Do you fill your car with petrol every week or wait until the price drops? If you wait, you might want to reconsider for one simple reason – when you fill up every week, price spikes are averaged out when petrol gets cheaper throughout the year. If you wait, you might miss the price drop, or the price might even increase – costing you more money…or even worse, leaving you with an empty tank.

In broad strokes, this is the concept behind dollar-cost averaging, one of the most popular long-term, low-risk investment strategies.

The dollar-cost averaging approach is a simple strategy involving investing regularly in the same security or instrument, no matter its current price. Over a longer timeframe, this should help lower a portfolio’s exposure to volatility by averaging price fluctuations.

In contrast, investing in a lump sum requires you to wait for the best market conditions. In the meantime, the asset you are interested in may continue to grow until a reversal happens. Instead of making money from these smaller climbs, you are waiting for a price target that might never happen.

To demonstrate, let’s say you are interested in trading gold. Gold has grown steadily since the beginning of 2023, with small drops in February and March. Before those drops, though, gold saw a $300 increase, which you would have missed if you were waiting for a price drop.

Investment Basics: The Dangers of Market Timing

Trying to hit the ideal market timing to optimise potential gains can carry unforeseen risks. One of the most significant is missing the tight window of opportunity – as the famous saying goes, “Never try to catch a falling knife”. No matter how long a positive trend has been going, a downturn will most likely follow, and predicting the exact moment when these reversals will happen is nearly impossible. That’s why most investors prefer to wait for a trend to be confirmed to minimise market exposure.

Timing the market also requires trial and error, effort, extensive market knowledge, and time. To calculate the moment of a reversal and confirm it’s an actual trend (not a momentary movement), you need to use a complex combination of indicators, carry out extensive research and analyse the stocks’ past performance. This information can be both expensive and difficult to source.

It also exposes you to various negative psychological effects such as so-called “revenge trading” i.e. trying to recover the funds from a loss immediately or panic selling. This can cause an investor or trader to act impulsively, resulting in even more losses.

Dollar-cost averaging, on the other hand, minimises the risk of market reversals without missing positive market actions since you are investing in regular intervals, no matter the share price. It also removes the need for time-consuming analysis or research and minimises the investor psychology component that can be detrimental to the performance of your portfolio.

Introducing Dollar-cost Averaging

What is Dollar-cost Averaging?

Dollar-cost averaging is simple to understand and easy to implement. You invest the same amount at regular intervals in a single or set of stocks or instruments. Beyond ease of use, as mentioned above, it doesn’t require advanced knowledge or a degree in economics, unlike “legacy” investing strategies.

If you have a workplace retirement plan, you probably already use dollar-cost averaging. Every month you make regular payments into a fund or portfolio managed by an investment advisor.

The concept behind this strategy is that the average purchase price of an instrument or stock over a longer period will take advantage of declining markets (by buying more shares with the same amount of money) while smoothing out price spikes. By the end of the year or a longer period, your smaller purchases equate to a lower average price than if you waited on the right price to act.

Origins and Evolution of DCA

You probably wouldn’t be surprised to find out DCA was mentioned in the go-to investing bible, “The Intelligent Investor“, by the legendary Benjamin Graham. And yes, that’s the same Benjamin Graham who taught and mentored one of the most successful investors in history – Warren Buffett.

The Mechanics of Dollar-cost Averaging

How DCA Works: A Step-by-step Guide

- Create a personal finance budget and decide what percentage of your income will be invested into the dollar-cost averaging strategy. This should be a fixed amount invested on a fixed schedule.

- Decide your timeframe and investment horizon i.e. the future results you expect when you use dollar-cost averaging.

- Which stocks or investment options you will be investing regularly into. This may require some research.

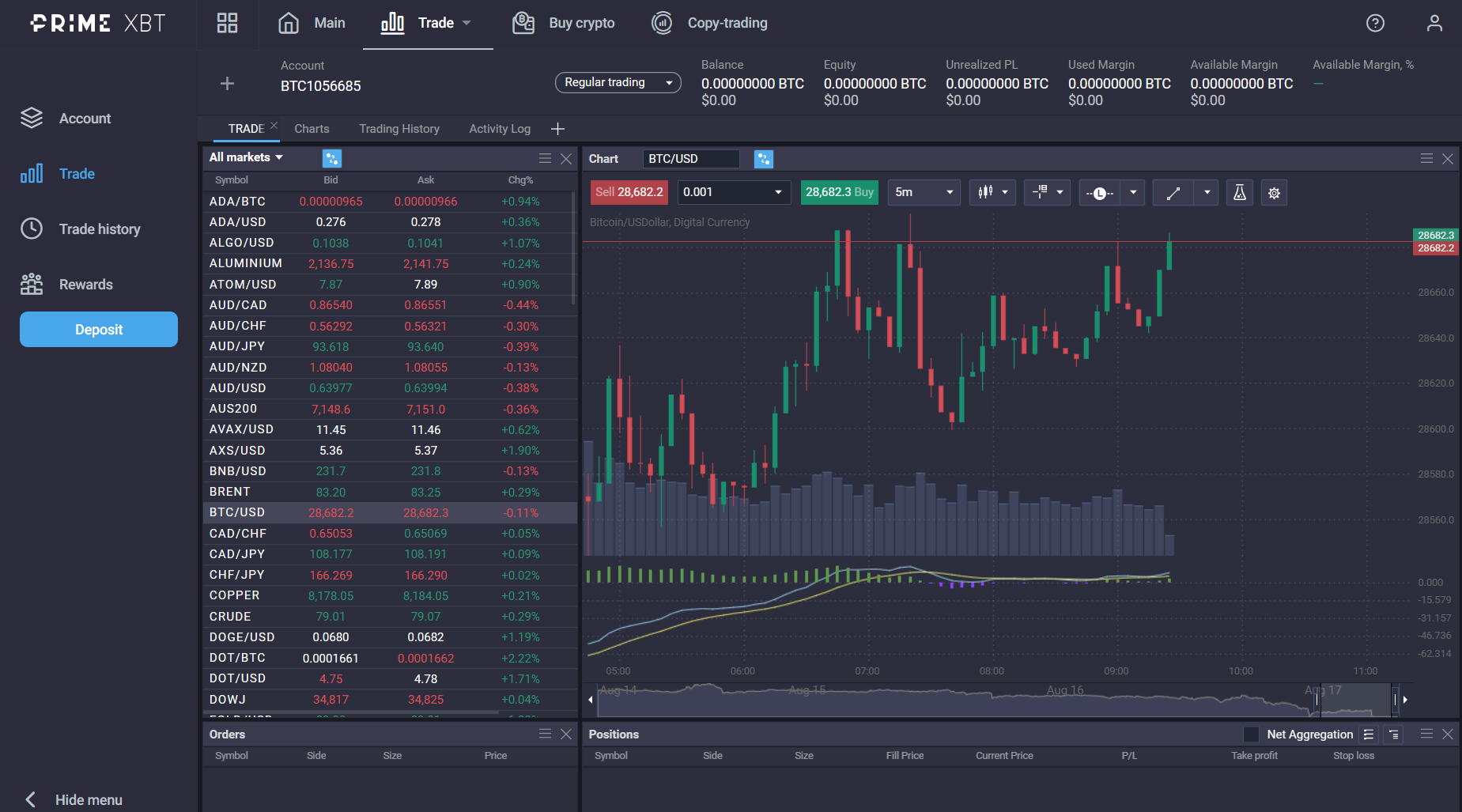

- Sign up for a brokerage account like the one Prime XBT offers that allows you to invest in cryptocurrencies, Forex, commodities and stock indices. Another benefit of working with a broker like Prime XBT is the ease of use and ability to access leverage.

Here is an example of how dollar-cost averaging works:

- Month 1 – $500 invested at $277.69 a share

- Month 2 – $500 invested at $277.46 a share

- Month 3 – $500 invested at $378.30 a share

- Month 4 – $500 invested at $422.98 a share

- Month 5 – $500 invested at $467.29 a share

- Month 6 – $500 invested at $439.40 a share

By the end of the 6 months from March 2023 to August 2023 although we have a stock price difference of $161.71, you will have purchased $3,000 of NVIDIA stock for an average price $377.18, which equates to a savings of $62.22 per share compared to the last price in our example. That means that you now own 7.95 stocks – saving you $494.88 if you bought those same stocks at the last price of $439.40.

In addition, you didn’t miss the growth the stock experienced in the meantime!

Based on the historical closing prices of NVIDIA from Yahoo Finance

Effects on Portfolio: Smoothing Out Market Volatility

Another way dollar-cost averaging works is that you get more stock when the prices drop and purchase less when the price increases. As you saw in the example above, although the stock price reached highs of $467.29 the average purchase price was well below that at $377.18.

This means that you purchased 1.8 of the stock when the price was $277.69 and fewer shares, 1.13 to be exact, when the price reached $439.40. Although stocks fluctuate significantly from monthly, your investment stays the same – getting you more shares when prices are low and fewer shares when stock prices are higher, essentially managing your market exposure automatically.

Benefits of Dollar-cost Averaging

Although the key advantage of dollar-cost averaging is averaging out price spikes, it also offers an unforeseen benefit. Dollar-cost averaging is practically an automatic trading plan. You can buy stocks or other instruments without the added stress and effort of analysing markets, trying to avoid a high point and waiting for prices to drop. It’s also a proven strategy long term investors have been using for decades.

Dollar-cost averaging comes with a minimal dedication of time and effort and keeps you insulated from the negative psychological effects of investing a large sum all at once.

Limitations and Considerations

When DCA Might Not Be the Best Choice

Timeframe and financial goals are important considerations before using dollar-cost averaging. If you’re a short-term, proactive investor or a trader wanting to capitalise on small market movements by frequently opening and closing smaller positions, then dollar-cost averaging isn’t the ideal strategy for you.

This is also true if you are a short to medium-term investor that focuses on an individual stock instead of a collection of stocks. To enjoy the full benefits of dollar-cost averaging, a longer timeframe and a selection of stocks and instruments are the best course of action.

But dollar-cost averaging works perfectly if you are trying to build wealth and increase your net worth over the long term, with minimum engagement, effort, analysis and market exposure.

Comparing Lump Sum Investing to DCA

Investing a large sum requires money and deep market knowledge. If you don’t have that, you can either invest in acquiring it or pay someone a fair bit of money to use their knowledge in your favour.

Beyond that, lump sum investing requires you to monitor the performance of your portfolio proactively. This includes frequently reviewing the selection of stocks you are investing in, talking with your financial advisor, and analysing the markets for new opportunities.

Making one large investment, even split into equal portions amongst multiple investment vehicles, exposes you to market movements before and after making your investment. If markets are in an upwards trend before you open your position, for example, this could force you to buy fewer shares, minimising your potential returns.

Dollar-cost averaging on the other hand, removes the need for deep financial knowledge. It also requires minimal maintenance other than investing in regular intervals. Other benefits include taking advantage of a growth market instead of waiting for the trend to end so you can make your stock purchases. Because the shares purchased previously will grow with the market.

All while averaging out the risk associated with rapid market price movements.

Implementing Dollar-cost Averaging in Your Investment Strategy

There are a few ways you can start using the dollar-cost averaging strategy to your advantage. First, calculate the amount of money you can allocate to your investments. Most personal wealth advisors recommend dedicating 10-15% of your annual income to investments, but this percentage can be adjusted depending on your financial goals and risk appetite. More is better though.

Next, calculate the intervals at which you would like to invest. For example, this could be monthly, bi-monthly, or once per quarter. Remember that the fewer intervals you plan or, the less frequently you make your investments, the lower the averaging effect will be, which may increase your risk.

Finally, you need a way to invest. Certain brokerages, like Prime XBT, beyond offering a fast, reliable gateway to the markets, also provide a platform with a wealth of built-in tools that can help you decide what you’d like to invest in.

An added benefit of Prime XBT’s services is the ability to Copy Trade, a method of trading that allows you to follow successful traders and, as the name indicates, copy their trades. This can be combined with dollar-cost averaging by investing the same amount in a specific strategy from one of these expert traders.

Conclusion: Embracing Consistency in an Unpredictable Market

Markets are unpredictable because people are, and that’s what moves prices. No matter how advanced economic theories become, one theory rules them all: supply and demand. And when demand outpaces supply, markets surge. When supply outweighs demand, we get lower prices. One small piece of news or even a rumour can cause panic, but dollar-cost averaging can help you avoid this volatility.

Furthermore, those surges and drops can be both taken advantage of and normalised with the dollar-cost average strategy. When you make regular investments in the stock market, when the prices climbs, so do your existing investments. When prices drop, you get more shares for your money.

Is Dollar-cost averaging a good strategy currently?

Absolutely, dollar-cost average strategy as the name implies, averages the risk associated with many stocks or other investment vehicles. It is a low-engagement method to invest. When prices are low, your money purchases more shares, and high prices are normalized over a longer period of time.

How does Dollar-cost averaging work?

It works much like an index fund or mutual funds, but instead of averaging the risk across multiple investment vehicles, it uses regular and reoccurring investments that normalise the price over a longer period.

What is an example of Dollar-cost averaging?

A retirement account is a great example of a dollar-cost average fund. You contribute a fixed amount every time you are paid, and that is invested, for the most part, in the same low risk investment vehicles. A real life example of this would be topping off your car with petrol consistently every week, no matter the price. Although the price of petrol may increase, at the end of the year, you will have spent less money than the highest price at the pump.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.