out before your trade starts performing.

- Don’t scale into losing trades. Many beginner traders make the mistake of scaling into (adding to) losing trades, hoping to quickly recover from the losses. When your trade isn’t working as expected, admit you were wrong and close it. There will always be new trading opportunities in the cryptocurrency market.

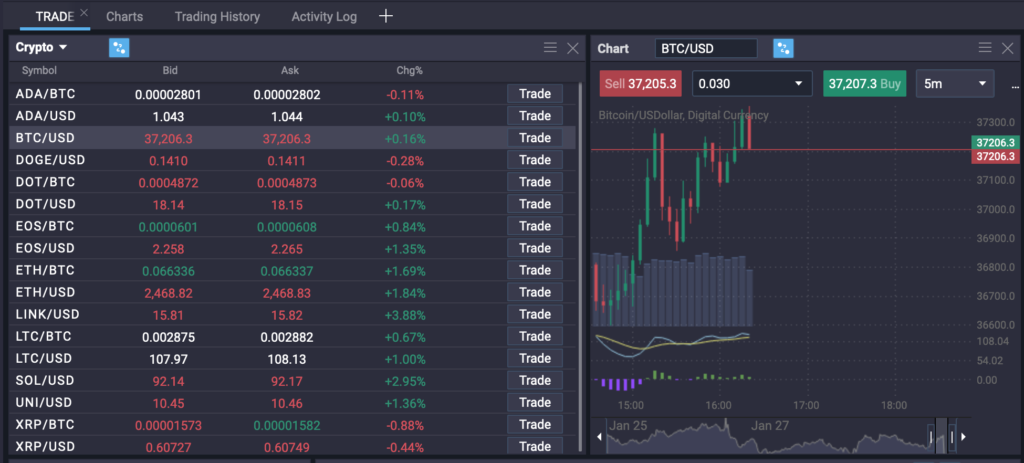

Why Trade Bitcoin with PrimeXBT

PrimeXBT is a leading online broker that offers trading on cryptocurrencies, commodities, indices, and forex. When trading with PrimeXBT, you get access to CFDs on a wide range of financial instruments, allowing you to efficiently diversify your portfolio and take advantage of leverage and margin trading.

The broker features an award-winning trading platform with advanced trading and charting tools. Whether you are a trend-following trader, day trader, or HODLer, PrimeXBT’s trading platform allows you to seamlessly execute your trading ideas with extremely low fees.

Margin trading isn’t only available for the more traditional asset classes, but for cryptocurrencies as well. You can control up to 100x your account size with a 100:1 leverage ratio, which allows you to profit even from very small movements in the price of Bitcoin.

If you don’t feel like you’re ready to trade Bitcoin yet, PrimeXBT features a copy trading module. With copy trading, you can copy trades of more experienced traders and enjoy the results of their analysis, while you gain the experience to start trading yourself.

What's the best way to buy Bitcoin?

What is the safest way to buy Bitcoin?

Can I buy less than 1 Bitcoin?

Is it easy to sell Bitcoin?

Is Bitcoin a good investment?

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.