Liquidity pools are a massive part of DeFi, or decentralized finance, one of the essential parts of the crypto world. By understanding what is possible with the liquidity pool, you may learn new ways to earn on the crypto you hold.

What Are Crypto Liquidity Pools?

Liquidity pools in crypto are a supply of digital cryptocurrency secured by a smart contract. Because of this, liquidity is produced, allowing for quicker transactions between parties. One of the essential functions of a liquidity pool is the automated market maker, which updates pricing in real-time and allows parties to exchange crypto seamlessly and fairly.

Offering liquidity allows traders and investors to convert crypto into cash if needed. If there is insufficient liquidity, it can take a long time to transform your assets back and forth. Liquidity pools are crucial in creating decentralized finance or a DeFi ecosystem.

How do Crypto Liquidity Pools Work?

Liquidity pools encourage and compensate members for depositing digital assets in the collection or group of assets. Rewards can take the form of cryptocurrency or a portion of the trading commissions paid by exchanges where they pool their assets.

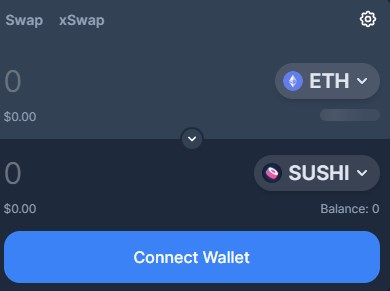

A liquidity pool will typically have its own website and interface. For example, one of the most popular crypto liquidity pools is called Sushiswap. If you wish to stake your Bitcoin, look for the BTC market. The liquidity pool is where you drop your BTC and receive the SUSHI token you have committed to keeping secure. It often doesn’t necessarily have to be for a set period, such as a week or several months. Your Bitcoin allows traders to make exchanges, and you, in turn, will receive a reward for keeping your Bitcoin in the pool.

What is Tether ERC-20?

Tether is what is known as a stablecoin, abbreviated USDT. Tether is backed by the US dollar and paid at an exchange rate of one dollar per USDT. ERC-20 is a protocol for an Ethereum token used as the payment method. 50% of all Tether is issued in the ERC-20 standard, a technological standard specifying a set of criteria that must be fulfilled for a token to function effectively inside the Ethereum ecosystem. Instead of thinking of it as a piece of code or software, it’s probably more accurate to define it as a technical guideline or specification.

ERC-20 developers have set up a standard allowing others to forecast how tokens and apps interact accurately. It is the reason for flawless operation inside the broader Ethereum ecosystem. ERC-20 tokens are used for a wide range of decentralized applications, exchanges, games, cryptocurrency wallets, etc.

What are Crypto Liquidity Pools Used For?

The world of finance desperately needs liquidity. Without available funds, systems can grind to a halt. The decentralized finance, or DeFi world, is no different. It is a term used for financial services and products on the blockchain.

Some of these activities include lending, borrowing, or token swapping, relying on smart contracts, which are self-executing codes. Users of DeFi protocols will lock up their crypto assets in these contracts, called liquidity pools, so that other traders and borrowers can use them.

There is no tangible equivalent in the physical world, as a liquidity pool makes the intermediary necessary in the traditional finance world wholly irrelevant and unnecessary. Because of this, many people believe this could be finance’s future.

Why Are Crypto Liquidity Pools Important?

The liquidity pool is a huge and vital component of decentralized finance, as it helps carry out many activities like trading, crypto yield farming, lending, arbitrage trading, and profit sharing. Furthermore, you can also get passive income by becoming a liquidity provider.

You can trade in a liquidity pool without the fear of the market maker’s price manipulation, increasing the trust that buyers, sellers, and liquidity providers have towards cryptocurrencies and decentralized finance in general. In the purest form, a liquidity pool allows for fair trading, something that market makers aren’t necessarily going to be able to be as good at because an order book, the traditional way to make a market, can be much too slow.

Pros and Cons of Crypto Liquidity Pools

Before getting involved in the liquidity pool, you should understand the pros and cons of this part of the crypto world, as there are both. A lack of understanding can cause extreme danger if you are not careful.

Pros

Crypto liquidity pools offer several benefits to their users, including the fact that you do not have to worry about finding a trading partner who shares your interest in cryptocurrency or the coin you are involved in. All exchanges in the liquidity pool happen automatically using smart contracts.

Users on crypto exchanges do not acquire assets through trading, at least not directly. They obtain assets from a liquidity pool that is already funded. These are produced from exchange rates, making the entire process circular.

Thanks to liquidity pools, vendors cannot ask for outrageous pricing, as there is a clear and present exchange rate. Furthermore, transactions go much more smoothly. The liquidity pool is a collection of assets secured by a smart contract, allowing their values to be constantly updated along with the most recent exchange rates.

Cons

Even though the liquidity pool offers many advantages, they have some cons. One of the biggest concerns you will have is risks related to smart contracts. Ignoring the dangers of intelligent agreements could result in a significant loss.

A liquidity pool acquires your assets once you contribute them. The contract will serve as a custodian to your purchase, even though there has been no intermediary to manage your funds. You could lose your money permanently if there is a systematic mistake via the smart contract.

When you add to liquidity, there is the potential that you could experience a quick loss. It can fluctuate between small and large volumes, typically in double-sided crypto liquidity pools. That being said, the loss is usually temporary.

There are also risks of access. Some projects in the past have had designers who can modify the pool’s rules in whatever way they want. An executive code or special access to the smart contract may be available to the developers, allowing them to cause harm and seize the money in the pool.

Conclusion

A liquidity pool functions as a trustless environment to facilitate crypto trading. It can be used for many different things, not the least of which would be to earn a yield on holdings, as you loan out your coins for traders to use on the exchange. Quite frankly, with a liquidity pool, it is easier to see trading in cryptocurrency flourish because you may have wildly fluctuating exchange rates. Of course, the difference between the bid and the ask on a currency pair could be huge.

The crypto liquidity pool allows more trust in the cryptocurrency ecosystem, as DeFi protocols automatically enable traders to go back and forth in different directions. Ultimately, crypto liquidity pools should continue to attract much attention, as liquidity pools are already used in other larger markets such as a foreign exchange.

Crypto liquidity pools have made the transacting of crypto much more straightforward, which is one of the essential things that crypto needs to look at, as the average person does not want to be bothered with many complexities. The crypto liquidity pools out there make it possible to change one coin for another, quite often, without even dealing with fiat currency. With that being said, the crypto liquidity pool should continue to expand.

Crypto liquidity pools are also a great way to earn passive income with your crypto, especially if you have no interest in getting rid of it anytime soon. After all, it can be thought of in similar ways to a dividend in the stock market, which is a great way to build wealth over the longer term.

Is a liquidity pool a good investment?

It depends on the liquidity pool, but you should likely be able to earn some yield or fee transactions through one of these liquidity pools. Risks are always associated with them, but a crypto liquidity pool typically allows traders to make on the crypto they plan on holding.

What’s a good liquidity pool?

There are several liquidity pools, but as a general rule, the more prominent names tend to do better as they have much more liquidity and, by extension, money backing them. This includes Uniswap, Balancer, Convexity Protocol, KeeperDAO, Curve Finance, and of course, the liquidity pool that you can loan your crypto to here at PrimeXBT.

How do crypto liquidity pools earn money?

Crypto liquidity pools typically earn money via trading fees from transactions inside the pool.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.