When you think of the stock market, you might picture a chaotic trading floor with ticker tape spewing prices and traders in suits shouting “BUY!” and “SELL!” at the top of their lungs. While this dramatic scene still plays out in Hollywood movies, the real world of trading has undergone a digital revolution. Today, trading has moved online, making it more accessible than ever for individuals looking to earn money from market movements.

The opportunities in online trading are vast, with countless assets to explore and strategies to master. Among these, one of the most popular and potentially lucrative methods is Day Trading—a fast-paced style of buying and selling stocks, commodities, or cryptocurrencies within a single day to take advantage of market fluctuations.

Day Trading isn’t just about making quick moves; it requires a blend of skill, strategy, and market knowledge. Traders often use short-term approaches like scalping, range trading, or news-based trading to profit from even the smallest price changes.

While the concept may sound straightforward—buy low, sell high—the reality is far more complex. This leads to the common question: Is Day Trading profitable? The answer isn’t simple. Success in this field demands a sharp understanding of markets, a well-thought-out strategy, and even a bit of luck. It’s not just about how to win, but also understanding why many day traders fail

The Challenges of Making Money in Online Day Trading

Day trading is often described as buying an asset at one price during the trading day and selling it later at a higher price. While this concept sounds simple in theory, the reality is far more complex. Successful day trading requires mastering multiple strategies, staying attuned to market dynamics, and, yes, even a bit of luck.

Day traders need a broad skill set that combines knowledge of economics, mathematics, politics, and other disciplines to make informed decisions. Beyond technical expertise, day trading often requires substantial starting capital, as the old adage goes: “It takes money to make money.” Leveraging can be an option, but it also introduces higher risks, which we’ll explore later.

While understanding what makes a great day trader is essential, it’s equally important to recognize the common challenges that prevent many from achieving consistent profitability.

Challenge #1: Managing Greed and Fear

Day trading is highly emotional, driven by human tendencies like greed and fear. These emotions often lead traders to abandon well-thought-out strategies, especially during winning or losing streaks.

For example, a trader riding a series of profitable trades might feel emboldened to take bigger risks—whether it’s entering a larger trade, using higher leverage, or tightening profit margins. Such decisions, fueled by greed, can backfire and wipe out an entire day’s profits or worse.

Conversely, after experiencing a loss, traders may become overly cautious, falling into a fearful mindset. Fear can cause panic selling when unexpected news hits or lead to missed opportunities because of reluctance to take calculated risks.

These emotional swings—oscillating between greed and fear—make it incredibly difficult to maintain consistency in decision-making. Unlike machines or algorithms, human traders are susceptible to external influences, making emotional control a critical skill.

Challenge #2: The Unpredictable Nature of the Market

The market itself presents one of the most significant challenges for day traders. Unlike a machine operating with precision, the market is swayed by human sentiment, external events, and countless unpredictable factors. Understanding how news and information drive market movements is a skill that requires time, experience, and a deep knowledge of market behavior.

Breaking news can offer opportunities to capitalize on rapid price changes, but it can also lead to devastating losses if the market reacts unpredictably. This is why experienced traders plan not only for when things go right but also for when they go wrong.

To grasp the market’s unpredictable nature, it’s essential to recognize that the market is essentially a collective of thousands of individual traders and investors. Each participant interprets events differently, adding layers of complexity to price movements. Predicting these collective reactions is a daunting task.

Adding to the challenge, markets often behave counterintuitively. For instance, bad news might lead to price increases if traders hedge their positions or anticipate future recoveries. Similarly, good news may not always result in the expected rally if the market has already priced it in. This counterintuitive behavior underscores the importance of understanding market sentiment and being prepared for unexpected reactions.

Success in navigating the market’s whims requires not only skill and strategy but also the ability to adapt and think critically in real-time. The unpredictable nature of the market is both its greatest risk and its greatest opportunity.

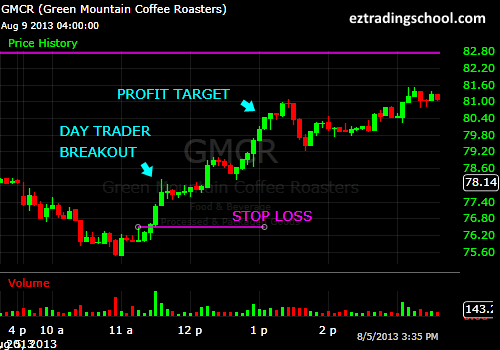

Challenge #3: Crafting and Sticking to a Solid Trading Strategy

Building a successful trading strategy is one of the most demanding yet crucial aspects of day trading. It’s not just about creating a plan—it’s about designing one that aligns with both your trading style and the market you’re operating in. Even with a solid strategy, executing and staying disciplined is often half the battle.

A good trading strategy serves as a roadmap, helping traders navigate the emotional rollercoaster of greed and fear while adapting to the unpredictable nature of the market. However, the complexity lies in creating a plan that can respond to varying market conditions. Strategies that work during an uptrend might fail during a downturn, requiring traders to continually refine and adapt.

Day trading, at its core, is about making predictions, but the unpredictable nature of the market means that no strategy guarantees success. Looking at historical patterns—like trend following, where traders capitalize on recurring price movements—can provide insights, but it’s not foolproof. Some traders opt for counter-trend strategies, betting against the current direction, which adds another layer of risk and complexity.

Even after crafting a strong strategy, sticking to it is a challenge. Emotional factors, unexpected market movements, and external influences can tempt traders to deviate from their plan. Fear may push you to exit too soon, while greed can lead to overtrading or unnecessary risks. The market itself may throw curveballs, rendering even the most well-designed strategies ineffective at times.

Mastering the art of building and adhering to a trading strategy requires patience, practice, and resilience. It’s not about predicting every move correctly but about staying disciplined and making informed decisions based on a tested approach.

Understanding How to Make Money Day Trading

Day trading is a popular method of trading financial assets, but it’s essential to approach it with realistic expectations. While it is possible to make money through day trading, it requires a thorough understanding of the markets, consistent practice, and a carefully developed strategy. This guide outlines the key steps and considerations for those looking to learn more about the process of day trading.

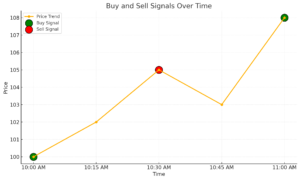

Step 1: Developing a Day Trading Strategy

A well-defined strategy is a cornerstone of day trading. Traders must consider what type of analysis fits their style and goals:

- Fundamental Analysis: Focuses on economic indicators, market news, and broader financial trends to predict price movements.

- Technical Analysis: Uses charts, patterns, and tools like moving averages and oscillators to identify trends and potential entry or exit points.

Selecting the right strategy takes time and often requires trial and error. It’s also important to incorporate risk management into your approach. For example, many traders follow the 5% rule, limiting risk on any trade to 5% of their total capital. This helps to reduce the likelihood of significant losses from a single decision.

Step 2: Practice Through Simulation and Backtesting

Before committing real capital, practicing in a simulated trading environment is highly recommended. Simulations allow traders to explore various strategies, test their effectiveness, and become familiar with market behavior—all without the risk of losing money.

Backtesting is another essential step. This involves applying a chosen strategy to historical market data to evaluate how it would have performed. While backtesting cannot predict future outcomes, it helps traders understand potential strengths and weaknesses in their approach.

Both simulation and backtesting are valuable tools for building confidence and refining techniques before live trading.

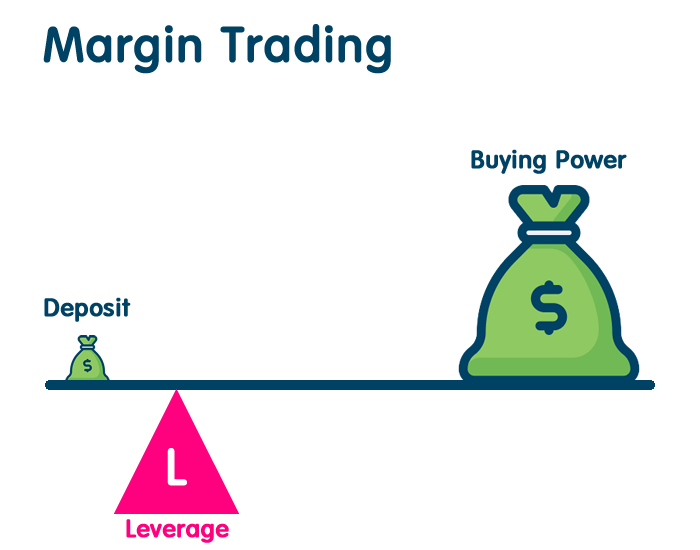

Step 3: Scaling with Tools Like Margin and Leverage

For traders who have developed their skills and are comfortable managing risk, tools like margin and leverage can provide opportunities to scale their positions. Margin trading involves borrowing funds to increase the size of a trade, while leverage multiplies the buying power of existing capital.

It’s important to note that while these tools can enhance potential returns, they also increase the level of risk. Traders should carefully assess their tolerance for risk and fully understand the implications of using leverage before incorporating it into their trading activities.

A Cautious Approach to Day Trading

Day trading can be a way to engage with the markets actively, but it’s not without its challenges. Success requires a commitment to learning, continuous practice, and disciplined risk management. Starting with small, manageable trades and focusing on education can help traders build a foundation for more informed decision-making.

Understanding the Role of Leverage in Day Trading

Leverage is a tool that allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and potential losses. It is frequently used in day trading to make the most of small price movements in the market, but it requires careful understanding and risk management.

Leverage works by multiplying the capital you allocate to a trade. For instance, with 10x leverage, a $1,000 position gives you the buying power of $10,000. While this increases the potential return on a successful trade, it also means that losses are amplified if the trade moves against you.

How Leverage Impacts Trading Capital

One way to view leverage is as a method to make your trading capital more efficient. By using leverage, traders can allocate a smaller portion of their funds to a trade while keeping the rest available for other opportunities. For example:

- Without Leverage: A trade involving 10,000 shares of a stock priced at $10 per share requires $100,000 in capital.

- With Leverage: Using a leverage ratio of 20:1, only $5,000 would be needed to enter the same trade, leaving the remaining capital available for diversification.

This approach allows traders to spread their risk across multiple positions rather than concentrating it in a single trade.

Can Leverage Reduce Risk?

While leverage is often associated with increased risk, it can also be seen as a way to manage risk effectively. By using leverage, traders can reduce the upfront capital required for a position, minimizing the total amount of personal funds at risk in a single trade. However, this only holds true when traders maintain disciplined risk management and avoid over-leveraging.

For example, instead of committing $100,000 to a single trade, a trader could use $5,000 in leveraged capital to achieve the same exposure. This approach leaves the remaining $95,000 protected, as long as the leveraged trade is carefully managed.

A Balanced Approach to Leverage

Leverage can be a powerful tool in day trading, but it is not without its challenges. Understanding how it works, using it responsibly, and keeping risk within manageable limits are essential for its effective use. New traders should approach leverage cautiously and prioritize education and practice to avoid common pitfalls.

Conclusion: A Realistic Perspective on Making Money Day Trading

Many are drawn to day trading by stories of easy profits and financial freedom. However, the reality is more complex. While it’s possible to make money through day trading, it requires dedication, learning, and practice. Success comes from developing a strong foundation, understanding market dynamics, and applying strategies consistently.

Day trading isn’t purely mechanical; it demands a combination of analysis, intuition, and experience. Markets are constantly evolving, and being able to adapt to changing conditions is essential. For those willing to invest time and effort, day trading can become a viable way to generate income.

One of the most appealing aspects of day trading is its potential for exponential growth. As traders master the basics, they can leverage advanced tools, like margin and leverage, to maximize their opportunities. However, it’s important to approach these tools responsibly, with a clear understanding of the associated risks.

For those ready to take the next step, platforms like PrimeXBT provide access to a wide range of trading opportunities. With options to trade forex, commodities, cryptocurrencies, and popular indices such as the S&P 500 and FTSE 100, traders can explore diverse markets and refine their skills. Features like up to 1,000x leverage offer added flexibility, making it a platform worth considering for both beginners and experienced traders.

Can you really make money day trading?

Yes, it’s possible to make money day trading, but success depends on your knowledge, skills, and strategy. Day trading requires a deep understanding of market trends, risk management, and discipline. While some traders can achieve consistent profits, many others struggle due to the high risks involved. Starting with a demo account and practicing your strategy is highly recommended before committing real capital

Can I day trade with $100?

Yes, you can start day trading with $100, but your earning potential will be limited. With a small account, it’s essential to focus on low-cost assets like penny stocks or fractional shares, and trade with brokers offering no minimum deposit requirements. Additionally, using leverage cautiously can help increase position size, but it also magnifies risk. Building skills and experience is critical before scaling up your investments

What are the common risks associated with day trading?

Day trading involves significant risks, primarily due to the rapid price fluctuations in the markets. Traders can face losses if they lack a clear strategy, fail to manage their risk effectively, or let emotions like fear and greed influence their decisions. The use of leverage, while potentially amplifying profits, can also magnify losses. To mitigate these risks, it’s important to practice disciplined trading, understand market dynamics, and avoid over-leveraging.

What skills are essential for successful day trading?

Successful day trading requires a combination of technical and analytical skills. Traders need to understand how to read price charts, identify trends, and use tools like moving averages or oscillators for analysis. In addition to technical expertise, emotional discipline is crucial for managing stress and avoiding impulsive decisions. Patience, adaptability, and continuous learning are also key to navigating the complexities of day trading

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.