Dogecoin and Bitcoin are two well-known crypto assets. However, some traders may not know how to compare Dogecoin vs. Bitcoin, so knowing some of the significant similarities and differences will be crucial for the prudent investor to grasp.

Dogecoin: The basics

DOGE’s current price is $0.18167. DOGE is 1.8% in the last 24 hours, with a circulating supply of 979120253 DOGE

To understand the difference between Dogecoin and Bitcoin, you must know how each coin works. In the case of Dogecoin, the following is essential to know.

What is Dogecoin, and how does it work?

Dogecoin is a cryptocurrency that uses a proof-of-work consensus algorithm, where miners use computers to solve equations to process transactions and record them on the Dogecoin blockchain. It is mainly thought of as a means of financial exchange, although it doesn’t have to be.

Dogecoin trading on the PrimeXBT platform.

Advantages of Dogecoin

The most significant advantage that Dogecoin has over Bitcoin is its speed. The speed of the transactions on this network is much more robust than Bitcoin, so in that sense, Dogecoin is superior. The low cost of Dogecoin allows people to have massive amounts, but this is also part of the “meme effect” of the coin. Because of this, there have been significant gains from time to time in Dogecoin, but massive losses can also be had.

Disadvantages of Dogecoin

Speed comes at a cost. In the case of Dogecoin, the network isn’t as secure as the Bitcoin network. Also, there is no limit to the amount of Dogecoin that can be mined, so in its very nature, it is an inflationary coin. Furthermore, the coin was initially started as a joke and is highly sensitive to social media.

Dogecoin is one of the original “meme coins.” This means there is an occasional hype or lack of hype that can move this coin’s value. Unfortunately, that momentum can disappear quite quickly as well. To be a good trader of Dogecoin, you must keep on top of what’s trending on social media. Also, you need to understand that Dogecoin rarely rallies if Bitcoin is struggling.

Bitcoin: The basics

BTC’s current price is $93685.6. BTC is 0.3% in the last 24 hours, with a circulating supply of 19855012 BTC

You will also need to understand the basics of Bitcoin to compare the two assets and perhaps build an investing thesis on these markets.

What is Bitcoin, and how does it work?

Bitcoin is a decentralized digital currency that you can buy, sell, and exchange directly with others. The transactions are done without intermediaries and in a “trustless environment.” The Bitcoin network uses a proof-of-work consensus algorithm to solve complex mathematical algorithms, to facilitate transactions.

Advantages of Bitcoin

Bitcoin has several advantages over Dogecoin and others. Accessibility and liquidity are significant advantages, as it ignores borders. User transparency is also a considerable advantage, and independence from a central authority is also a big draw.

There is a high return potential in owning Bitcoin, as it has seen massive gains over the last several years. It also features irreversibility in transactions.

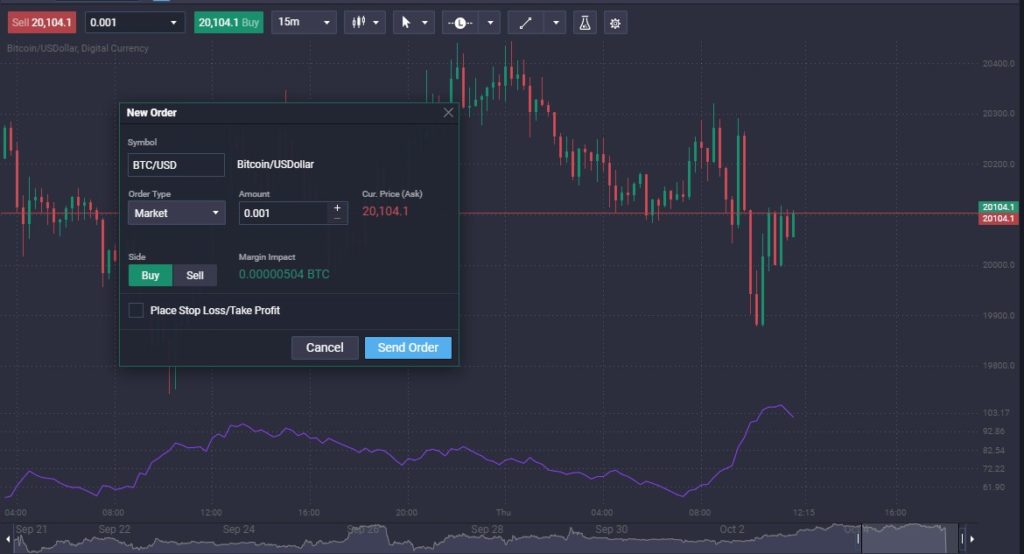

Trading Bitcoin on the PrimeXBT platform.

Disadvantages of Bitcoin

The biggest issue that many people have with Bitcoin is volatility. This makes Bitcoin difficult for businesses to accept, as the underlying value of Bitcoin can move several percent in a day. It also has somewhat limited use and isn’t regulated. This isn’t always a good thing, depending on the situation.

Bitcoin is still in the early stages of adoption, so it isn’t used everywhere. There is also the possibility that Central Bank Digital Currencies might squeeze out Bitcoin as well.

Critical differences between Dogecoin and Bitcoin

To differentiate the difference in trading opportunities, you need to understand some of the critical differences between Dogecoin and Bitcoin. While there are some similarities, there are also glaring differences between the two.

Value

Value is derived by the community using the coin. In the case of Dogecoin, it started as a joke, and quite frankly, it is something to keep in the back of your mind. Furthermore, because there is absolution on how many Dogecoins you can produce over the network’s lifetime, inflation will continue to eat away at the value over the longer term, all things being equal.

Evolution

As stated previously, Dogecoin was started as a joke by two engineers named Billy Markus and Jackson Palmer in response to the idea of Bitcoin being so slow. While they did increase speed, they also were not overly worried about security. Jackson Palmer has stated more than once that he does not own any Dogecoin and doesn’t understand why it is popular.

Alternatively, Bitcoin was started as a project in 2007, around the same time as the Great Financial Crisis. On October 31, 2007, Satoshi Nakamoto published a white paper on the cryptography mailing list at metzdowd.com describing a digital cryptocurrency titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Since then, Bitcoin has caught worldwide attention and skyrocketed in value. The adoption of Bitcoin has been widespread, primarily for security reasons and as electronic payment in underbanked parts of the world.

Coin Limits

Dogecoin has no limit on how many will be mined. This is a problem down the road as it inherently builds inflation into the ecosystem. By contrast, Bitcoin has a limit of 21 million, meaning it will never inflate above. By being a deflationary token, it derives its value from scarcity. With this, the main question will be whether people care about scarcity in the future. (Think of buggy whips. They are scarce, but not exactly in demand.)

What Makes Bitcoin and Dogecoin Similar?

There are some similarities between Bitcoin and Dogecoin. Because of this, some people may have difficulty differentiating between the two.

Mining Process

The mining process of both networks relies on work-of-proof methods. This is the solving of complex mathematical problems to “mine blocks.” While the Bitcoin network is slower and more secure, the Dogecoin network is quicker and less secure. One of the biggest complaints about Bitcoin is the amount of energy required to run the network.

Less Energy

At this point, the idea of using less energy is one of the most desired outcomes for these “POW” networks. While they are more efficient than they once were, they are most certainly lagging proof-of-stake networks like Ethereum. This is an ongoing problem for these networks, but at this point, something that is being worked on.

Staking.

Staking is a way of earning more coins in a proof-of-stake network. Mining is the only way to earn more cash in these two networks. This makes the Bitcoin network the most secure out of the crypto networks but also a bit slower – although the network has been improved.

Bitcoin vs. Dogecoin: Comparison

By stacking up each network’s main points and ideals in a list, you can see some of the significant similarities and differences between Bitcoin and Dogecoin. While not exhaustive, this chart is a “30,000-foot overview” of the networks.

| Feature | Dogecoin | Bitcoin |

| Date Founded | 2013 | 2009 |

| Ticker | DOGE | BTC |

| Market Cap (Oct. 2022) | $8 billion | $388 billion |

| General Purpose | Payments | Payments |

| Mining Standard | Proof-of-work | Proof-of-work |

| Maximum Available Supply | Unlimited | 21 million |

| How Is the Currency Used? | Digital payments | Digital payments |

| What Influences the Value? | Social media and hype | Supply and demand |

DOGE vs. BTC: Historical Price Action Reviewed

There is no comparison between Dogecoin and Bitcoin regarding historical price action. After all, Bitcoin has reached a value of roughly $68,000, while Dogecoin has still yet to hit $1. However, on a percentage basis, Dogecoin returned almost 13,000% at one point. A lot of this will come down to what price you get involved. The barrier to entry with Dogecoin is much lower than with Bitcoin as it is significantly cheaper.

Dogecoin vs. Bitcoin: Which one is the better investment?

While you can make an argument for both coins, the reality is that Bitcoin is by far the superior investment. The most significant difference that you can make is that much institutional money has been invested in BTC. As a result, the market will likely be much more stable and almost as important, liquid. Getting in and out of an asset at the price you expect is crucial for institutional traders.

The next thing to think about is adoption. Bitcoin has attracted much more inflows than Dogecoin, which directly reacts to the number of places you can use, sometimes referred to as the “network effect.”

The reality is that Bitcoin is something that many people trust at this point, but the Dogecoin market is one that was set up as a joke. It moves on memes and social media hype, not on any fundamental value. There is no comparison to the one you should invest most of your trading capital in.

Conclusion

The differences between Dogecoin and Bitcoin are numerous. They should be thought of as entirely different types of assets. This is because Bitcoin is being developed by many big players, while Dogecoin is essentially something that runs on hype and fun. Keep in mind that for crypto to become mainstream, people must have a “killer app” that people love. At this point, it likely occurs on the Bitcoin network much quicker than on Dogecoin or others.

The investment thesis is simple when it comes to Dogecoin. The reality is that the money traders invest in Dogecoin should be considered speculative at best, which is fine – but in moderation. Any Dogecoin allocation should be a small portion of your crypto portfolio. However, it can be one of the biggest outperformers in good times.

As for Bitcoin, it’s the “Grandaddy of all” in crypto. It is hard to imagine a well-balanced cryptocurrency portfolio that doesn’t have at least some Bitcoin in it. Furthermore, you can look at Bitcoin as a harbinger for the rest of the crypto markets. When it does well, other markets flourish. However, when Bitcoin struggles, other smaller crypto markets fall.

It is probably best to think about cryptocurrencies as a spectrum of risk appetite, with Bitcoin being the “safest” and other smaller “meme coins” like Dogecoin being much more “riskier.” However, with risk comes the opportunity for more significant gains.

Is Bitcoin better than Dogecoin?

Yes, it most certainly is. Bitcoin has enjoyed quite a bit of adoption and is the biggest market in the world of cryptocurrencies.

Is Dogecoin safer than Bitcoin?

No. The easy mining and high speed that Dogecoin enjoys come at security’s expense. However, Dogecoin wasn’t meant to be as robust as Bitcoin.

Is Dogecoin the next Bitcoin?

No. Dogecoin has no limit to how much can be mined, so there will be an unlimited supply. By contrast, Bitcoin is capped at 21 million.

Is Bitcoin more valuable than Dogecoin?

Yes, quite a bit. Dogecoin typically is measured in cents, while Bitcoin is measured in thousands of dollars.

Is Dogecoin mined the same as Bitcoin?

Yes, both use a proof-of-work consensus. They do use different equipment, though, as Dogecoin miners cannot use SHA-256 Bitcoin mining equipment. In other words, it is a similar process, but with different hardware.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.